LME aluminium opened at US$2,290 per tonne in the previous trading day, with its high and low at US$2,313.5 per tonne and US$2,285.5 per tonne, respectively, before closing at US$2,309 per tonne, up US$25.5 per tonne or 1.12 per cent.

On Thursday, aluminium prices surged to their highest point in 11 weeks, driven by rising buying interest amidst improving demand forecasts from China, the largest metal consumer. As per the data, both LME aluminium cash bid price and LME aluminium official settlement price surged by US$32 per tonne or 1.43 per cent and US$32.5 per tonne or 1.45 per cent to settle at US$2,263 per tonne and US$2,264 per tonne.

On the same day, both 3-month bid price and 3-month offer price gained US$29.5 per tonne or 1.29 per cent and US$29 per tonne or 1.27 per cent to halt at US$2,311.50 per tonne and US$2,312 per tonne.

December 25 bid price and December 25 offer price expanded by US$23 per tonne to peg at US$2,518 per tonne and US$2,523 per tonne. LME aluminium opening stock came in at 564050 tonnes. Live warrants and Cancelled warrants closed at 342950 tonnes and 221100 tonnes.

LME aluminium 3-month Asian Reference Price hiked by US$27.75 per tonne or 1.22 per cent to clock at US$2,297.92 per tonne.

SHFE aluminium price

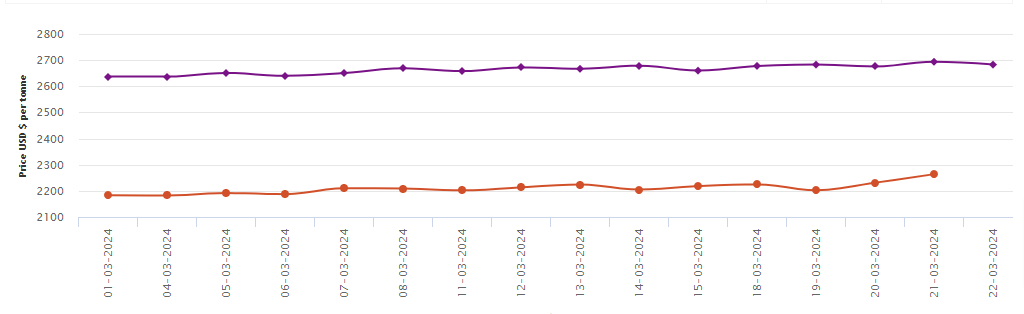

On Friday, March 22, the SHFE aluminium price dropped by US$11 per tonne or 0.40 per cent to rest at US$2,683 per tonne. Overnight, the most-traded SHFE 2405 aluminium contract opened at RMB 19,510 per tonne, with high and low at RMB 19,530 per tonne and RMB 19,365 per tonne before closing at RMB 19,405 per tonne, down RMB 80 per tonne or 0.41 per cent.

Responses