Here’s why India needs aluminium as its cornerstone to achieve her ‘Viksit Bharat’ vision

The non-ferrous green metal has changed the nation’s economic sustainability for countries like USA and UAE. Yes, we are talking about aluminium’s indispensability in domestic as well as commercial sectors across the globe. However, India is yet to utilise the full potential of one of the most promising base metals. With timely interventions, India can depend upon aluminium as the cornerstone of its Viksit Bharat vision, nurturing a bright economic future for the republic.

Recent global incidents have endowed India with a hoard of opportunities and challenges, wherein bullish trade dynamics in aluminium are resurging off the back of its versatile applications. China’s decision to put a stop to its export tax rebate policy is a significant development that is likely to increase the price of Chinese aluminium in international markets. This creates a potential opportunity for Indian producers. However, India’s aluminium industry is stagnating due to a surge in primary and scrap imports from both Free Trade Agreement (FTA) and non-FTA countries. This influx undermines local manufacturers and deters new investments in expanding production capacity.

Aruna Sharma, Practitioner Development Economist and Former Secretary, Govt of India, has shared her insight on the matter through a national media platform, “The Indian government has signalled its intent to revitalise manufacturing with new incentives as preparations for Budget 2025 gather steam. These efforts align with broader economic ambitions, including transformative infrastructure projects like the ambitious Bharatmala Pariyojana project and a concerted push toward renewable energy and EVs.” She has also voiced, “Global aluminium demand remains resilient, driven by the rising usage in solar panels, EVs, and expanded power-grid infrastructure. Domestically, aluminium consumption is projected to double to 10 million tonnes per annum (MTPA) by 2030, requiring significant capacity expansion. However, achieving this will necessitate overcoming substantial policy and structural barriers.”

Among the crucial policy changes in this aspect remains the raising of import duties on primary and downstream aluminium products from 7.5 per cent to 10 per cent and aligning scrap duties at 7.5 per cent, which will, in turn, lure new investments in the aluminium sector. These bars are the mirror to creating a level playing field for domestic producers who are contending with aggressive pricing from global competitors attempting to flood the Indian market with surplus production.

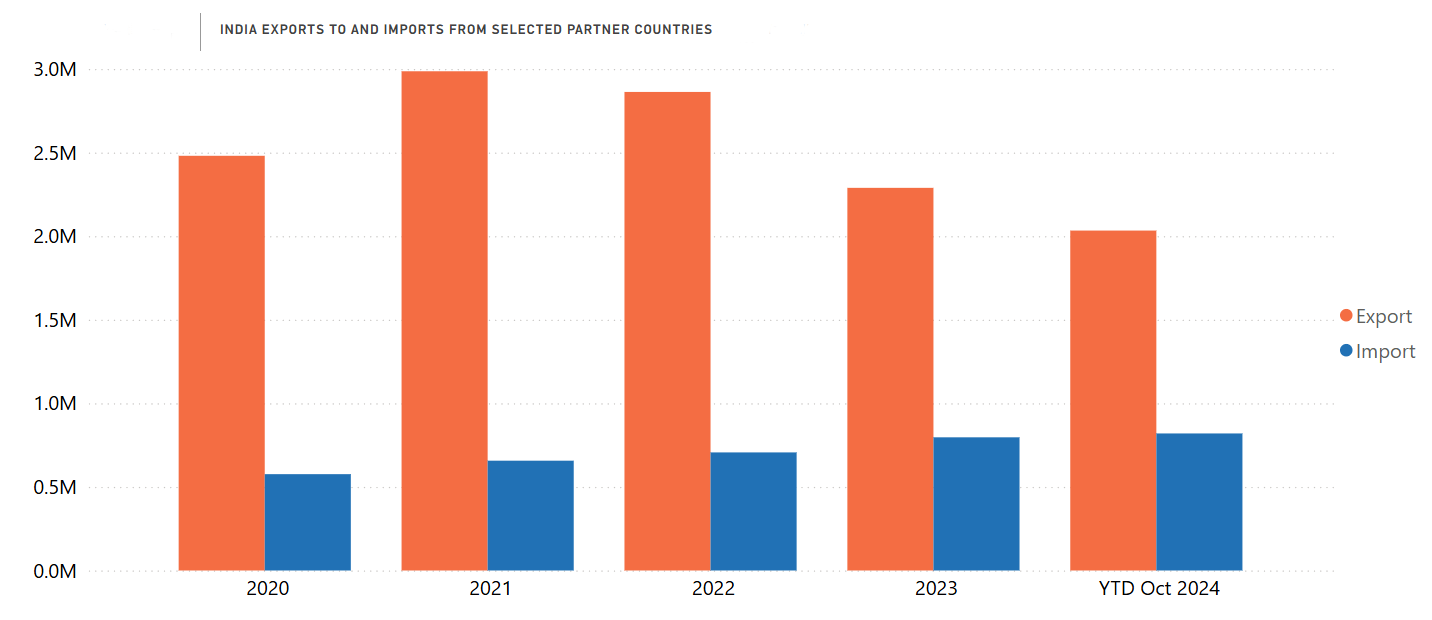

Image Source: International Trade Association

Image Source: International Trade Association

Events

Events

e-Magazines

e-Magazines

Reports

Reports

This news is also available on our App 'AlCircle News' Android | iOS