Aluminium profiles manufacturer Winstar Capital Bhd moves towards IPO with TA Securities

The Malaysia-based Winstar Capital Bhd, a manufacturer of aluminium products, has signed an underwriting agreement with TA Securities Holdings Bhd for its upcoming initial public offering (IPO) on the ACE Market.

According to a company statement, TA Securities will underwrite 30.45 million new shares that have been allocated to the Malaysian public and eligible individuals. Winstar, which is supported by the publicly traded renewable energy firm Sunview Group Bhd, aims to complete its listing by the end of 2024.

Vincent Chua, CEO of Winstar Capital Bhd, said, "The agreement not only reinforces their confidence in us but also takes us a step closer to our IPO."

"We are ready to take advantage of the opportunities in Malaysia's renewable energy, construction and property development industry."

Winstar, a Selangor-based manufacturer, generates 57 per cent of its revenue from producing aluminium profiles and ladders. The company also trades and distributes building materials and has a secondary involvement in solar panel installation, which it views as a non-core business.

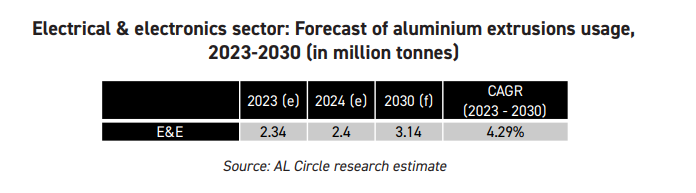

AL Circle’s industry-focused report “The World of Aluminium Extrusions—Industry Forecast to 2030” revealed that the usage of aluminium extrusions for various industrial applications, including solar power modules, is estimated at 3.14 million tonnes in 2023. During the next five years, the usage is forecast to grow at around a CAGR of 3.56 per cent to reach 4.01 million tonnes by 2030.

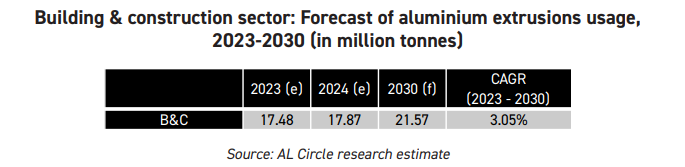

Aluminium extrusions account for over 80 per cent of the aluminium used in the building & construction sector. They enable architects to achieve complex designs for demanding applications. Extrusions also provide several advantages to the construction sector, including ease of fabrication/maintenance and assembly, offering a good strength-to-weight ratio and being subject to minimal expansion/contraction. The use of aluminium extrusions in the building & construction sector across the world is estimated at around 17.48 million tonnes in 2023, and it is forecast to grow at an average annual rate of 3.05 per cent to reach 21.57 million tonnes by 2030.

China accounts for 70 per cent of aluminium extrusions usage in 2023. Compared to growth in other geographies, usage in the Rest of the Asia Pacific region is expected to witness good growth of about 9 per cent per annum during the next seven years. India and other developing nations are expected to contribute to this growth. Get a copy of the report to learn more about aluminium extrusion in the building, construction, and electrical industries region by region.

According to its draft prospectus, Winstar's proposed initial public offering (IPO) will comprise a public issue of 56.55 million new shares and an offer for sale of 17.4 million existing shares. The final price will be determined at a later stage. The total offering aims to provide investors with up to a 25.5 per cent stake in the company.

Winstar plans to use part of the IPO proceeds to acquire extrusion press machines and equipment, effectively boosting its annual production capacity to 15,285 tonnes. Additionally, funds will be allocated for working capital, primarily for purchasing aluminium billets, a key raw material.

Earlier this year, Winstar began fabricating aluminium mounting structures for solar panel installations and is now looking to leverage various solar projects under the National Energy Transition Roadmap to drive demand, according to Chua, a company representative.

The public issue portion of the IPO will allocate 14.5 million new shares to the general public, 15.95 million shares to eligible individuals, and 26.1 million shares to selected investors via private placement.

The offer for sale, involving the existing 17.4 million shares, will be conducted through private placements to select investors. The proceeds from this segment will benefit a group of selling shareholders, including Chua and his father, Vice Chairman Chua Nyok Chong.

TA Securities serves as the principal adviser, sponsor, sole placement agent, and sole underwriter for the IPO, while Eco Asia Capital Advisory Sdn Bhd acts as the financial adviser.

Image credit: Upstox

This news is also available on our App 'AlCircle News' Android | iOS