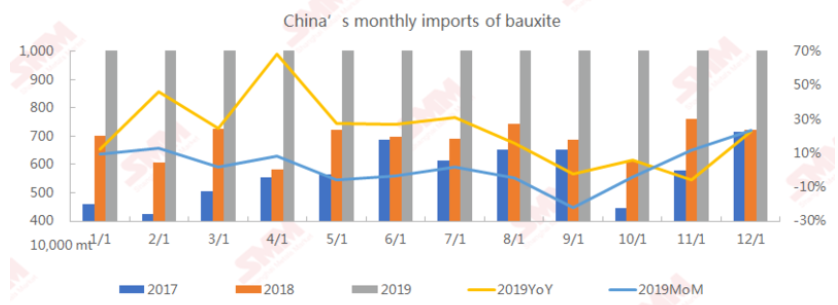

According to China customs data, the country in the entire year of 2019 imported 100.66 million tonnes of bauxite, compared to 82.57 million tonnes in 2018. This means the year saw an increase of 21.91 per cent in the import volume, exceeding the 100 million tonnes level for the first time.

The Republic of Guinea, Australia, and Indonesia remained the top three bauxite exporters to China, accounting for over 94 per cent of China’s bauxite imports in total.

From Guinea, China imported 44.45 million tonnes, up 16.49 per cent year-on-year. Imports from Australia expanded 21.08 per cent to 36.04 million tonnes, as demand from refineries in coastal regions in Shandong and Inner Mongolia held stable and that from northwest China such as Chongqing grew. In the future also, the demand for Australian bauxite is expected to grow in these regions.

Last but not the least, Indonesia’s bauxite exports to China jumped 91.16 per cent to 14.41 million tonnes.

The remaining 6 per cent of China’s bauxite imports in 2019 originated from Malaysia, Brazil, Solomon Islands, the Republic of Montenegro, Jamaica, India, Turkey, Ghana, Vietnam, and Sierra Leone.

Bauxite originated from Brazil, Ghana, and Sierra Leone is of good quality but is relatively expensive. So, some Chinese alumina refineries buy from them when sea freight charges are low. Imports of bauxite from other countries stood less than 10,000 tonnes per month on average in 2019.

SMM survey showed that 47 per cent of alumina capacity in China used imported bauxite in 2019.

For 2020, SMM expects China’s bauxite imports to continue to stand above 100 million tonnes. Guinea, Australia, and Indonesia are estimated to remain the top exporters. Prices and volumes of imported bauxite are, however, likely to be sensitive to weather, political, and policy stability in bauxite exporters, sea freight charges, and the progress in technology upgrading at Chinese alumina refineries.

Responses