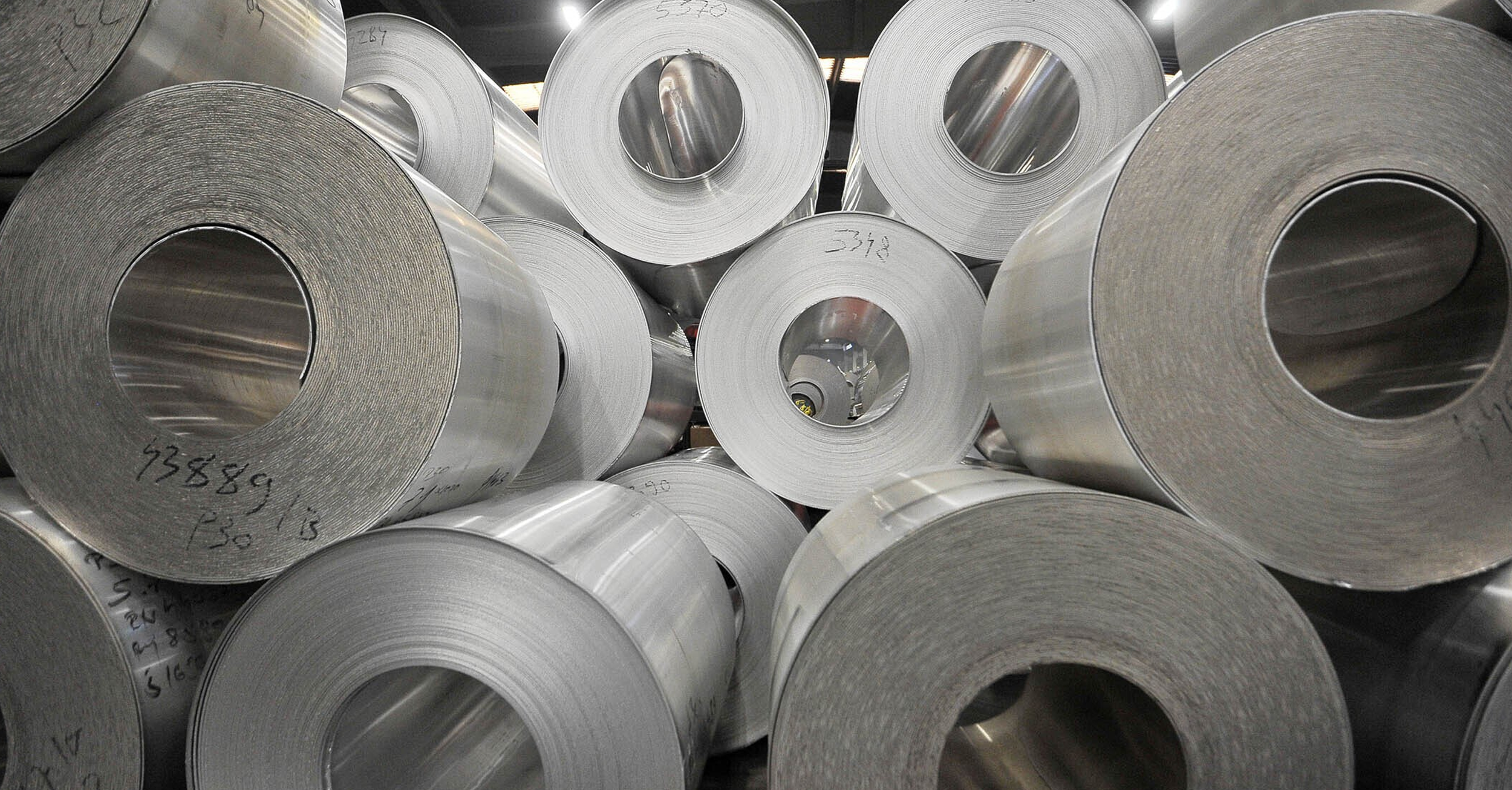

On Friday, August 30, the Directorate General of Trade Remedies (DGTR) under the Ministry of Commerce and Industry suggested an anti-dumping duty on Chinese aluminium foil imports as it observed Chinese foils accounting for 30 per cent of the Indian market despite adequate domestic production capacity.

The duty recommendation followed an inquiry request from Hindalco on account of the adverse impact of imports on domestic foil manufacturing companies. Other companies that filed an inquiry include Shyam Steel & Power Ltd., Venkateshwara Electrocast Pvt. Ltd., and Ravi Raj Foils Ltd.

The inquiries were filed on grounds of Chinese aluminium foil influx into India. In the first seven months of FY2024-25, the import value exceeded $60 billion, up by 10 per cent from the $55 billion recorded during the corresponding period of the previous year. In the last financial year, the import value surpassed $100 billion.

The final import duty is levied by the Ministry of Finance after the result of the anti-dumping investigations.

In the initial investigations, the DGTR has found the imports of aluminium foil up to 80 micron, excluding foil below 5.5 microns for non-capacitator applications, are mainly affecting the domestic industry, compelling it to reduce the selling price below the cost of production to compete with the imported Chinese foils. Thus, DGTR recommends a duty of $619 per tonne to $873 per tonne.

DGTR also found that the combined capacities and production of domestic producers during the investigation were 132,140 tonnes and 69,572 tonnes, respectively, against India’s total capacity and production volumes of 289,735 tonnes and 1,26,495 tonnes.

However, in response to DGTR’s recommendation, the industry people stated that the implementation of duties could affect downstream producers, leading to an inability to meet customer demands. According to AL Circle’s report “Aluminium Foil and its End Uses Current Trends and Forecast till 2028”, aluminium foil usage in India is projected to grow at about 5.9 per cent during 2023-28. The industry also warned of the increased cost of downstream finished goods, making the Indian downstream sector unviable.

Responses