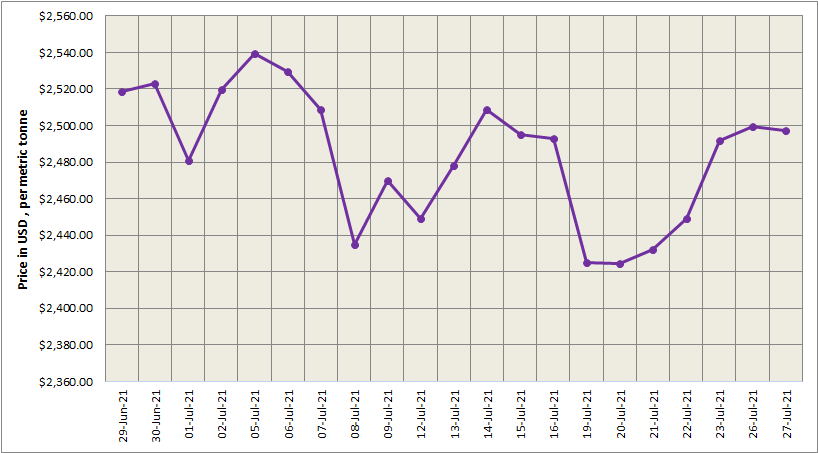

Three-month LME aluminium closed 0.78 per cent lower at US$ 2,485 per tonne on Tuesday, with open interest increasing 3,728 lots to 669,000 lots, and is expected to trade between US$ 2,470-2,530 per tonne today.

LME aluminium cash (bid) price and LME official settlement price inched down by US$ 2 per tonne to stand at US$ 2,497.50 per tonne on Tuesday, July 27, following five consecutive days of hike. However, 3-months bid price and 3-months offer price increased sharply by US$ 83.50 per tonne to come in at US$ 2,492 per tonne. On the other hand, Dec 22 bid price and Dec 22 offer price plunged from US$ 2,489 per tonne to US$ 2,466.50 per tonne.

LME aluminium opening stock further decreased to 1408000 tonnes. Live Warrants totalled 831825 tonnes, while Cancelled Warrants closed at 576175 tonnes.

LME aluminium 3-months Asian Reference Price hovered around US$ 2,498.52 per tonne as of July 27.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE edged down as well by US$ 52 per tonne to stand at US$ 2,984 per tonne as of Wednesday, July 28.

The most-traded SHFE 2109 aluminium closed down 0.05 per cent or RMB 10 per tonne to RMB 19540 per tonne, with open interest down 7 lots to 287000 lots.

The most-active SHFE 2109 aluminium contract decreased 1.22 per cent to end at RMB 19,385 per tonne last night, with open interest down 12,049 lots to 275,000 lots, and is expected to trade between RMB 19,100-19,800 per tonne today.

Responses