The Trump administration's recent tariff hike on metals imports has raised fresh concerns within Europe, as fears mount that subsidised aluminium could flood the EU market. A draft proposal from the European Commission reveals that Brussels is now weighing potential measures to curb rising aluminium imports in a bid to shield its domestic industry.

Image credit: Zalco

In parallel, the Commission is also considering imposing duties on exports of scrap metals—a strategic move aimed at bolstering Europe's production sector amidst mounting global competition.

Last week, the US Administration imposed steep 25 per cent tariffs on steel and aluminium imports, triggering swift retaliation from the EU, which announced tariffs on up to USD 28 billion worth of American goods.

While Europe already has certain safeguards in place—such as import quotas for steel—and initiated a probe into aluminium alloys last December, industry leaders argue these measures fall short. They warn of an imminent glut, particularly driven by excess supply from China, which risks being redirected to Europe as producers seek alternative markets in the wake of US protectionist policies.

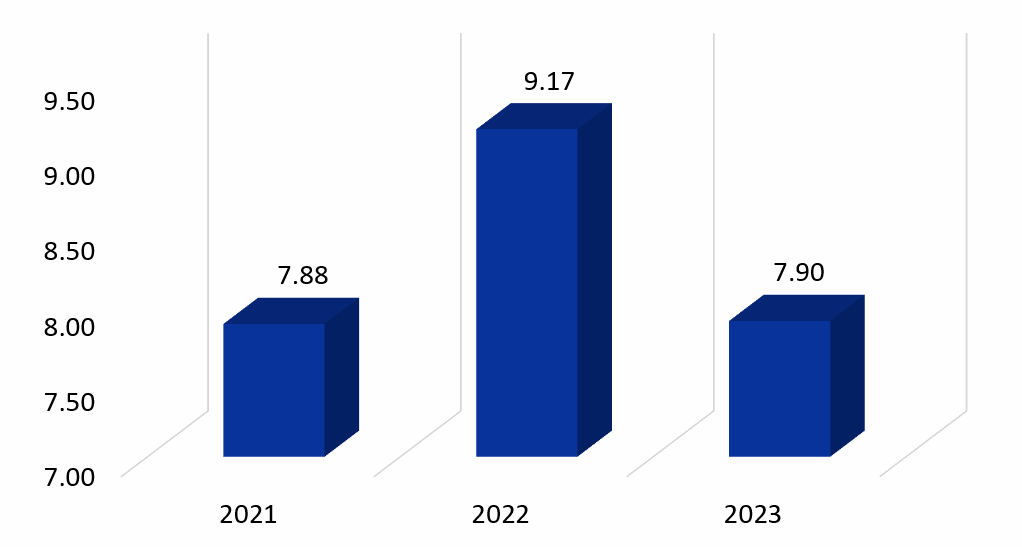

EU (27) unwrought aluminium imports (HSN -7601), 2021-2023 (in million tonnes)

Source: International Trade Council (ITC)

As pressure builds, the European Commission faces mounting calls to step up its defence of the continent's steel and aluminium sectors against the knock-on effects of escalating global trade tensions.

The document states, "The situation is also deteriorating in the aluminium sector. EU producers lost substantial market share over the past decade, and production has not recovered since the Covid-19 pandemic, the commission said, a situation aggravated by high energy prices, sluggish demand and cheap imports from Russia and other parts of the world."

"The recently announced US tariffs on aluminium are likely to worsen the situation further with a significant threat of trade diversion from multiple destinations."

Apart from Norway and Iceland—both part of the bloc’s economic area and potentially eligible for exemptions—the primary sources of aluminium imports are the United Arab Emirates, Russia, and India. Since the Ukraine-Russia geopolitical crisis in 2022, Russian aluminium imports have steadily declined, accounting for just 6 per cent of total imports last year. In a decisive move last month, the EU announced plans to phase out Russian aluminium imports by 2026 completely. In the interim, it has extended tariffs that previously applied to only a portion of these imports.

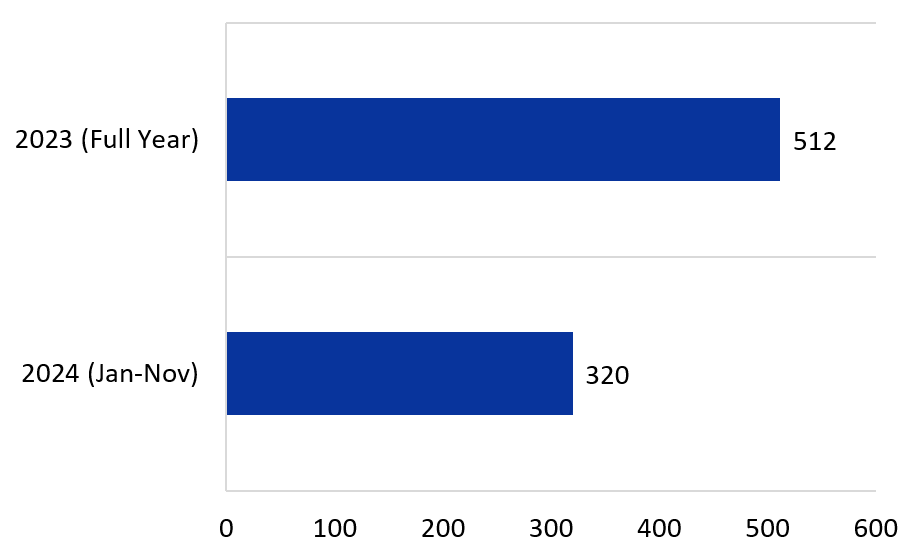

EU imports of Russian unwrought aluminium, 2023-2024 (in 000 tonnes)

Source: SMM; Mining.com

Russia's aluminium exports to the European Union (EU) fell to just USD 828.2 million (EUR 862.5 million) last year, marking their lowest level since 2009. However, according to data from Eurostat and national statistical agencies, the decline was largely compensated by a significant rise in Russian shipments to China and South Korea.

According to the European Commission's publication on February 24, 2025, article 'EU adopts 16th package of sanctions against Russia', it stated under 'trade measures':

Direct import ban on Russian aluminium

Responses