LME aluminium price surges by US$60.5/t boosted by strong Japan premiums; SHFE market is closed for the Qingming Festival

Aluminium showed strong performance yesterday, supported by factors like higher premiums in Japan and better-than-expected economic data from China, which countered worries about reduced demand from the world's largest consumer. Additionally, encouraging news from U.S. manufacturing, showing expansion for the first time in 1 1/2 years, added to the optimism surrounding demand outlooks.

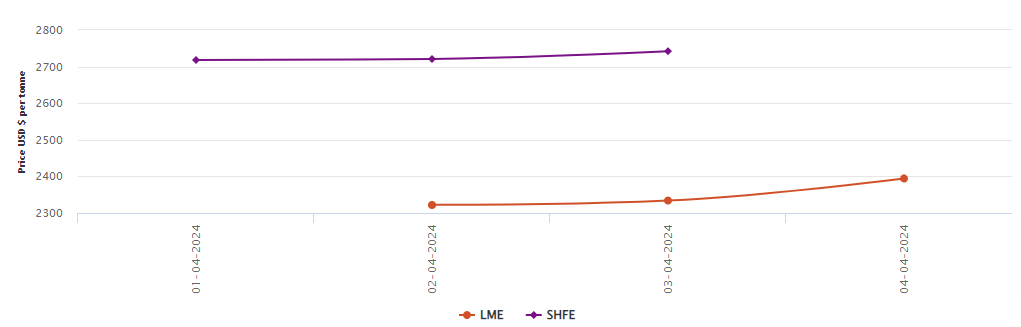

On Thursday, April 4, both LME aluminium cash bid price and LME aluminium official settlement price surged by US$60.5 per tonne or 2.59 per cent to settle at US$2,394 per tonne and US$2,394.50 per tonne.

{alcircleadd}3-month bid price and 3-month offer price expanded by US$61 per tonne to halt at US$2,439 per tonne and US$2,440 per tonne. December 25 bid price and December 25 offer price hiked by US$38 per tonne or 1.47 per cent to dock at US$2,618 per tonne and US$2,623 per tonne.

LME aluminium opening stock came in at 536850 tonnes. Live warrants and Cancelled warrants closed at 326475 tonnes and 210375 tonnes. LME aluminium 3-month Asian Reference Price gained US$66.67 per tonne or 2.80 per cent to settle at US$2,445.11 per tonne.

SHFE aluminium price

The SHFE market is closed on the occasion of the Qingming Festival (The Tomb-Sweeping Day) and will reopen again on April 8.

This news is also available on our App 'AlCircle News' Android | iOS

.gif/0/0)