Iceland aluminium smelters support primary capacity of the U.S. aluminium majors

The U.S. primary aluminium industry which was once buzzing with 30 aluminium smelters in the country by aluminium majors like Alcoa and Century is now operating just just five smelters with curtailed capacity with uncertain future. Aluminium producers like Alcoa and Century Aluminum which have closed smelters in the U.S. have their smelters running in Iceland, mostly because of the cheaper hydroelectricity in the country.

This tiny Iceland country which was once known only for its huge fish production and export is on the way to produce more aluminium in 2017 than the United States in the same way like two other countries with hydropower, Canada and Norway.

This is the ideal example of globalization where Iceland gets jobs, Alcoa gets higher profits and buyers in the United States get lower prices. American aluminium industry and its workers are expecting this globalization to help the surviving companies against the overwhelming presence of China in the market.

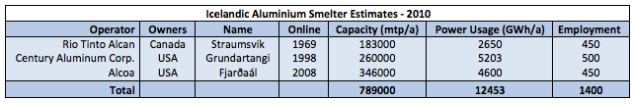

Iceland’s first smelter sits just south of Reykjavik, the capital city and dominant population centre. The second, opened by Century in 1998, sits just to the north. Alcoa started in 2007 after Iceland had built a giant power plant on the other side of the island. Electricity rates for Alcoa in Iceland are about 30% less than in the United States. That’s a crucial advantage considering the more than five million megawatt-hours of electricity consumed by Alcoa each year.

American smelters which have not been technically upgraded have been failing to produce aluminium at a competitive rate owing to increasing energy costs. America’s reliance on imported aluminium has grown rapidly in recent years. According to U.S. Geological Survey Report imports accounted for 52% of domestic consumption in 2016.

Presently, the U.S. aluminium industry does not want to bring back the jobs that have moved to Canada and Iceland and other countries where American companies have built their smelters. Rather, the domestic industry is focusing on building a strong value-added segment for the aluminium industry and supplying to the automotive, packaging and aerospace sector. They are foreseeing that China is slowly beginning to expand into the still profitable business of downstream aluminium products. They are also urging for protective measures against Chinese semi-finished export to the U.S.

{googleAdsense}

The government of Iceland estimates that it has harnessed only about a quarter of the country’s potential output of hydropower and geothermal energy. And all three of the aluminum companies have floated expansion plans in recent years. Critics from the country however, have argued that Iceland is not leveraging on their low-cost hydropower benefits.

Petur Blondal, the managing director of the Icelandic Association of Aluminum Producers indicated that Iceland is more interested to build a value added segment for aluminium than constructing new primary smelters.

This news is also available on our App 'AlCircle News' Android | iOS