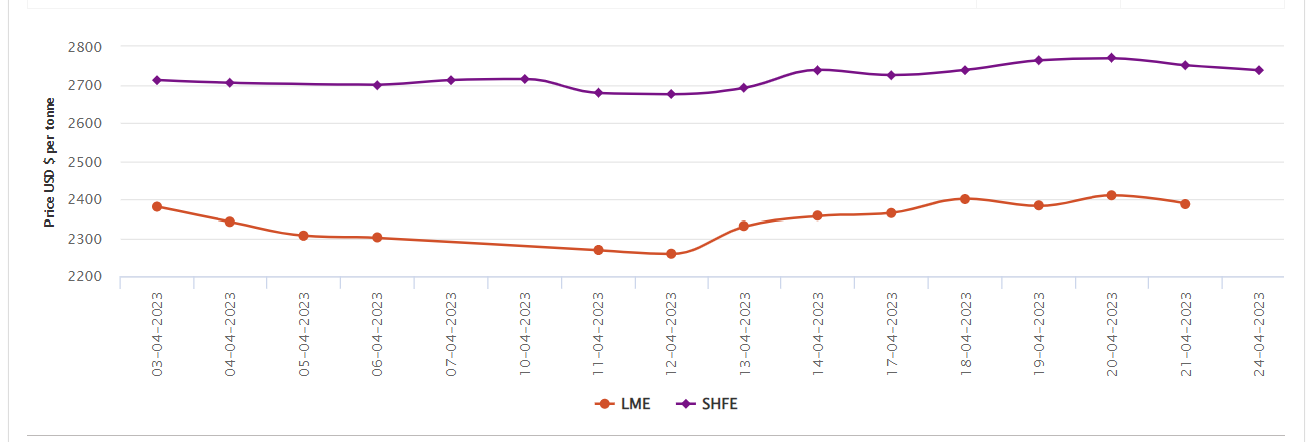

LME aluminium benchmark price shrinks to US$2388.5/t; SHFE price descends by US$13/t

On Friday, April 21, three-month LME aluminium opened at US$2,422 per tonne last Friday and closed at US$2,402 per tonne, a drop of 0.85 per cent.

On the same day, the LME aluminium cash bid price and LME aluminium official settlement price shrank by US$21.50 per tonne or 0.89 per cent. That marked a downfall on an alternate day after a fall of US$19 per tonne on April 19. With the latest decline, LME aluminium cash bid price and LME aluminium official settlement price closed the week at US$2,388 per tonne and US$2,388.50 per tonne, respectively.

The 3-month bid price and 3-month offer price decreased by US$32 per tonne and US$31 per tonne, respectively, to peg at US$2,398 per tonne and US$2,400 per tonne. December 24 bid price and December 24 offer price dwindled US$34 per tonne to rest at US$2,563 per tonne and US$2,568 per tonne.

LME aluminium opening stock totalled 571,400 tonnes, down 875 tonnes from 572,275 tonnes. Live warrants grew by 1,250 tonnes to 504,775 tonnes, while cancelled warrants slipped by 2,125 tonnes to 66,625 tonnes.

LME aluminium 3-month Asian Reference Price descended by US$47.50 per tonne or 1.94 per cent to settle at US$2,397.50 per tonne.

SHFE aluminium price

On Monday, April 24, SHFE aluminium benchmark price further declined over the weekend by US$13 per tonne to start the week at US$2,738 per tonne.

The most-traded SHFE 2306 aluminium contract opened at RMB 18,960 per tonne at last Friday’s night session, with its low at RMB 18,875 per tonne before closing at RMB 18,955 per tonne, down RMB 55 per tonne or 0.29 per cent.

SHFE 2306 aluminium dipped RMB 225 per tonne or 1.18 per cent to RMB 18,890 per tonne. The open interest declined 24,948 lots to 265,810 lots.

This news is also available on our App 'AlCircle News' Android | iOS

.gif/0/0)