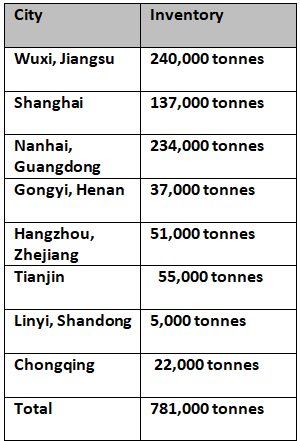

As updated by Shanghai Metals Market, social inventories of primary aluminium across eight consumption areas in China, including SHFE warrants, extended their declines over the weekend and stood at 781,000 tonnes as of Monday November 25. That was down by 18,000 tonnes from 799,000 tonnes on Thursday November 21.

The chart below shows the current status of the primary aluminium inventories across China in more details:

{alcircleadd}

Primary aluminium stocks in Shanghai and Nanhai, Guangdong were down by 1,000 tonnes and 9,000 tonnes from Thursday November 21 to 137,000 tonnes and 234,000 tonnes on November 25. Stocks in Gongyi, Henan and Hangzhou, Zhejiang stood at 37,000 tonnes and 51,000 tonnes on Monday, down 5,000 tonnes and 3,000 tonnes from 42,000 tonnes and 54,000 tonnes.

Primary aluminium stocks in Wuxi, Jiangsu, Tianjin, Linyi, Shandong, and Chongqing remained unchanged at 240,000 tonnes, 55,000 tonnes, 5,000 tonnes, and 22,000 tonnes.

On Monday, 25 November 2019, A00 aluminium ingot price increased to RMB 14060 per tonne from its previous price of RMB 14050 per tonne on November 22. This marked an increase of RMB 10 per tonne or 0.07 per cent.

Responses