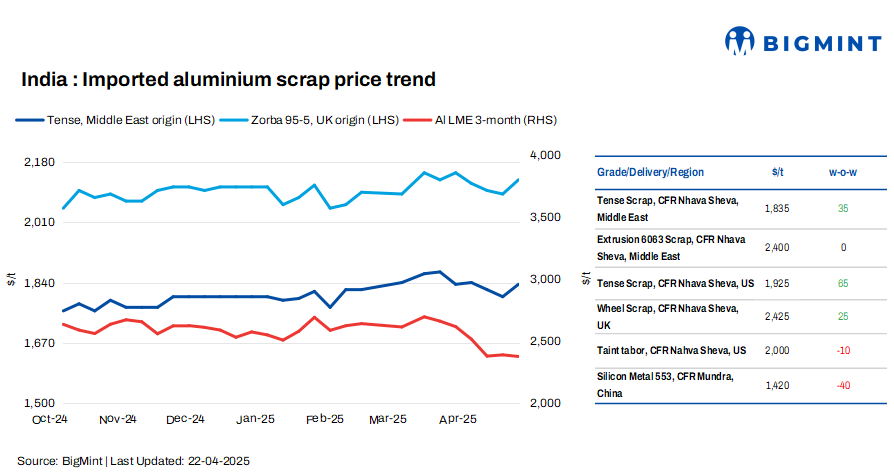

BigMint's latest assessments indicate that Tense scrap from the US stood at $1,925/t, while Wheels from the UK remained stable at $2,425/t, both on a CFR west coast India basis.

On the London Metal Exchange (LME), aluminium prices remained largely range-bound, with the benchmark price averaging $2,375/t, slightly down from $2,388/t last week. Meanwhile, LME-registered warehouse inventories climbed by 5.2 per cent to 462,450 t, up from 439,325 t in the previous week.

Domestic scrap prices up w-o-w

In the domestic market, Tense scrap prices in both Delhi and Chennai inched up by INR 3,000/t compared to last week. According to BigMint's assessment, domestic Tense scrap stood at INR 187,000/t ex-Delhi-NCR and INR 188,000/t ex-Chennai.

In India, the aluminium market is experiencing an improvement in sentiments, with demand steadily rising across key sectors, reflecting stronger buying interest. However, this optimism is tempered by tight supply conditions, particularly in raw materials like Tense and Extrusion. Aluminum semi-finished products have also remained on the higher side. The shortage is driving up prices and accelerating procurement activity as buyers move swiftly to secure limited available stocks.

Market sentiments

A source informed, "US scrap is not being imported as prices are currently unviable for Indian buyers, making it more expensive compared to supplies from other countries. Also, some grades were heard at a premuim in the US domestic market."

Additionally, the Middle East taint tabor export prices remained high for India, with domestic trades heard at $2,260/t, driven by strong demand, while Indian buyers are sourcing material at $2,300/t. Meanwhile, prices of Middle East extrusion 6063 stood at $2,460/t levels.

The continued imposition of a 2.5 per cent customs duty on aluminium scrap, while duties on other metal scraps have been removed, has created an uneven playing field for Indian recyclers. This policy discourages domestic recycling, encourages imports of finished goods, and could shift recycling operations overseas. Indian recyclers also face higher costs compared to counterparts in countries like Malaysia and Thailand with zero duty.

Outlook

In a recent BigMint poll on the impact of reciprocal tariffs between China and the West, the largest share of respondents indicated they are waiting for a clear trend in LME aluminium prices, reflecting prevailing market uncertainty. Some participants believe the tariffs will have minimal impact on regional markets, while others expect prices to remain stable around $2,400/t. The results highlight a cautious outlook, with most closely watching global developments before taking positions.

Note: This article has been issued by BigMint and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses