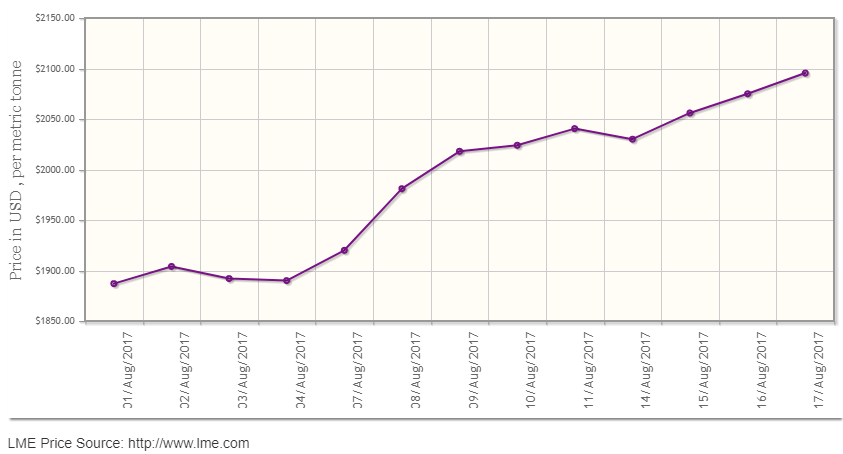

LME aluminium continues its upward trend; to test support at the 5-day moving average

LME aluminium continues its upward trend with another leap from US$2,075 per tonne on Wednesday August 16 to close at US$2,095.50 per tonne on Thursday, August 17. As reported by Reuters, LME aluminium may settle into a range of US$2,081- 2,089 per tonne as it has stabilized around a support at US$2,068/t. SMM predicts LME aluminium will range within US$2,055-2,075/t today and test support at the 5-day moving average. Traders are flooding into aluminium market on growing bullishness keeping prices high.

As on August 17, LME official cash buyer aluminium price (Bid Price) stands at US$2,094.50 per tonne, cash seller & settlement aluminium price (Offer price) is US$2,095.50 per tonne, 3M Bid Price is US$2,085 per tonne, 3M Offer Price is US$2,086 per tonne, Dec1 Bid Price is US$2,123 per tonne, and Dec1 Offer Price is US$2,128 per tonne. LME aluminium Opening Stock drops further to 12,83,525 tonnes, total Live Warrants is 10,53,725 tonnes, and Cancelled Warrant is 2,29,800 tonnes.

SME and SHFE Aluminium Price Trend

The benchmark aluminium price at Shanghai Metal Exchange (SME) has dropped to US$2,393 per tonne on Friday, August 18 from US$2,432 on Thursday, August 17, attributed mostly to rising stocks and slow demand.

SHFE 1710 aluminium opened at RMB 16,505/mt on Thursday and climbed up to RMB 16,660/mt finally falling back to RMB 16,425/mt. Finally, the most active contract ended at RMB 16,520/mt. SHFE 1710 aluminium should move in a wide range of RMB 16,000-16,250/t today. In east China’s spot aluminium market, spot discounts are expected at RMB 240-200/t over SHFE 1709 aluminium contract. Positive fundamentals will support market prices of all base metals in China.

On Friday, market focus should be on University of Michigan’s consumer confidence index for August. The US dollar index rose above 94 overnight due to pullback in the euro but, fell back later and should move around current level in the short term.

This news is also available on our App 'AlCircle News' Android | iOS

.gif/0/0)