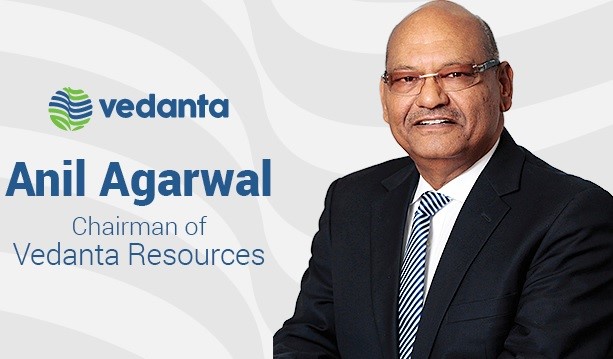

Anil Agarwal contemplates listing Vedanta’s multiple businesses as separate shareholding entities

Vedanta's Chairman Anil Agarwal has declared that Vedanta's board is thinking of demerging and separately listing some or most of its businesses, like iron & steel, oil & gas and aluminium, to unbolt shareholders' incentives. The parent company, Vedanta Resources, based in London, will prevail as a holding firm of diversified mining entity Vedanta Ltd. At the same time, some of its counterparts will start acting as independently listed companies.

The Chairman spoke out in a video message: "This means if you have one share of Vedanta Ltd, you will have many shares of other (demerged) companies."

In November 2021, Anil Agarwal first spoke about spin-offs, demergers and strategic alliances. He said the new advancement would help Vedanta achieve streamlined activities, permitting great value returns for all shareholders and also aid in forming strategic partnerships that would enhance the company's global and regional capacity. But alas, his dream was not realised. That is why he has resorted to seeking shareholder feedback for separate listing of businesses.

Anil Agarwal illustrated the present condition of the company: "Vedanta, in last two decades, has gone into the business which is more and more import substitute; very difficult for the entry into these areas. We have the business of oil and gas, the largest producer of aluminium, completely integrated power, copper, zinc, silver, lead, iron and steel, nickel, ferroalloys, semiconductors, display glass and more."

All these businesses are intertwined with Vedanta at this moment.

He sounded optimistic as he attested: "The whole world is looking to invest in India. I have been told that investors like pure play. I have asked all my advisors and my people to look (if we) can have these all products or some products to be independent, so the independent management and leadership can grow this business to the highest level".

The demerger will help these businesses reach new heights, as per the industry expert. This would also bridge the gap between investors and the company shares, as they might now choose where to invest their precious money according to their individual interests.

Though no scheduling has been done for this ultimate change in course, it is quite evident that the Chairman is quite preoccupied with this idea. He exclaimed: "Some international companies want to invest in a particular area; they will get that opportunity. I would also like to have your view so we can take that step forward. I promise you that we will always remain focused on creating shareholder value... when I find that it is appropriate, we will go to the board and will take it forward."

He also stated that this move might increase the rate of return for shareholders and spike the dividend value. This is similar to what Adani Group did in 2015 when the power & transmission units and ports parted ways from the actual Adani Enterprises and were listed as individual entities.

The evaluation of the structure by Agarwal aims to create businesses that can effectively capitalise on their unique market positions, leading to long-term growth and strategic partnerships. This restructuring process would also involve tailoring the capital structure and allocation policies to the specific dynamics of each business, resulting in distinct investment profiles that can attract a wider range of investors. Vedanta has reportedly faced challenges in financing projects, prompting its parent company, Vedanta Resources, to secure approximately USD 450 million from two of its rivals earlier this year. This development has raised concerns about the company's ability to secure funding through traditional debt channels and banks.

This news is also available on our App 'AlCircle News' Android | iOS

.png/0/0)