Market Commentary: China is transitioning from 2024 to 2025 with bold trade strides as global geopolitics weigh in

Aluminium prices edged up by 0.08 per cent to close at INR 252.75 (USD 2.92) amid renewed investor optimism over China following comments from former US President Donald Trump hinting at a potential trade deal with the world's largest consumer of metals, as reported by investing.com. Market sentiment was further buoyed by developments within the European Union, which is preparing to impose sanctions on imports of primary aluminium from Russia. This anticipated move, the EU's geopolitical move of continual phasing-out of Russian aluminium, is a trend that has accelerated since European manufacturers began distancing themselves from Russian goods following the 2022 invasion of Ukraine.

_0_0.jpg)

Overview of China's aluminium trade front

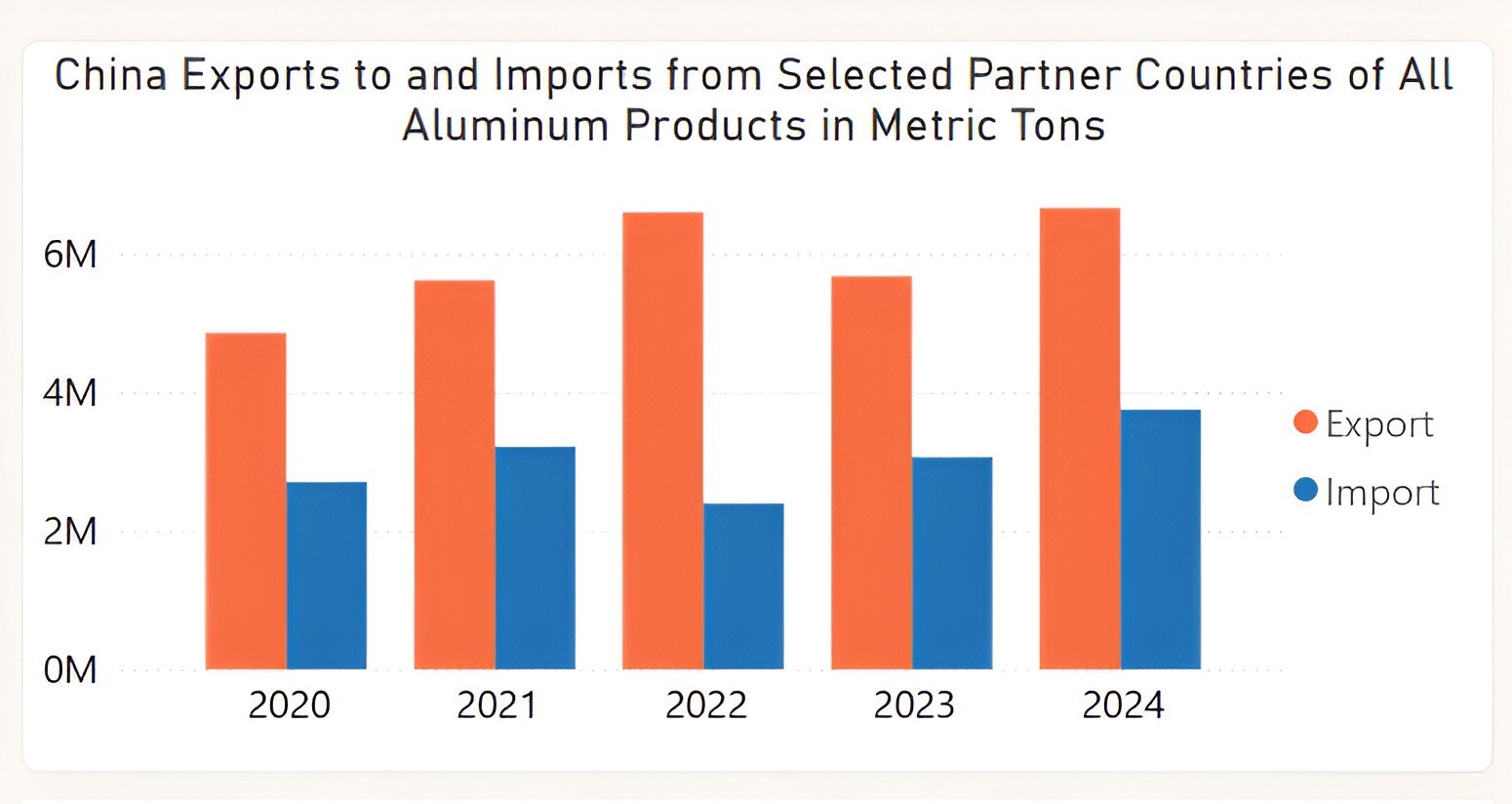

China's aluminium export trade exhibited significant growth between 2020 and 2024, both in volume and value. Export volumes increased from approximately 4.85 million tonnes in 2020 to 6.65 million tonnes in 2024, representing a cumulative growth of around 37 per cent. In terms of value, exports rose from USD 13.13 billion in 2020 to a peak of USD 25.97 billion in 2022 before stabilising at USD 22.03 billion in 2024. This substantial increase in export value during 2022 likely reflects favourable global aluminium prices and heightened international demand amid supply chain disruptions. Despite subsequent price corrections, China's export strategy has remained robust, driven by its advanced production capacity and global trade partnerships.

China's aluminium import patterns exhibited notable fluctuations both in volume and value. Imports rose from approximately 2.70 million metric tons in 2020 to a peak of 3.21 million tonnes in 2021 before declining to 2.39 million tonnes in 2022. Import volumes rebounded to 3.74 million tonnes by 2024. The value of aluminium imports followed a similar trajectory, increasing from USD 6.28 billion in 2020 to USD 9.55 billion in 2021, then dropping to USD 7.50 billion in 2022. By 2024, the value of imports recovered significantly to USD 10.11 billion. This recovery highlights China's growing need for external aluminium supplies amidst tightening environmental regulations and geopolitical shifts.

The data underscores China's dynamic role in the global aluminium market. The record export value in 2022, alongside declining import volumes, suggests a strategic emphasis on strengthening export capacity during a period of high global demand. However, the recovery in import values by 2024 indicates China's focus on securing stable aluminium supplies to meet domestic demand and sustain industrial production. The rising import values also hint at an increase in global aluminium prices and China's reliance on higher-value aluminium products.

China's aluminium trade from 2020 to 2024 illustrates its adaptability in navigating both global market opportunities and challenges. The consistent rise in export values highlights its growing influence in the international market, while the fluctuating import patterns underscore the complexities of managing domestic demand and supply chains. With the ongoing impact of environmental regulations and geopolitical tensions, China's aluminium trade strategy will likely continue evolving, positioning itself to maintain resilience and competitiveness in a volatile market.

Image Source: International Trade Administration

Image Source: International Trade Administration

Events

Events

e-Magazines

e-Magazines

Reports

Reports

This news is also available on our App 'AlCircle News' Android | iOS

.png/0/0)

.png/0/0)