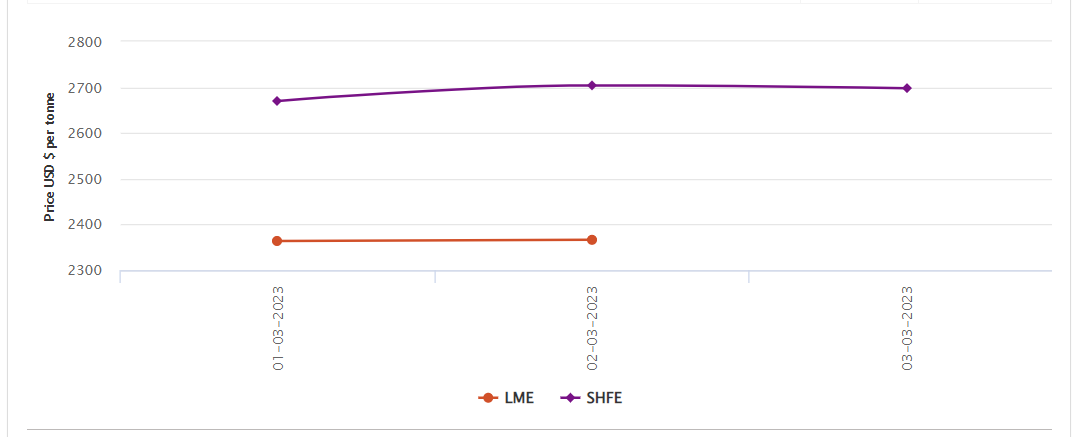

LME aluminium benchmark price stands slightly higher at US$2366.5/t; SHFE price slips by US$12/t

Three-month LME aluminium opened at US$2,441.50 per tonne on Thursday, March 2, and closed at US$2,395.50 per tonne, down US$48.50 per tonne or 1.98 per cent.

LME aluminium cash bid price and LME aluminium official settlement price continued to grow but at a much lower rate. The former grew by only US$3.50 per tonne to stand at US$2,365.50 per tonne as of March 2 and the latter inched up by US$2.50 per tonne to close at US$2,366.50 per tonne.

Both 3-month bid price and 3-month offer price increased by US$4.5 per tonne to rest at US$2,410 per tonne and US$2,411 per tonne, respectively. December 24 bid price and December 24 offer price climbed US$12 per tonne to peg at US$2,605 per tonne and US$2,610 per tonne.

LME aluminium opening stock totalled 546825 tonnes, losing 3,275 tonnes from the previous day. Live warrants dropped by 1,000 tonnes to settle at 438,750 tonnes, and Cancelled warrants decreased by 2275 tonnes to 108,075 tonnes.

LME aluminium 3-month Asian Reference Price built-up US$13.62 per tonne to come in at US$2,427.29 per tonne as of Thursday, March 2.

SHFE aluminium price

On Friday, March 3, the SHFE aluminium benchmark price closed lower at US$2,698 per tonne. It suffered a loss of US$12 per tonne compared to US$2,704 per tonne the previous day.

The most-traded SHFE 2304 aluminium contract opened at RMB 18,600 per tonne overnight and closed at RMB 18,605 per tonne, down RMB 60 per tonne or 0.32 per cent.

The most-traded SHFE 2304 aluminium closed up 0.54 per cent or RMB 100 per tonne at RMB 18,650 per tonne, with open interest down 9,701 lots to 195,704 lots.

This news is also available on our App 'AlCircle News' Android | iOS

.gif/0/0)