According to the Shanghai Metals Market, primary aluminium inventories in China witnessed an augmentation of 3,000 tonnes week-on-week across eight major consumption areas, including SHFE warrants. Therefore, on Thursday, July 28, the inventories totalled 671,000 tonnes, which in comparison with the month’s third Monday, July 18, shrunk by 11,000 tonnes. As of now, the inventories in June dropped by 88,000 tonnes as recorded in the same period last year.

China’s weekly ingot inventory was holding a balanced outlook, with varied dynamics in different areas. The ingot inventory in Gongyi decreased due to delayed arrivals from Xinjiang but is estimated to rise since all the cargos are already in logistics. The inventory saw a minor rise as some local houses were supplying the requirement. Buying and selling of spot aluminium were comparatively low with unenergetic downstream demand, but most importantly, the cause for low inventory was nothing but a falling arrival rate. At this moment, the market will measure the arrivals of cargos already in shipment.

Last week, on July 21, primary aluminium inventories fell by 29,000 tonnes from the week before on Thursday across eight major consumption areas to come in at 668,000 tonnes.

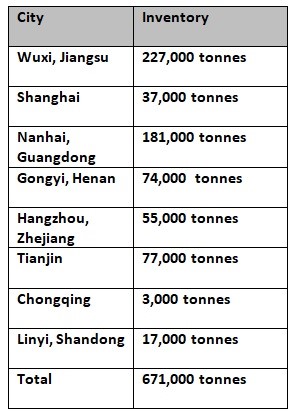

The chart below indicates the current status of primary aluminium inventories across China in more detail:

The aluminium ingot inventories rose the highest in Wuxi by 7,000 tonnes over a week to 227,000 tonnes from 220,000 tonnes, as was recorded last Thursday. In Nanhai, inventories increased by 6,000 tonnes to 181,000 tonnes, while the aluminium inventory in Shanghai escalated by 1,000 tonnes to 37,000 tonnes. Inventories in Hangzhou, Chongqing and Linyi remained restrained at 55,000 tonnes, 3,000 tonnes and 17,000 tonnes, found SMM.

Meanwhile, primary aluminium inventories in Gongyi shed 10,000 tonnes to rest at 74,000 tonnes. Tianjin saw a dip of 1,000 tonnes week-on-week to come in at 77,000 tonnes.

Responses