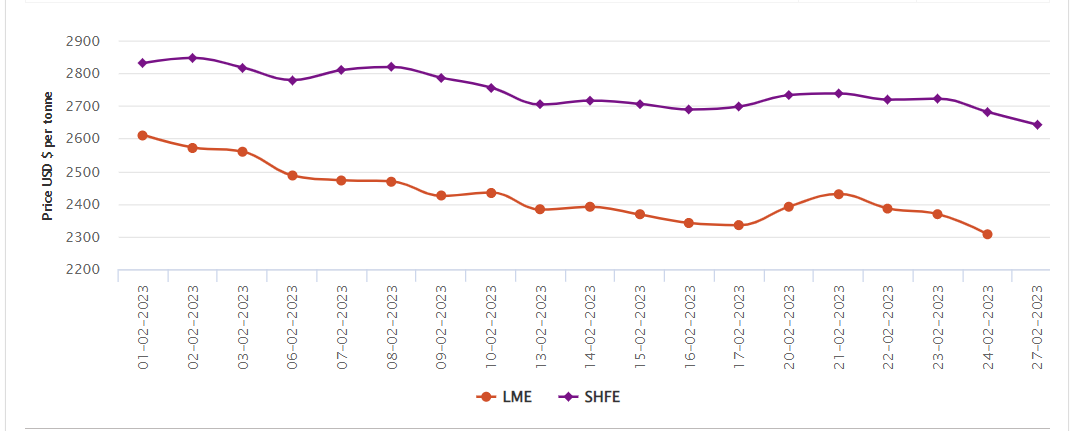

LME aluminium benchmark price slumps by US$61.50/t over the weekend; SHFE price moves down to US$2642/t

Three-month LME aluminium opened at US$2,389.50 per tonne last Friday and closed at US$2,642 per tonne, a decrease of US$47.50 per tonne or 1.99 per cent.

On Friday, February 24, the LME aluminium benchmark price contracted significantly, marking the third consecutive fall. While the LME aluminium cash bid price nosedived by US$63 per tonne to close the week at US$2,305 per tonne, the LME aluminium official settlement price plummeted by US$61.50 per tonne to settle at US$2,307 per tonne.

3-month bid price and 3-month offer price also registered a sharp fall of US$52.50 per tonne and US$52 per tonne, respectively, to come in at US$2,355 per tonne and US$2,356 per tonne. December 24 bid price and December 24 offer price slipped by US$27 per tonne from the previous day to peg at US$2,558 per tonne and US$2,563 per tonne as of February 24.

LME aluminium opening stock totalled 563,600 tonnes, down by 5,200 tonnes from 568800 tonnes on February 28. Live warrants dropped by 500 tonnes to 447,075 tonnes and Cancelled warrants plunged by 4,700 tonnes to 116,525 tonnes.

LME aluminium 3-month Asian Reference Price dipped US$16.98 per tonne to close at US$2,393.22 per tonne as of Friday, February 24.

SHFE aluminium price

On Monday, February 27, the SHFE aluminium benchmark price extended a decline over the weekend by US$39 per tonne to stand at US$2,642 per tonne.

The most-traded SHFE 2304 aluminium contract opened at RMB 18,570 per tonne at last Friday’s night session before closing at RMB 18,365 per tonne, down RMB 270 per tonne or 1.45 per cent.

The most-traded SHFE 2304 aluminium closed down 0.59 per cent or RMB 110 per tonne at RMB 18,635 per tonne, with open interest up 6,317 lots to 205,167 lots.

This news is also available on our App 'AlCircle News' Android | iOS

.gif/0/0)