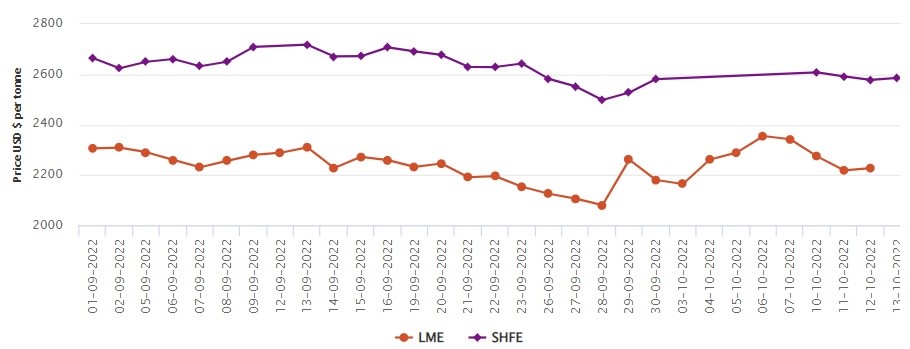

LME aluminium price climbs up the graph by US$8.5/t to US$2,227/t; SHFE price ascends by US$8/t

LME aluminium slid to US$2,200 per tonne after opening at US$2,240 per tonne on Wednesday but then jumped more than 6 per cent to US$2,400 per tonne as the United States was considering retaliatory measures against Rusal. LME aluminium closed at US$2,344 per tonne, an increase of 4.11 per cent.

On Wednesday, October 12, LME aluminium cash bid price and LME aluminium official settlement price went up after experiencing a decline for three consecutive days. As per the data, both prices grew by US$8 per tonne or 0.36 per cent and US$8.5 per tonne or 0.38 per cent to settle at US$2,226 per tonne and US$2,227 per tonne.

On the same day, 3-month bid price and 3-month offer price climbed up the graph by US$4.5 per tonne or 0.20 per cent to stand at US$2,219.50 per tonne and US$2,220 per tonne.

December 23 bid price and December 23 offer price increased by US$5 per tonne or 0.21 per cent to halt at US$2,302 per tonne and US$2,307 per tonne.

LME aluminium opening stock came in at 336275 tonnes. Live warrants and Cancelled warrants closed at 283600 tonnes and 52675 tonnes.

LME aluminium 3-month Asian Reference Price went down by US$8.33 per tonne or 0.37 per cent to reside at US$2,230.50 per tonne.

SHFE aluminium price

On Thursday, October 13, the SHFE aluminium benchmark price ascended by US$8 per tonne or 0.31 per cent to halt at US$2,586 per tonne.

The most-traded SHFE 2211 aluminium closed down 1 per cent or RMB 185 per tonne to RMB 18,340 per tonne, with open interest down 3,350 lots to 144,110 lots.

The most-traded SHFE aluminium contract opened at RMB 18,280 per tonne overnight and rose to RMB 18,590 per tonne before closing at RMB 18,485 per tonne, up or 0.57 per cent.

This news is also available on our App 'AlCircle News' Android | iOS

_0_0.gif)

.png/0/0)