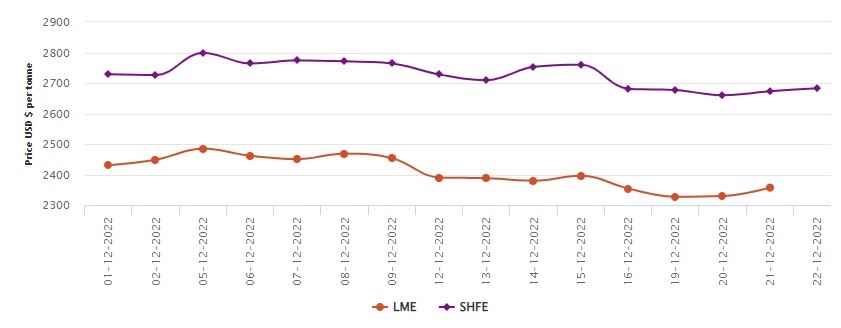

LME benchmark aluminium price marks an elevation of US$27.5/t; SHFE witnesses US$10/t spike

LME aluminium opened at US$2,377 per tonne on Wednesday, with its high and low at US$2,418 per tonne and US$2,376 per tonne respectively before closing at US$2,392 per tonne, a gain of US$20.5 per tonne or 0.86 per cent.

On December 21, Wednesday, LME aluminium cash bid price jumped up by US$26 per tonne or 1.12 per cent, closing at US$2,355 per tonne and the LME aluminium official settlement price soared by US$27.50 per tonne or 1.18 per cent to rest at US$2,357 per tonne.

The 3-month bid price escalated by US$20 per tonne or 0.84 per cent officially closing at US$2,390 per tonne and the 3-month offer price experienced a hike of US$21 per tonne or 0.88 per cent to halt at US$2,392 per tonne.

December 23 bid price and December 23 offer price both witnessed a similar rise of US$22 per tonne or 0.9 per cent, stopping at US$2,475 per tonne and US$2,480 per tonne, respectively.

LME aluminium opening stock went up the graph by 2,675 tonnes or 0.56 per cent to settle at 481,175 tonnes from 478,500 tonnes recorded on Tuesday.

Only, live warrants totalled 237,550 tonnes, with a plunge of 100 tonnes. Cancelled warrants read 243,625 tonnes, with an addition of 2,775 tonnes or 1.15 per cent.

LME aluminium 3-month Asian Reference Price came in at US$2,389.64 per tonne after a spike of US$5.89 per tonne or 0.25 per cent.

SHFE aluminium price

Today, on December 22, the SHFE benchmark aluminium price has levitated by US$10 per tonne or 0.37 per cent, closing at US$2,683 per tonne, with a constant rise for two days.

The most-traded SHFE 2301 aluminium contract opened at RMB 18,655 per tonne overnight, with its high and low at RMB 18,755 per tonne and RMB 18,650 per tonne before closing up RMB 90 per tonne or 0.48 per cent.

The most-traded SHFE 2301 aluminium closed up 0.51 per cent or RMB 95 per tonne at RMB 18,655 per tonne, with open interest down 9,582 lots to 119,748 lots.

This news is also available on our App 'AlCircle News' Android | iOS

.png/0/0)