Shanghai Metals Market, on Thursday, November 21, found the social inventories of primary aluminium continued to decline by a larger margin, as stocks in Nanhai and Gongyi fell sharply. Data showed the stocks across eight major consumption areas, including SHFE warrants, decreased by 35,000 tonnes week-on-week and 24,000 tonnes from Monday, November 18 to stand at 799,000 tonnes.

On last Thursday, November 14, the primary aluminium inventories had come in at 834,000 tonnes after declining by 19,000 tonnes over the week, while that on November 18 were at 823,000 tonnes after decreasing by 11,000 tonnes from November 14. This indicates that the drop in inventories of primary aluminium expanded on November 21.

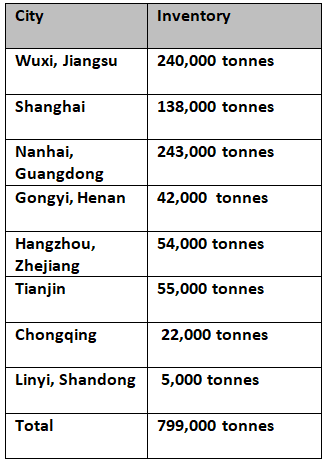

{alcircleadd}The chart below shows the current status of the primary aluminium inventories across China in more details:

From a week ago, the primary aluminium stocks in Shanghai dropped by 6,000 tonnes to stand at 138,000 tonnes, while that in Nanhai, Gongyi, and Hangzhou by 20,000 tonnes, 11,000 tonnes, and 1,000 tonnes to come in at 243,000 tonnes, 42,000 tonnes, and 54,000 tonnes, respectively.

In this background, the A00 aluminium ingot price recorded a significant rise of RMB 110 per tonne, on November 21, to stand at RMB 14,090, but followed this it dropped today, November 22, by RMB 40 per tonne to clock at RMB 14,050 per tonne, found SMM data.

Responses