What happened in India's secondary aluminium industry in Jan'25? BigMint analysis

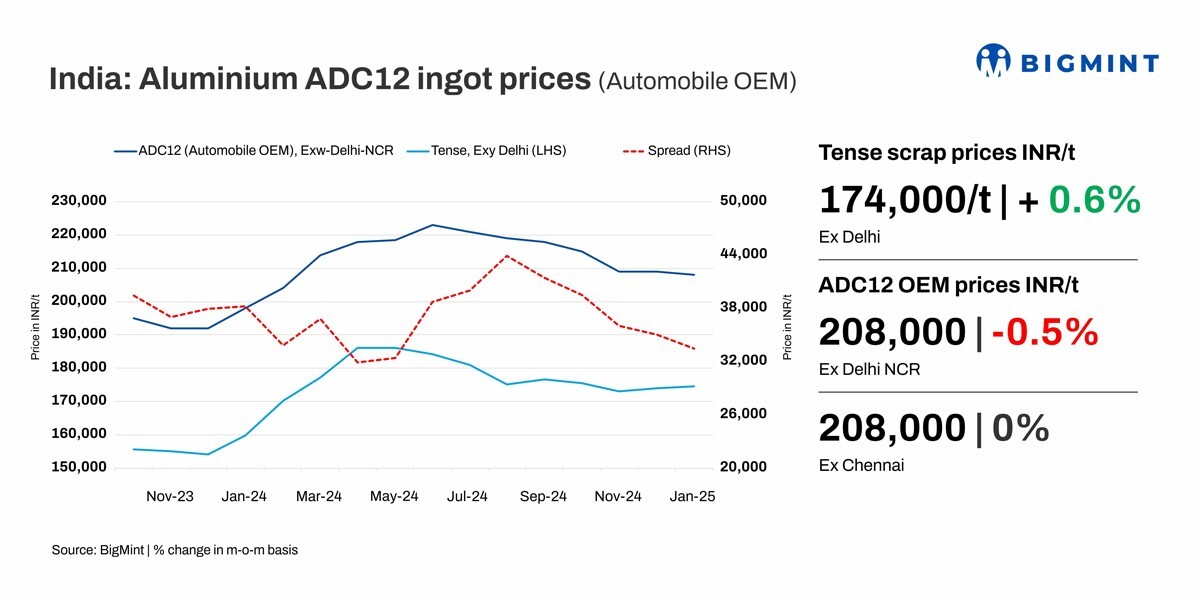

India's ADC12 alloy market faced challenges in January 2025 as demand softened and prices hit their lowest level in nine months. BigMint's latest assessment shows that OEM-approved ADC12 in both Delhi and Chennai was priced at INR 208,000/tonne (t), a decrease of INR 1,000/t m-o-m. This decline reflects weaker demand from the automotive sector, particularly as major players announced price cuts for ADC12. For January settlements, automakers' ADC12 prices stood at INR 208,000/t, down INR 1,000/t from December 2024.

While India's largest automaker reduced prices in January, this has had minimal effect on the local tags of ADC12 and raw materials, which remained stable. While the gap between scrap and ADC12 narrowed over the last few months of CY'24, it was firm in January 2025 at INR 33,000-34,000/t.

Indian export offers for ADC12 were stable m-o-m in January 2025 at $2,400-2,420/t CFR Japan despite limited traction, driven by slow automotive demand. Notably, the Indian market experienced an oversupply of ADC12 alloyed ingots, driven by weak overseas demand, particularly from Japan, its largest buyer.

Imported scrap prices edge up m-o-m

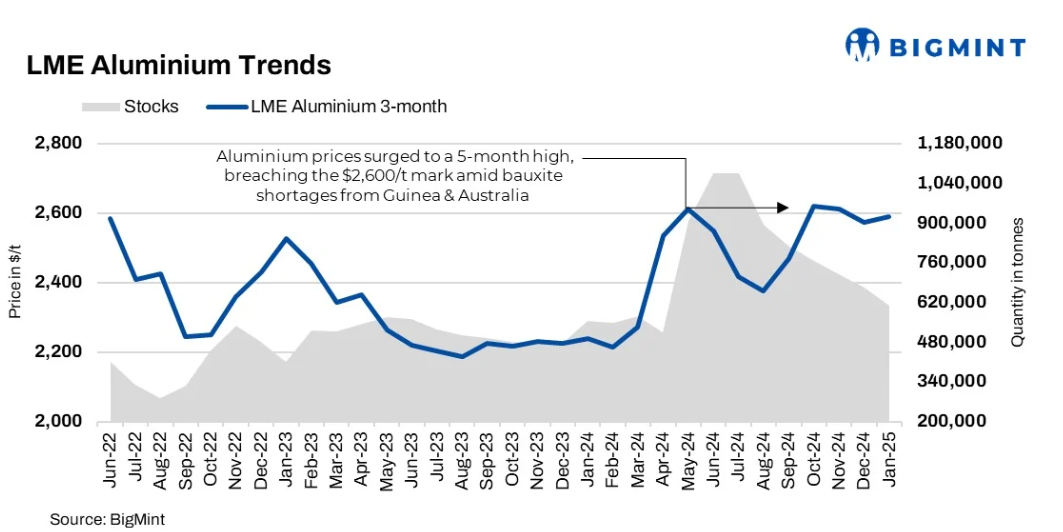

Imported aluminium scrap prices increased slightly in January 2025, driven by a marginal upward trend in the future. For instance, US-origin Tense scrap inched up to $1,840-1,850/t, while UK-origin Wheels rose by 1.5 per cent to $2,449/t. Meanwhile, the London Metal Exchange (LME) aluminium prices increased by 1 per cent m-o-m in three months.

Scrap, ingot imports decrease

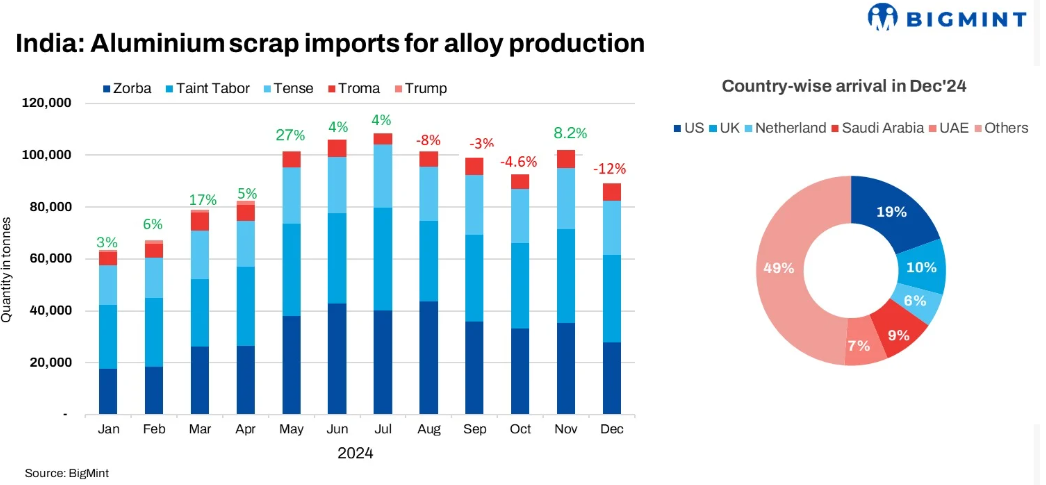

Aluminium scrap imports declined m-o-m to 146,000 t in December 2024. Zorba imports fell 21 per cent m-o-m to 27,829 t, while Taint Tabor dropped by 7 per cent m-o-m to 33,742 t.

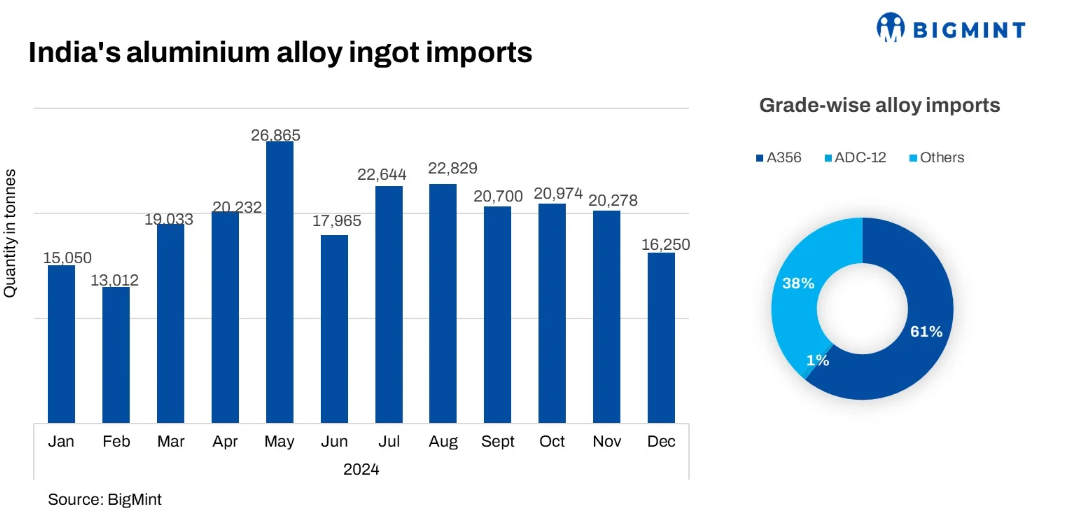

Similarly, semi-finished ingot imports dropped 14 per cent m-o-m, with key grades such as A356 and LM24 experiencing notable declines.

ADC12 imports plunged by 86 per cent m-o-m, from 1,258 t to 177 t in December 2024, while exports were 1,926 t during this period.

Market scenario - preference for domestic scrap rises

Due to the high cost of imported raw materials, local suppliers shifted towards using domestic scrap. This, along with sluggish exports, led to a surplus of ADC12 ingots in the market.

A prominent source stated, "In northern and southern India, participants expect scrap demand to move up further."

Another source highlighted, "Scrap demand typically picks up mid-year, which could lead to shortages given its higher usage currently. Additionally, several countries are planning to restrict scrap exports, further impacting supply. In response to rising primary ingot premiums, A356 manufacturers have started using scrap instead. Scrap shortages are expected to push prices even higher in the next quarter."

However, recent production cuts may moderate scrap demand. A market participant commented, "Due to weak demand, many alloy ingot manufacturers have been operating below capacity for months, making it difficult to determine inventory levels. Recently, rising imported raw material prices have also driven up domestic costs of the same. Consequently, small- and medium-scale alloy producers have cut production, while only larger mills continue to buy scrap despite high prices."

A source mentioned "India's largest automaker has kept ADC12 Feb'25 settlement prices at 207.90/kg, however OEM's in North and South have started quoting prices levels of 211-212/kg owing to shortage of raw material in the market currently".

Maruti Suzuki's sales rise in Jan'25

In January 2025, Maruti Suzuki India Limited recorded its highest-ever monthly sales of 212,251 units. This included 177,688 units in domestic sales, marking its best performance in the segment, along with 7,463 units sold to other OEMs and 27,100 units exported. The milestone reflects the company's growing demand across domestic and international markets.

Outlook - Prices to improve in the short term

The ADC12 alloy market is likely to strengthen in the near term, driven by rising raw material costs and an anticipated recovery in overseas demand. Additionally, the spread between scrap and semi-finished products narrowed last month, which could create room for adjustments in the coming month.

Notably, in December 2024, India's automobile retail sales declined by 12 per cent y-o-y to 1,756,419 units from 1,990,915 units in the year-ago period, according to the Federation of Automobile Dealers Associations (FADA). This decrease was primarily due to high inventory levels following the festive season and subdued consumer sentiment.

FADA has stressed that the sector's performance during the fourth quarter will be crucial. Excess inventory will need to be cleared to end FY'25 on a strong note. With OEM support, favourable government policies, and a possible recovery in consumer demand, the association remains cautiously optimistic about improved sales.

Top image credit: Peakmore

Note: This article is received under the content exchange agreement with BIGMINT and published as received without edits from AL Circle.

This news is also available on our App 'AlCircle News' Android | iOS

.jpg/0/0)

.gif/0/0)