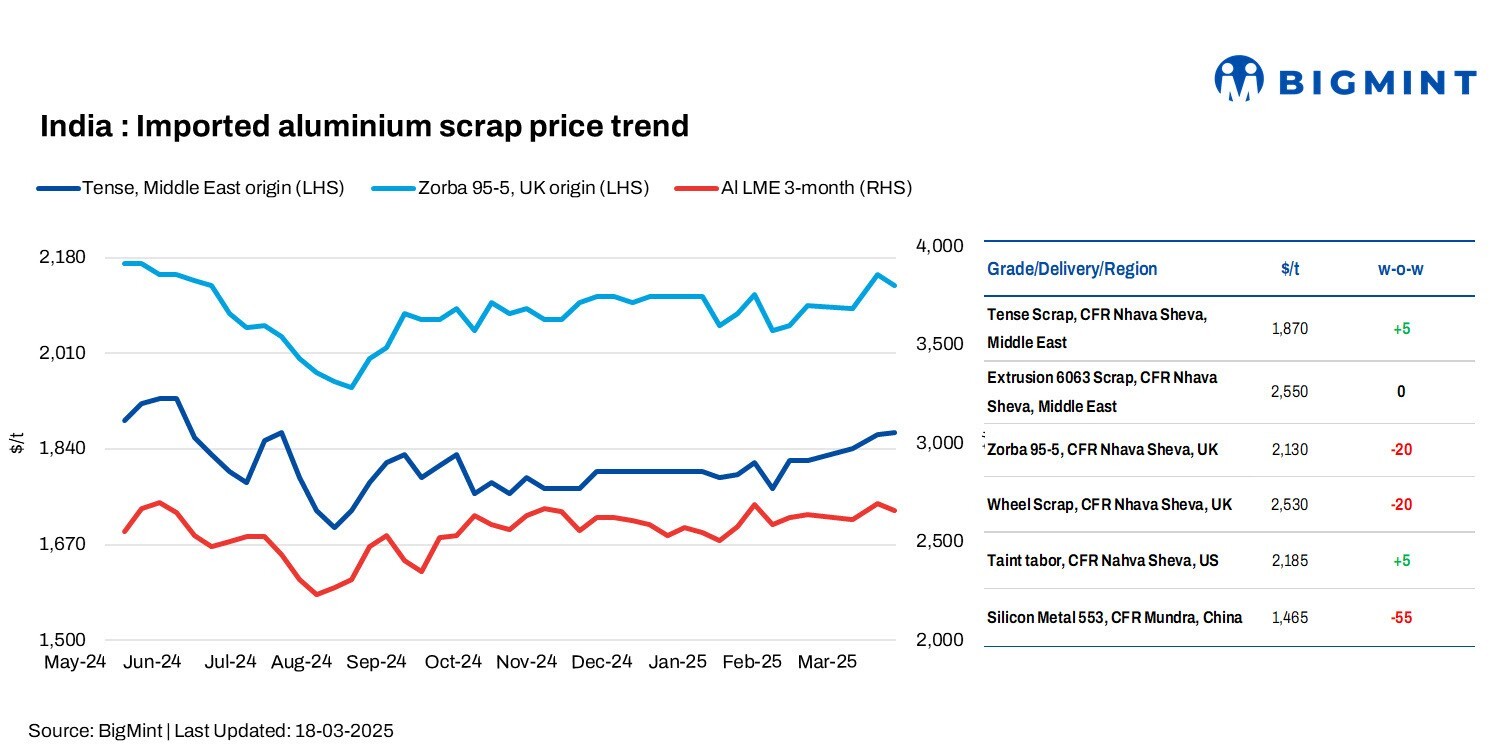

India's imported aluminium scrap prices fluctuated by up to $15-20/t w-o-w amid raw material shortages and tight supply.

Image credit: IndiaMart

BigMint's benchmark assessment for Tense scrap originating in the US was at $1,960/tonne, increasing by $10/tonne w-o-w, while Wheels from the UK stood at $2,530/tonne, down $20/t w-o-w, both CFR west coast, India.

This week, aluminium prices on the London Metal Exchange (LME) decreased by 1.2 per cent to $2,662/tonne from last week's $2,695/tonne. Meanwhile, stocks at LME-registered warehouses stood at 497,275 tonnes, down 1 per cent from 502,150 tonnes last week.

Domestic scrap prices rise w-o-w

In the domestic market, Tense scrap prices in both Delhi and Chennai inched up by INR 1,000/tonne as compared to last week. According to BigMint's assessment, domestic Tense scrap stood at INR 186,000/t ex-Delhi-NCR and INR 186,000/tonne ex-Chennai.

According to market participants, "Zorba grades are currently not workable in the market, and there is also a shortage of tense and taint tabor in the local market."

Additionally, demand for taint tabor and extrusion in the Middle Eastern market remains high, leading to elevated export offers. India is engaging in these deals but at higher price levels.

Semi-finished aluminium prices are currently on the higher side. With the Japanese automobile market showing improvement, there has been a rise in demand for aluminium scrap. This increased demand is likely to have a positive impact on the ADC12 market, especially given Japan's significant need for ADC12 imports.

Market updates

EU to investigate aluminium imports amid US tariffs: The European Commission will launch a safeguard investigation on 19 March to assess the impact of rising aluminium imports. This follows concerns that US tariffs could redirect excess aluminium to Europe. On 12 March, the US imposed a 25 per cent tariff on steel and aluminium imports, limiting EU producers' access to the US market. This could result in excess aluminium flooding the European market.

The European Commission is introducing a new 'Melt and Pour' rule. Under this rule, the origin of aluminium will be determined by where it was first melted, not where it was processed. This will prevent minor processing from being used to evade duties and ensure better tracking of product origins.

This investigation is part of a broader EU strategy to protect its metals industry and maintain fair competition.

Chinese market updates

According to BigMint's assessment, the price of China's 553-grade silicon dropped by $55/tonne w-o-w, reaching $1,465/tonne CFR Mundra. Additionally, freight rates for a 20-ft container from China to Mundra were recorded at approximately USD1,400.

The aluminium scrap market in China has remained within a stable range. Baled UBC aluminium scrap is priced between RMB 14,950/t (USD 2,068/tonne) and 15,800/tonne (USD 2,186/tonne)(excluding tax), while shredded aluminium tense scrap is quoted at RMB 16,350-17,950/tonne (USD 2,262-2,483/tonne) (liquid aluminium, excluding tax). In the short term, the resumption of production in both the upstream and downstream sectors in China has eased procurement pressures.

Outlook

Increasing demand for ADC12 alloyed ingots from overseas markets and a price hike for April settlement by a major player are expected to drive up scrap and ingots prices. This rise in overseas demand could positively impact the market, leading to higher price trends in the near term.

Responses