The US dollar fell on Thursday as investors bet the Federal Reserve would cut interest rates to offset the impact of the spreading coronavirus amid the rapid rise in the number of COVID-19 cases.

The dollar index, which tracks the greenback against a basket of other currencies, slipped to 98.36, the lowest level since February 6, and ended down 0.65 per cent at 98.47.

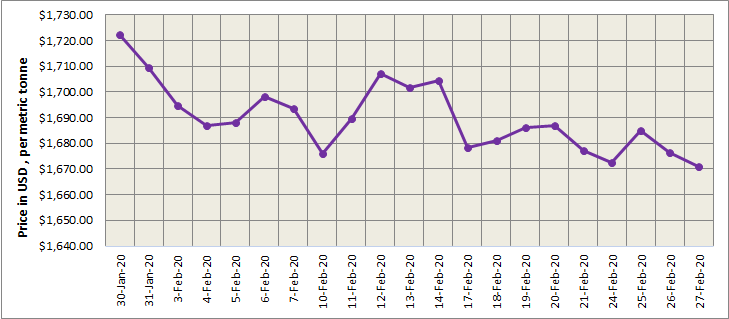

Three-month LME aluminium slipped to the lowest level in three years at US$ 1,682.5 per tonne before it closed 0.68 per cent lower on the day at US$ 1,690.5 per tonne. While LME aluminium inventories extended slide and the US dollar softened, prices of the base metals will remain under pressure before the epidemic is contained. Today, LME aluminium is expected to trade at US$ 1,670 per tonne to US$ 1,710 per tonne.

{alcircleadd}

As of Thursday, February 27, LME aluminium cash (bid) price stood at US$ 1670.5 per tonne after declining by US$ 5.5 per tonne from the previous day, while LME official settlement price dropped to US$ 1671 per tonne from US$ 1676.5 per tonne. 3-months bid price came in at US$ 1690 per tonne and 3-months offer price at US$ 1690.5 per tonne. Dec 21 bid price stood at US$ 1818 per tonne and Dec 21 offer price at US$ 1823 per tonne.

The LME aluminium opening stock decreased from 1103575 tonnes to 1092275 tonnes, as of February 27. Live Warrants totalled at 791850 tonnes and Cancelled Warrants 300425 tonnes.

LME aluminium 3-months Asian Reference Price hovered at US$ 1694.17per tonne.

SHFE Aluminium Price Trend

Benchmark aluminium price for SHFE also declined on Friday, February 28, from US$ 1,911 per tonne to US$ 1,893 per tonne.

The most-active SHFE 2004 contract extended its losses, plumbing a new one-year low of RMB 13,410 per tonne before closing down by 0.59 per cent at RMB 13,430 per tonne. SMM data showed the social inventories of primary aluminium in China continued to trend higher this week, as demand recovered slowly. The contract is expected to trade at RMB 13,300 per tonne to RMB 13,600 per tonne.

Responses