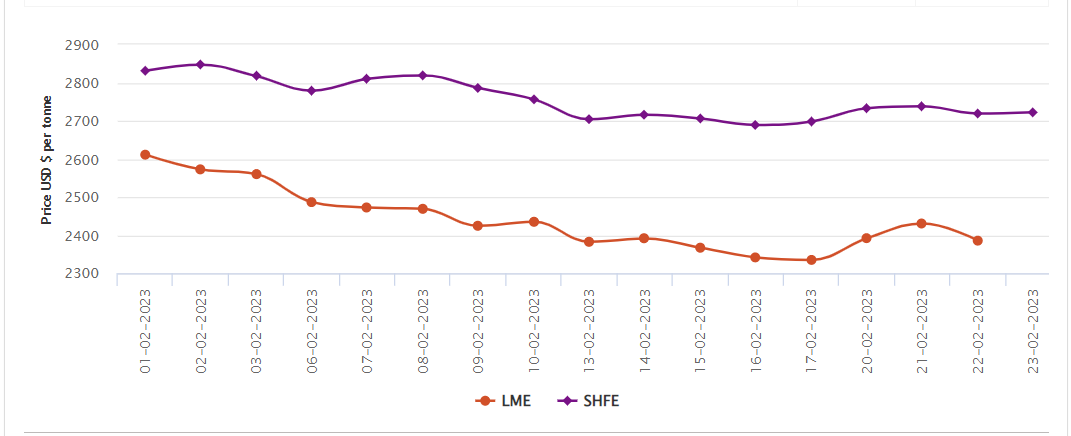

Three-month LME aluminium opened at US$2,458.50 per tonne last night and closed at US$2,413 per tonne, down US$46 per tonne or 1.87 per cent.

On Wednesday, February 22, the LME aluminium benchmark price registered a significant decline after two consecutive days of hike. While the LME aluminium cash bid price plummeted by US$45 per tonne to US$2,385 per tonne, the LME aluminium official settlement price slumped by US$45.50 per tonne to settle at US$2,385.50 per tonne.

The 3-month bid price and 3-month offer price shrank by US$42 per tonne and US$43 per tonne to peg at US$2,428 per tonne and US$2,429 per tonne, respectively. December 24 bid price and December 24 offer price contracted US$35 per tonne to close at US$2,600 per tonne and US$2,605 per tonne.

LME aluminium opening stock stood at 574,025 tonnes on February 22, down by 7,275 tonnes from 581,300 tonnes the previous day. Live warrants stayed muted at 451,725 tonnes, while Cancelled warrants decreased from 129,575 tonnes to 122,300 tonnes.

LME aluminium 3-month Asian Reference Price dropped US$3.25 per tonne, settling at US$2,445.71 per tonne.

SHFE aluminium price

On Thursday, February 23, SHFE aluminium benchmark price grew slightly by US$3 per tonne to peg at US$2,722 per tonne.

The most-traded SHFE 2304 aluminium closed down 0.27 per cent or RMB 50 per tonne at RMB 18,765 per tonne, with open interest up 6,833 lots to 191,052 lots.

The most-traded SHFE 2304 aluminium contract opened at RMB 18,785 per tonne overnight and closed at RMB 18,765 per tonne, a drop of RMB 30 per tonne or 0.16 per cent.

Responses