India’s small-scale exporters push for import duty cuts amidst Trump tariff. Aluminium export scenario also under radar

Donald Trump's 25 per cent tariff on imported aluminium and steel, set to take effect on March 12, has left many domestic industries worried about rising prices and declining orders. As a result, India's small engineering goods exporters have called on the government to lower import tariffs on select US products in a bid to secure more favourable trade conditions, as President Donald Trump moves forward with new steel and aluminium duties.

USA is a major importer when it comes to Indian engineering products like machinery and equipment parts. The EEPC and other industry chambers have urged government to reduce tariffs on select US goods with low import volumes, Chadha told Reuters on Wednesday.

"Of India's $20 billion annual engineering goods exports, nearly $7.5 billion worth of shipments could be affected," said Pankaj Chadha, chairman of the Engineering Export Promotion Council, representing over 10,000 small exporters.

They believe that lowering these tariffs could encourage the Trump administration to offer better terms and advance discussions on a proposed bilateral trade deal. Trump has criticised India as a high-tariff nation and warned of imposing "reciprocal tariffs" starting in early April. Meanwhile, India's trade minister, Piyush Goyal, is in the US for negotiations, aiming to secure tariff reductions and evaluate the potential impact of Trump's proposed measures.

So what will India do now?

Pankaj Chadha suggested that India might consider lowering the import duty on US steel scrap from 7.5 per cent to nearly zero, along with reducing tariffs on items like nuts, castings, and forgings, while offering concessions on select agricultural and manufactured goods. Exporters are also concerned that India's proposed safeguard duty of up to 14 per cent on steel imports — designed to shield domestic producers from low-cost Chinese steel — could push up local prices and erode their profit margins.

India's engineering goods exports to the US surged 18 per cent year-on-year in January, reaching $1.62 billion and outpacing the sector's overall growth of 7.44 per cent ahead of the tariffs, according to EEPC data. Between April 2024 and January 2025 — the first 10 months of the fiscal year — exports to the US grew 9 per cent annually to $15.6 billion, fuelled by rising shipments of aircraft parts, electrical machinery, automobiles, industrial equipment, and medical instruments.

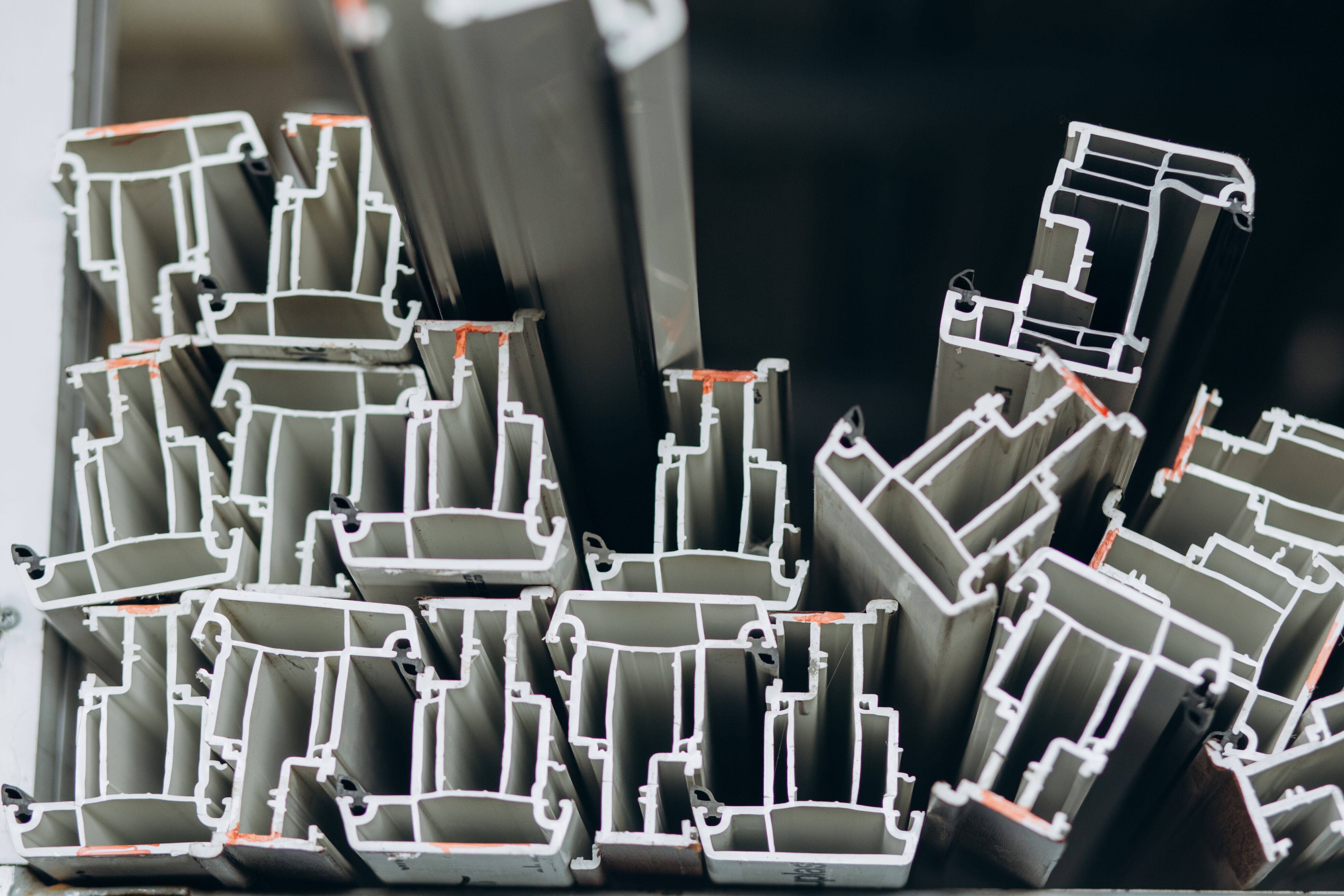

Aluminium export scenario to the US

Out of this, India exported a total of 110.39 thousand tonnes (110,397.04 metric tonnes) of aluminium to the United States from January to November 2024, a significant growth of 9.17 per cent from January to November 2023 (101.12 thousand tonnes).

However, if we see the price analysis, the recorded aluminium exported to the United States from India (January to November 2024) closed at US$262.68 million, which, compared with 2023 for the same time span, closed at US$338.59 million.

The data shows that India's export revenue to the US for January to November 2024 had faced a decline of 28.89 per cent. So, if the tariff gets implemented, there is a chance that the revenue could face further decline along with the volume.

Conclusion

Trump's tariff declaration has led to too many questions and speculations. And during such a critical situation, sustained government support through export credit and technological investment remains essential to maintain global competitiveness.

This news is also available on our App 'AlCircle News' Android | iOS

.jpg/0/0)

.gif/0/0)