Aluminium usage in cars spikes as electrification takes off in the automotive sector

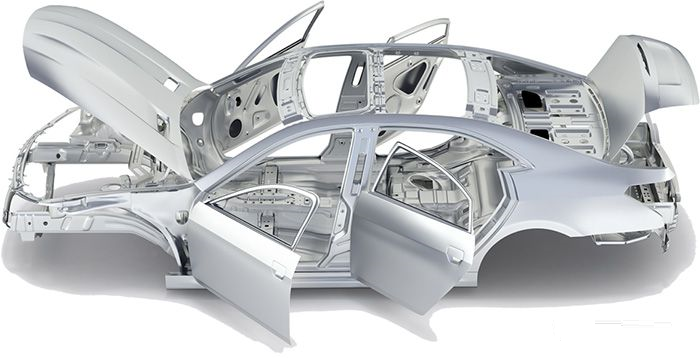

According to a recent study commissioned by European Aluminium, the voice of the aluminium industry in Europe and completed by Ducker Carlisle, a global consulting and M&A advisory company with an unrivalled continuum of insights, benchmarking, and strategy solutions has found that the average quantity of aluminium used in European cars rose by 18 per cent from 174 kg in 2019 to 205 kg in 2022. The report predicts that this trend will continue, with the average amount of aluminium in a car rising from 205 kg in 2022 to 237 kg by 2026 (+15.6 per cent) and 256 kg by 2030 (+24.9 per cent).

According to the survey, the automotive industry's move towards lightweighting and electrification is generating a large growth in aluminium content. Electric vehicles, in particular, add to this development, with a battery electric vehicle (BEV) built in Europe in 2022 holding an average of 283 kg of aluminium, compared to 169 kg in a petrol or diesel ICE-only car. Between 2022 and 2026, the average aluminium content of an electric vehicle is predicted to rise by 9.5% to 310 kg. The use of aluminium in BEVs has increased dramatically, owing mostly to its employment in e-drive housing, battery pack housings, ballistic battery protection, and cooling plates.

Furthermore, aluminium is used in electromobility infrastructure such as power cables and charging stations. The inherent recyclability of aluminium also ensures that the material used in cars today will be ready to be reused once the car has reached the end of its life.

Hélène Wagnies, the Principal at Ducker Carlisle, said, "Our latest assessment reinforces the crucial role of aluminium for lightweight. With the acceleration of powertrain electrification – which turns out to further speed up with every new update of vehicle production forecasts - the requirement for lightweight to offset battery weight has been increasing significantly and, with it, the aluminium content in cars. Beyond EV-specific components, implementing large and mega castings in the car's body structure will also strongly contribute to higher aluminium intensity."

"With the EU's ambitious target of a 55% reduction in CO2 emissions for cars by 2030, aluminium will continue to be critical in the material mix for car makers to achieve their sustainability goals. It will grow in all product forms – extrusions, sheet, castings, as well as forgings."

Florian Stadler, Managing Director of AMAG Rolling and Chair of European Aluminium's Automotive & Transport Board, emphasises the urgent need for EU policymakers to provide adequate support measures to the European aluminium industry, which is currently experiencing increasing production losses, particularly concerning primary production as a result of the ongoing energy crisis and an uneven playing field globally.

Florian added, "The demand for aluminium is rapidly increasing as the automotive industry accelerates towards lightweight and electrification. To meet this growing demand, policymakers must act to ensure that sustainable aluminium with a low CO2 footprint, locally produced or recycled in Europe, is readily available to car manufacturers. Doing so can reduce our dependence on imports, create jobs in Europe, and achieve our sustainability goals. It's time to shift into high gear and drive Europe towards a cleaner and greener future."

The latest industry-focused report publication by AlCircle, ‘Global Aluminium Industry Outlook’, reveals that aluminium usage in the transportation sector stood at 25.9 million tonnes in 2022. The demand is likely to reach 26.3 million tonnes in 2023. Passenger cars are the single largest user segment of aluminium amongst other transport sectors.

This news is also available on our App 'AlCircle News' Android | iOS