The central bank stated that it would seize the opportunity to implement RRR cuts and interest rate cuts, focusing on the release of end-use demand

Futures Market: Overnight, the most-traded SHFE aluminium 2505 contract opened at RMB 20,945 per tonne, hitting a high of RMB 21,035 per tonne and a low of RMB 20,875 per tonne, before closing at RMB 21,020 per tonne, up RMB 35 per tonne or 0.17 per cent. On Thursday, LME aluminium opened at USD 2,701 per tonne, reached a high of USD 2,707.5 per tonne and a low of USD 2,666.5 per tonne, and closed at USD 2,705 per tonne, up USD 5 per tonne or 0.19 per cent.

Futures Market: Overnight, the most-traded SHFE aluminium 2505 contract opened at RMB 20,945 per tonne, hitting a high of RMB 21,035 per tonne and a low of RMB 20,875 per tonne, before closing at RMB 21,020 per tonne, up RMB 35 per tonne or 0.17 per cent. On Thursday, LME aluminium opened at USD 2,701 per tonne, reached a high of USD 2,707.5 per tonne and a low of USD 2,666.5 per tonne, and closed at USD 2,705 per tonne, up USD 5 per tonne or 0.19 per cent.

{alcircleadd}

Macro: (1) The central bank held an expanded meeting, emphasising the implementation of an appropriately loose monetary policy and the timing of RRR cuts and interest rate cuts based on domestic and overseas economic and financial conditions as well as financial market performance. (Bullish★)

(2) The National Financial Regulatory Administration announced the continued expansion and efficiency improvement of the urban real estate financing coordination mechanism, ensuring the delivery of housing projects and accelerating the formulation of financing systems aligned with the new real estate development model. (Bullish★)

(3) Regarding the recent implementation of the US policy imposing a 25 per cent tariff on imported steel and aluminium, Ministry of Commerce spokesperson Yongqian He responded on the 13th, stating that China has consistently viewed the US Section 232 measures as unilateralism and protectionism under the guise of "national security." China, along with many other countries, firmly opposes these measures and urges the US to revoke the Section 232 measures on steel and aluminium promptly. (Neutral)

(4) The US February PPI M-o-M recorded 0 per cent, below the expected 0.3 per cent, marking the smallest increase since July 2024. Following the release of US initial jobless claims and PPI data, US short-term interest rate futures still indicate that the US Fed will cut interest rates in June. (Bullish★)

Fundamentals: (1) According to SMM, as of this Thursday (March 6-13), the national operating capacity of aluminium stood at approximately 43.78 million tonnes per year, with an operating rate of 95.6 per cent. Recently, aluminium production has resumed, leading to higher operating capacity. However, due to the time required to reach full production, there was no significant contribution to this week's aluminium production, which remained around 857,000 tonnes. (Neutral)

(2) Domestic spot alumina prices showed a renewed downward trend. From last Thursday through Friday, sporadic spot transactions emerged in the north China market, with transaction prices generally ranging from RMB 3,200-3,300 per tonne. The decline in spot alumina prices resumed. (Bearish★)

(3) According to an SMM survey, the operating rate of leading domestic aluminium downstream processing enterprises rose 0.8 percentage points W-o-W to 61.6 per cent this week. Aluminium processing enterprises continued their recovery trend, but high aluminium prices suppressed downstream purchase willingness, limiting the operations of some enterprises. SMM predicts that the operating rate will continue to rise next week, potentially exceeding the 62 per cent threshold. (Bullish★)

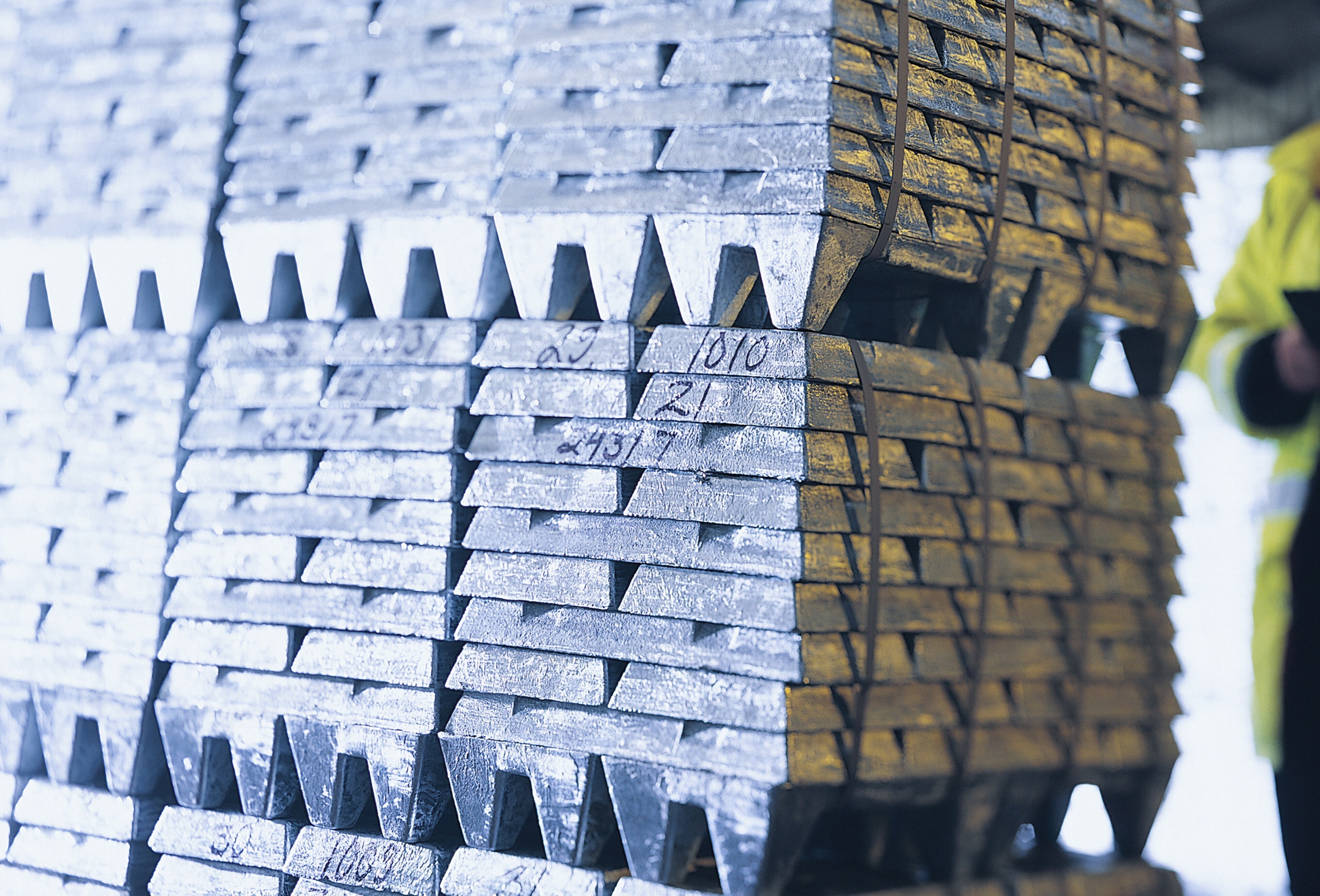

Primary aluminium market: On Thursday morning, SHFE aluminium fluctuated, with the front-month contract consolidating around RMB 20,900-21,000 per tonne. Spot market sentiment was bullish, and aluminium ingot destocking supported high prices. Specifically, trading activity among traders in East China was active, but rapid price increases made it difficult to narrow spot discounts. Yesterday, SMM A00 aluminium recorded a discount of RMB 40 per tonne against the SHFE aluminium 2503 contract, with SMM A00 aluminium ingot prices at RMB 20,910 per tonne, up RMB 10 per tonne from the previous trading day.

In the central China market, transactions showed no significant improvement yesterday. Downstream safety-related production restrictions ended, and high prices led to prioritising inventory consumption. Yesterday, transactions in central China were mainly on par with SMM central China prices, with SMM central China A00 aluminium recording RMB 20,790 per tonne against the SHFE aluminium 2503 contract, up RMB 10 per tonne from the previous trading day.

The price spread between Henan and Shanghai was RMB -120 per tonne. In the short term, destocking in major consumption areas and optimistic downstream demand expectations will support aluminium prices. Combined with downstream purchasing as needed, spot premiums and discounts may fluctuate.

Secondary aluminium raw materials: Yesterday, primary aluminium spot prices rose RMB 10 per tonne from the previous trading day, with SMM A00 spot closing at RMB 20,910 per tonne. The aluminium scrap market remained stable, with downstream purchasing as needed. Baled UBC aluminium scrap was quoted at RMB 15,250-16,150 per tonne (excluding tax), while shredded aluminium tense scrap was quoted at RMB 16,450-17,950 per tonne (excluding tax).

In the short term, domestic new scrap supply has improved, but downstream demand remains weak. Coupled with high primary and aluminium scrap prices, downstream and end-use demand remains sluggish, and aluminium scrap prices may fluctuate rangebound with primary aluminium.

Secondary aluminium alloy: Yesterday, aluminium prices fluctuated slightly, and the secondary aluminium market remained stable. SMM ADC12 prices were unchanged from the previous day, ranging from RMB 21,200-21,400 per tonne. Current downstream demand is weak, and low-priced supplies in the market are abundant, limiting the upside room for ADC12 prices. If demand continues to show no significant improvement, ADC12 prices may face downward pressure due to cost easing and the impact of low-priced supplies in the market.

Summary: On the macro side, the central bank emphasised implementing an appropriately loose monetary policy and timing RRR cuts and interest rate cuts. Fundamentals side, domestic aluminium production resumption continues; with weak spot prices for alumina and petroleum coke, cost-side support for aluminium weakens further.

Aluminium ingot social inventory continued destocking during the week, coupled with a sustained recovery in aluminium processing enterprise operations, providing support on the consumption side. However, high aluminium prices suppressed downstream purchase willingness, limiting the momentum for operating rate growth in some enterprises, while spot premiums in various regions faced constraints. Aluminium prices are expected to hover at highs in the near term, with close attention to changes in US tariff policies and the actual release of downstream demand.

Note: This article has been issued by SMM and has been published by AL Circle in its original form without any modifications or edits to the information.

This news is also available on our App 'AlCircle News' Android | iOS

.gif/0/0)