West Africa’s Capesize growth hits new heights: Bauxite, iron ore, and manganese propel the region forward

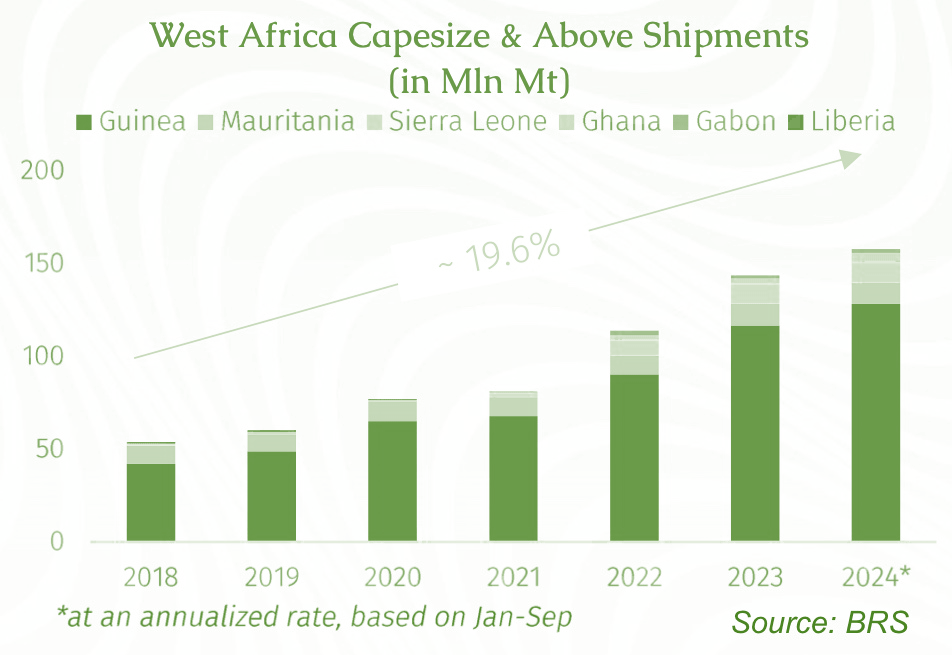

West Africa, led by Guinea, is rapidly becoming a key supplier of bulk cargo for the Capesize shipping trades, bolstered by China's expanding electric vehicle (EV) industry. With Capesize and larger shipments from the region rising at an annual rate of 19.6 per cent since 2018, analysts at broker BRS project West African exports could exceed 150 million tonnes in 2024.

The region's largest contribution comes from Guinea, but other nations are also seeing significant growth. Mauritania, Africa's second-largest iron ore producer, along with Sierra Leone, Ghana, and Gabon, now accounts for approximately 20 per cent of Capesize and above cargo volumes leaving West Africa.

Notably, Ghana's iron ore exports surged by 76 per cent in the first nine months of this year. Gabon has tapped into the Capesize market with high-grade manganese ore, facilitated by transhipment from Libreville.

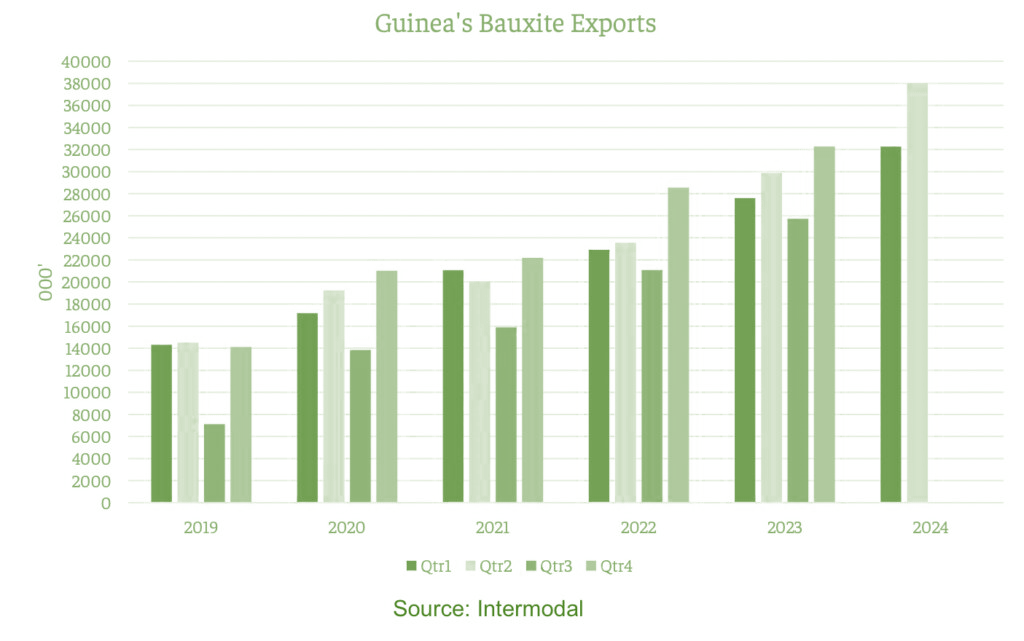

The Guinea-to-China bauxite route has become a "pivotal pillar" of the Capesize trades, underscoring the strategic importance of the trade corridor. BRS data reveals that there are now only 1.67 Brazilian shipments for every Guinean shipment—a dramatic shift from the 2019 ratio when every Guinea shipment was met with 337 Brazilian shipments. This year, bauxite has come to represent roughly 13 per cent of global Capesize trade volumes, a sharp rise from 10 per cent in 2023 and just 5 per cent in 2020, according to data from investment bank Jefferies.

Guinea's status in global shipping is set to rise even further with the anticipated opening of the Simandou iron ore mine in 2025, poised to make the nation a major iron ore supplier for China. The development solidifies Guinea's—and West Africa's—role as a powerhouse in bulk exports to Asia, a trend that shows no signs of slowing.

This news is also available on our App 'AlCircle News' Android | iOS

.png/0/0)