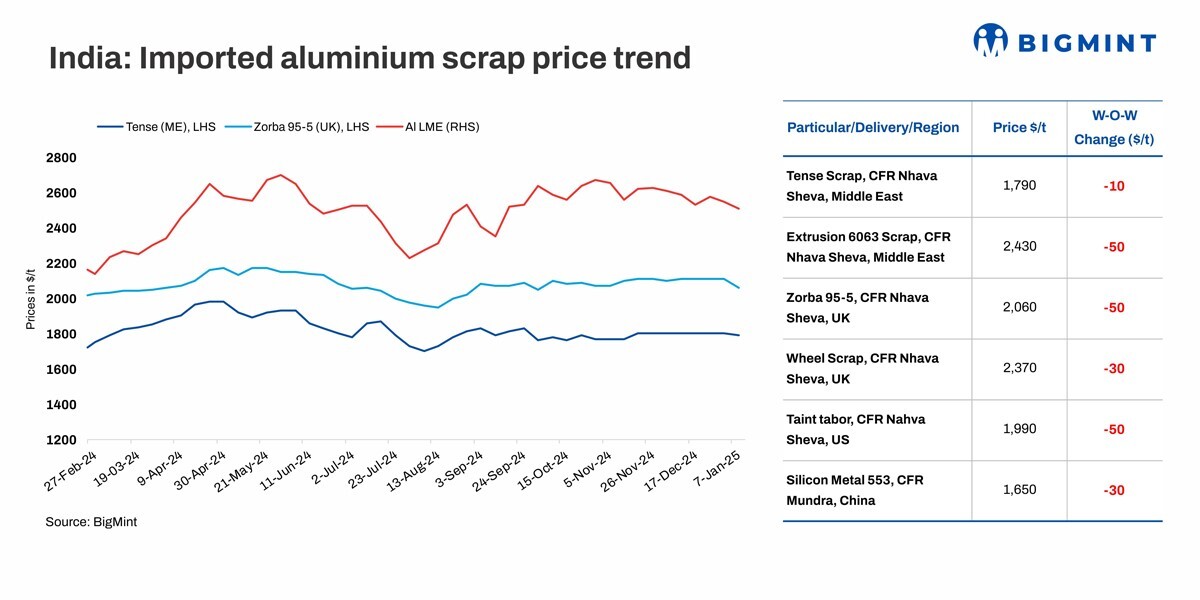

India: Imported aluminium scrap tags fall w-o-w amid decline in LME prices

Imported aluminium scrap prices in India dropped by up to 2.5 per cent w-o-w, mirroring a decline in London Metal Exchange (LME) levels. However, certain scrap grades held firm w-o-w amid reports of supply shortages.

BigMint's benchmark assessment for Tense scrap originating from the UAE stood at $1,790/tonne (t), falling by $10/t w-o-w, while Zorba 95/5 from the UK was at $2,060/t, down by $50/t w-o-w, both CFR west coast of India.

Domestic aluminium Tense scrap prices remained stable w-o-w, with ex-Delhi at INR 174,000/t and ex-Chennai at INR 175,000/t.

This week, LME aluminium prices dropped by around 2 per cent to $2,507/t. Meanwhile, stocks at LME-registered warehouses stood at 626,775 tonnes, falling by around 12,000 t w-o-w from 639,150 t.

Market scenario

This week, the overall market remained slow following a downtrend in LME levels. However, it recovered slightly, with some trades heard. With almost all market participants returning from their holidays this week, demand is expected to rise. This could lead to a price increase driven by a surge in trading activity.

Recently, deals from Australia were heard, with freights recording a decline to around $1150-1250 for a 40-foot container. Additionally, a source stated, "India is opting to procure scrap, particularly Tense, from South Africa, as it is being offered at reasonable prices, at around $1,700/t."

The semi-finished market appeared to be recovering, with buyers increasing their bids by nearly INR 2,000/t in the northern region. Domestic scrap demand remained strong, although prices continued to be firm.

As for the international market, a trader stated, "Europe is experiencing a shortage of non-ferrous metals in local markets. Leading suppliers suggest that, alongside copper motors, the region may consider imposing a ban on non-ferrous metals to mitigate these market issues."

The UK market continued to show strong demand for aluminium Wheels, Taint Tabor, and Extrusion products. European suppliers took advantage of this trend, securing premiums of up to $100/t over the prices available in India and supplying more of their material to the UK.

Additionally, President-elect Trump's planned tariffs in 2025 are expected to raise US aluminium prices. A 60% tariff on Chinese imports and 25 per cent on imports from Mexico and Canada, unless border security measures are enhanced, could significantly affect the market. The aluminium industry is on high alert as demand rebounds.

China's silicon prices down

According to BigMint's assessment, prices of China's 553-grade silicon dropped by $30/t w-o-w to $1,600/t CFR Mundra. Freights were at around $2,000-2,300 for a single container from China to Mundra.

Outlook

As market participants return from the New Year holidays, the market is expected to pick up momentum. With the resumption of trading activities, demand is likely to rise, which could lead to a price increase in the coming weeks.

Note: This article is received under the content exchange agreement with BIGMINT and published as received without edits from AL Circle.

Top image credit: Luvot International

This news is also available on our App 'AlCircle News' Android | iOS