China is the world's second-largest economy after the United States and despite its recent challenges, China poured an impressive $940 billion into clean energy initiatives in 2024, bringing its investment close to the $1.12 trillion spent globally on fossil fuels.

This substantial commitment underscores China's accelerating shift toward renewable energy and its pivotal role in reshaping the global energy landscape, as highlighted by a new analysis for the U.K.-based research organisation Carbon Brief.

Note: Here’s the graph visualising China's clean energy investment growth and its contribution to GDP from 2023 to 2024. The green line represents the sharp decline in investment growth, while the black dashed line shows the sector's increasing share of GDP.

Although there was a slowdown in China's green energy investment growth—dropping from 40 per cent in 2023 to just 7 per cent in 2024 due to overcapacity—the sector remained a key economic driver. More than half of the investment stemmed from China's rapidly expanding electric vehicle, battery, and solar industries. According to research by Carbon Brief, conducted by analysts at the Helsinki-based Centre for Research on Energy and Clean Air (CREA), the clean energy sector's contribution to China's GDP rose to 10 per cent in 2024, up from 9 per cent the previous year.

Clean energy grew three times faster than China's overall economy, yet its contribution to the country's GDP declined to 26 per cent last year from 40 per cent in 2023, reflecting a slowdown in the sector's expansion. Clean energy industries—including electric vehicles, batteries, renewable manufacturing, power generation, railways, electric grids, storage, and energy efficiency—experienced cooling growth.

The decline in GDP contribution was also driven by deflation and sharp drops in the prices of renewable energy equipment, particularly solar panels and batteries. While these lower costs accelerated the adoption of renewables, they also weighed on the sector's overall economic impact, the report noted.

China's drive toward green aluminium production was estimated to reach a major milestone. The China Green Metal Certification Center (CGMC) projected the accreditation of approximately 2.75 million tonnes of low-carbon aluminium by the end of 2024. According to a Beijing-backed industry association, this accounts for around 7 per cent of the country's total aluminium output. However, it was forecasted to reach 4 million tonnes in 2024.

China produces 80 per cent of the world’s solar panels. Solar PV is expected to remain a major driver of aluminium demand, reflecting the material’s role in advancing renewable energy adoption worldwide.

China's rapidly expanding electric vehicle (EV) industry has emerged as the largest contributor to the nation's GDP, generating RMB 3 trillion from EV and hybrid production and an additional RMB 1.4 trillion from factory investments. The country's charging infrastructure further added 122 billion yuan to the economy.

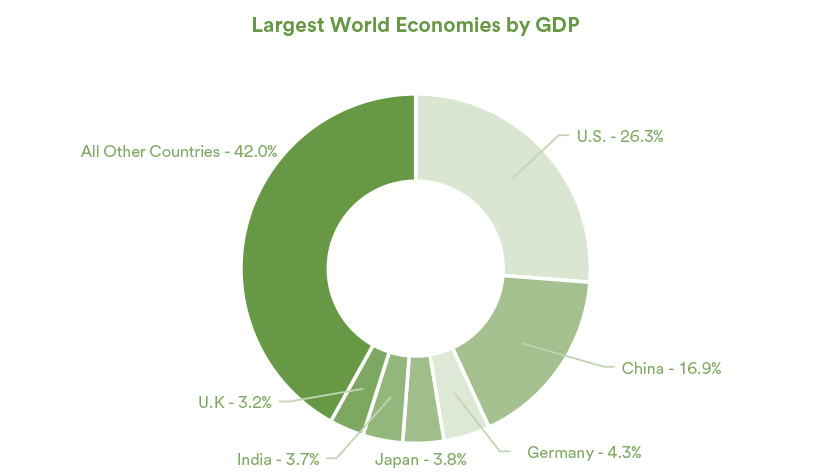

Source: International Monetary Fund, “World Economic Outlook,” January 2025

Source: International Monetary Fund, “World Economic Outlook,” January 2025

Following closely, the solar sector contributed around USD $384 billion to GDP, with USD 139 billion stemming from investments in power generation projects. However, as solar panel prices hit record lows, manufacturing investment dropped to around USD 106 billion, falling behind power generation. Meanwhile, component exports and electricity generation contributed around USD 83.36 billion and USD 53.04 billion, respectively.

Researchers anticipate a continued surge in clean power investments through 2025, the final year of the current five-year plan. However, they stress that setting more ambitious targets for the 2026–2030 plan will be crucial to maintaining the current momentum of clean energy deployment.

Source: World Bank. As of Jan. 17, 2025. *Projected growth in 2025

Is China’s coal expansion threatening its clean energy transition?

According to two think tanks, in 2024, China initiated the construction of 94.5 gigawatts (GW) of new coal-fired power capacity and resumed 3.3 GW of previously suspended projects—the highest level of coal power expansion in the past decade.

This rapid buildout, driven by substantial investments from the coal mining sector, raises serious concerns about China’s ability to transition away from fossil fuels. However, analysts anticipate that the country’s massive clean energy capacity additions will gradually reduce coal’s share in electricity generation. As China pushes toward its “dual-carbon” goals—peaking carbon emissions by 2030 and achieving carbon neutrality by 2060—the challenge remains: Can clean energy growth outpace coal reliance in time?

A new joint report by the Centre for Research on Energy and Clean Air (CREA) and Global Energy Monitor (GEM) highlights that China's renewed surge in coal-fired power plant construction is hindering the country’s progress toward clean energy.

Image credit: China Briefing

Information credit: Industry publications

Responses