In 2024, the European Union (EU) found itself tussling with a significant trade deficit of EUR 11.1 billion in aluminium and related articles. This figure emerged from imports totalling EUR 29.5 billion, overshadowing exports valued at EUR 18.4 billion. Since 2019, imports have surged by 29.9 per cent (EUR 6.8 billion), while exports have seen a 21.3 per cent (EUR 3.2 billion) rise. Interestingly, these monetary increases occurred despite a slight decline in the physical weight of exports by 1.7 per cent and imports by 6.2 per cent, indicating that rising prices primarily drove the value uptick.

Information and Image credit: Eurostat

Information and Image credit: Eurostat

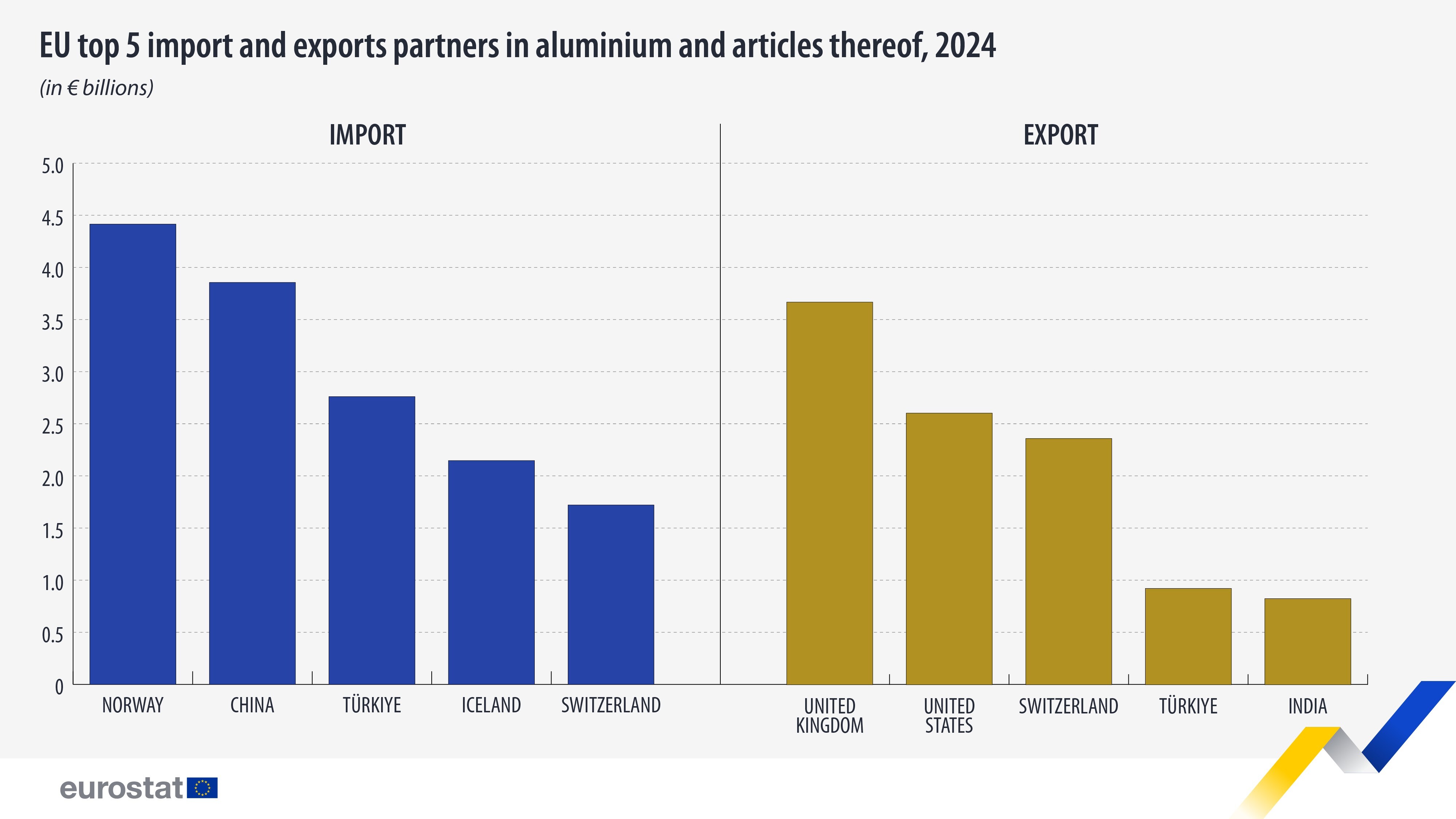

Norway and China lead in imports and UK in export

Delving into the origins of these imports, Norway and China emerged as the EU's top suppliers in 2024. Norway led with EUR 4.4 billion worth of aluminium imports, accounting for 15 per cent of the total, while China followed closely with EUR 3.9 billion (13.1 per cent). Other significant contributors included Türkiye (EUR 2.8 billion; 9.4 per cent), Iceland (EUR 2.1 billion; 7.3 per cent), and Switzerland (EUR 1.7 billion; 5.8 per cent). Particularly noteworthy is the doubling of imports from Iceland (+104.9 per cent) and the near doubling from Türkiye (+95.4 per cent) compared to 2019 figures.

On the opposite angle, the UK leads. As for exports, the United Kingdom led the list with EUR 3.7 billion worth of aluminium (19.9 per cent of the total exports), followed by the United States, with EUR 2.6 billion (14.1 per cent) and Switzerland, with EUR 2.4 billion (12.8 per cent). Türkiye took the 4th place with EUR 0.9 billion (5 per cent) and India the 5th with EUR 0.8 billion (4.5 per cent). This group's exports to India (+135.6 per cent) and Türkiye (+66.7 per cent) increased the most since 2019.

Strategic initiatives to steer forward domestic production

In response to the growing reliance on external sources, the European Commission unveiled 47 strategic projects aimed at enhancing the EU's production of 14 critical materials essential for the energy transition and security. These initiatives, aligned with the Critical Raw Material Act of 2023, set ambitious targets: mining 10 per cent, processing 40 per cent, and recycling 25 per cent of these materials by 2030. Spanning 13 EU countries, the projects encompass the extraction, processing, and recycling of metals such as aluminium, copper, nickel, lithium, and rare earth elements. To facilitate these endeavours, streamlined permitting processes and financial support from both public and private sectors are planned.

Challenges for the European aluminium industry

Despite these progressive initiatives, the whole of the European metals sector faces hard-hitting challenges like high energy costs, global overcapacity, and trade policies. Geopolitical interventions like tariffs imposition by the United States have adversely affected EU steel and aluminium production capacities. For instance, the EU has initiated an investigation into the aluminium market following a surge in cheap imports resulting from US tariffs. This probe may lead to countermeasures to protect the domestic industry from unfair trade practices.

Embracing recycling and digitalisation

Amid these challenges, the industry is witnessing a pivotal shift towards sustainability and efficiency. Producing recycled secondary aluminium from scrap metal presents a promising avenue for decarbonisation, potentially reducing direct CO₂ emissions by up to 95 per cent compared to primary aluminium production. The International Energy Agency anticipates that the share of secondary aluminium production will reach 42 per cent by 2030.

Concurrently, the adoption of innovative digital technologies is revolutionising aluminium production. The integration of Industrial Internet of Things (IIoT) devices and advanced data analytics enables real-time monitoring and optimisation of production processes. These advancements not only enhance product quality and reduce waste but also address the growing skills shortage by empowering operators with actionable insights.

Vision 2050: A roadmap for the future

For the near future, the European aluminium industry has articulated a comprehensive roadmap — Vision 2050. This plan envisions a carbon-neutral, circular, and energy-efficient aluminium value chain (ideologically, which seems impeccable, but the feasibility check has hit hard) in Europe by 2050. Key projections include a 50 per cent increase in global demand for primary aluminium, reaching 107.8 million tonnes, and a balanced approach to meeting European demand through both primary and recycled aluminium production. Achieving these objectives hinges on supportive policies that foster sustainability and competitiveness within the industry.

All in all, the EU's consequential trade deficit in aluminium accentuates the pressing need for immediate interventions going above and beyond geopolitical strategies to support domestic production and reduce reliance on imports.

Responses