Market Commentary: Middle East aluminium industry's past, present and tentative future analysed amid global market shifts in 2024

The Middle Eastern aluminium market is poised for significant growth, with projections indicating a valuation of USD 16.68 billion by 2030, driven by a compound annual growth rate (CAGR) of 5 per cent from 2024. This burgeoning market, according to an elaborate report by NextMSC, is currently valued at USD 11.33 billion and is being fuelled by a confluence of factors, including a growing emphasis on sustainability and the region's position as a major global producer.

Global production landscape

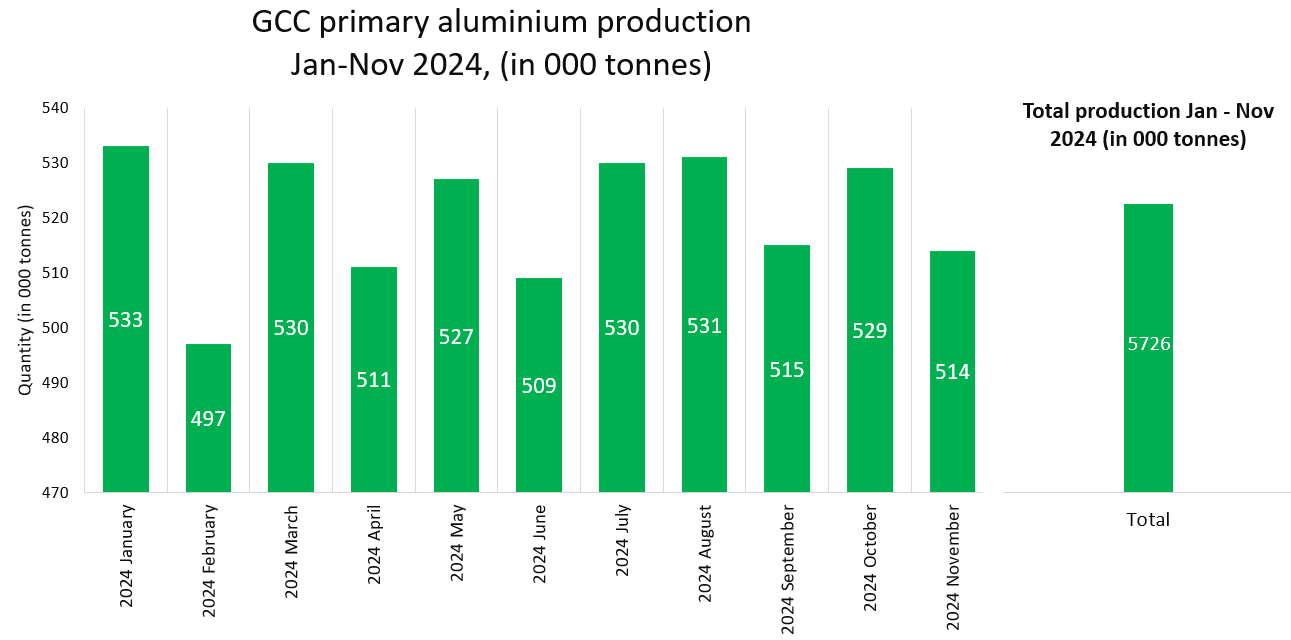

While China continues to dominate global aluminium production, accounting for an estimated 39,653 thousand tonnes in 2024 (January-November), representing nearly 60 per cent of the total output, the Gulf Cooperation Council (GCC), which consorts a massive middle-eastern aluminium trading countries, solidifies its position as the second-largest producer, contributing 5,726 thousand tonnes. Other key contributors include Asia (excluding China) at 4,403 thousand tonnes, North America at 3,646 thousand tonnes, and Russia & Eastern Europe at 3,808 thousand tonnes.

Middle Eastern trade dynamics

Aluminium exports have seen a dramatic increase in Middle Eastern countries between 2017 to September 2024. In Bahrain, exports have risen from approximately 435,000 tonnes in 2017 to a peak of 1,818,000 tonnes in 2022. Conversely, aluminium imports have followed a more volatile trajectory. A substantial decline is observed from 149,000 metric tons in 2017 to a low of 15,000 metric tons in 2021, possibly indicating a successful drive towards self-sufficiency or a change in domestic demand. However, imports rebounded in 2022 and 2023. From January to October 2024, 1.16 million tonnes of aluminium was exported from the country, whereas during the same period, 23.5 thousand tonnes were imported into the country. UAE which accounts for the majority share of the business in the region, Wherin a dynamic picture of the UAE's aluminium trade can be witnessed between 2017 to September 2024. Exports have remained relatively stable, fluctuating around 2.3 million tonnes. However, imports have steadily increased, reaching nearly 292,000 tonnes in 2022, indicating growing domestic demand. The recent decline in both exports and imports in YTD September 2024, accounting for 1.9 million tonnes of exports and over 250 thousand tonnes of imports, can be attributed to various factors, including global economic fluctuations, changing EU and environmental policies, and adjustments in domestic production and consumption patterns.

Events

Events

e-Magazines

e-Magazines

Reports

Reports

This news is also available on our App 'AlCircle News' Android | iOS

.jpg/0/0)