Metro Mining Q4 2024 update: Record performance from Bauxite Hills Mine

The Australian mining and exploration company Metro Mining Limited has published its Q4 2024 operational update. As announced on January 6, 2025, the Bauxite Hills Mine has successfully demonstrated its capability to consistently operate at the expanded target rate of 7 million wet metric tonnes (WMT) per annum.

However, despite challenging weather conditions in December 2024, which led to the cancellation of the final vessel in the shipping schedule, total shipments for Q4 reached 2.1 million WMT. For the full calendar year, the Company achieved total shipments of 5.7 million WMT.

Another important aspect that happened during the quarter was that Metro successfully refinanced its senior debt and private royalty obligations held by Nebari Natural Resources Credit Fund I, LP and Nebari Natural Resources Credit Fund II, LP (collectively referred to as ‘Nebari’). Additionally, Metro fully repaid its remaining junior debt owed to Ingatatus AG Pty Ltd (‘Ingatatus’) and Lambhill Pty Ltd (‘Lambhill’).

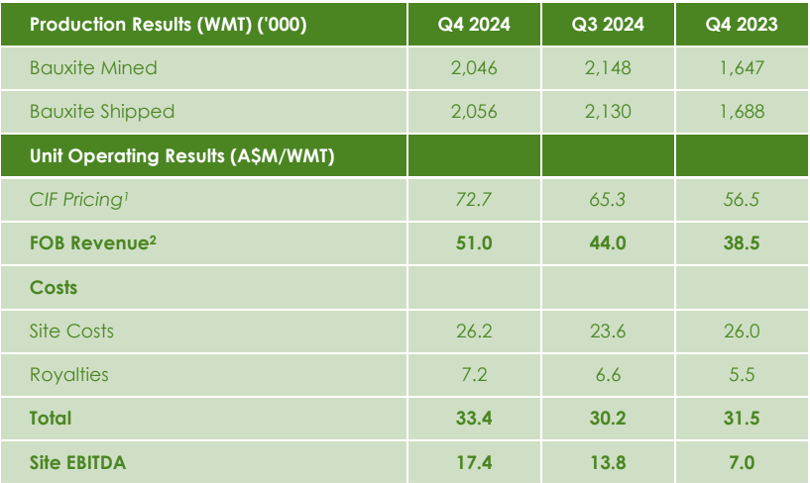

Increased production is being delivered in a period of tightness in the traded bauxite market and aluminium value chain as benchmark prices for bauxite and alumina rose strongly towards the end of the quarter. Metro’s average delivered prices were up 32 per cent year-on-year and approximately 16 per cent over Q3. Quarterly contract prices are expected to increase further in Q2 2025, underpinned by offtake contracts from a high-quality customer portfolio.

The new wobbler screening circuit, combined with the Offshore Floating Terminal (OFT) Ikamba, achieved consistent throughput levels of approximately 800,000 WMT per month. This success has shifted the primary bottleneck to the barge loader (BLF) and tug/barge circuit. Although adverse weather in December and one-off expansion expenditures impacted quarterly costs, margins improved to $17.4/WMT.

During the maintenance shutdown, significant attention was given to BLF and transhipping assets, setting the stage for achieving the annual shipment target of 6.5–7.0 million WMT. This is expected to drive economies of scale, and operational cost efficiency will be a key focus area for 2025.

Net cash flow from operations remained strong at $34 million. After a debt repayment of $11.7 million, the company ended the quarter with $31 million in cash and $11 million in trade receivables.

Let us hear what Simon Wensley, CEO & MD of Metro Mining, said,

"Whilst our Q4 results are starting to show industry-leading margins, I am also extremely pleased with the delivery and risk reduction in all parts of the business. Confirming our expanded production capability, restructuring, and lowering the cost of our balance sheet, upgrading, and diversifying our customer portfolio sets Metro up strongly for the future. This couldn't come at a better time as bauxite prices hit record levels. I'd like to pay tribute to the hard work and continuous problem-solving efforts of the MMI and contractor teams, which will underpin continuous improvement from this point."

Bauxite market

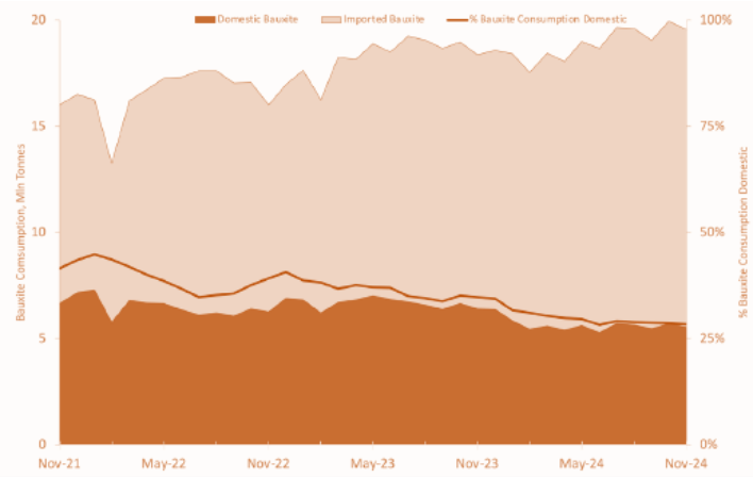

In 2024, alumina prices surged to record highs, exceeding US$700 per tonne (MT), fuelling robust demand for traded bauxite during Q4. China’s bauxite imports for the full calendar year 2024 reached an all-time high of 159 million tonnes (MT), marking a 12 per cent increase compared to CY 2023 and setting a new consecutive yearly record.

China Bauxite Consumption- Imports and Domestic (Mt/month; CM Group)

Source: Metro Mining

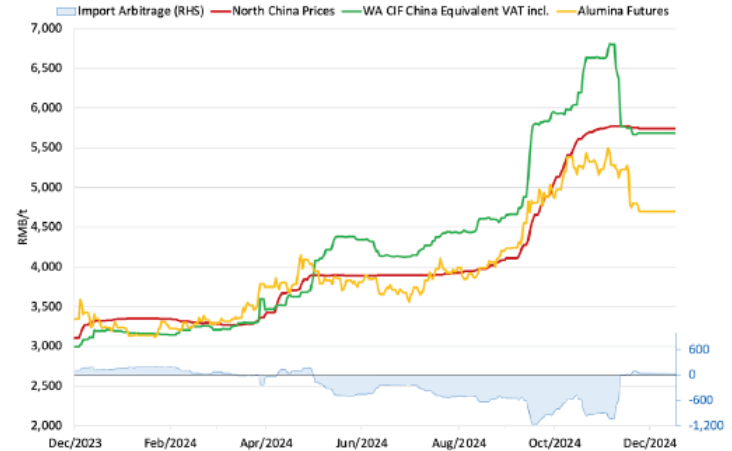

Traded Alumina Prices- China and International (RMB/t; CM Group)

Source: Metro Mining

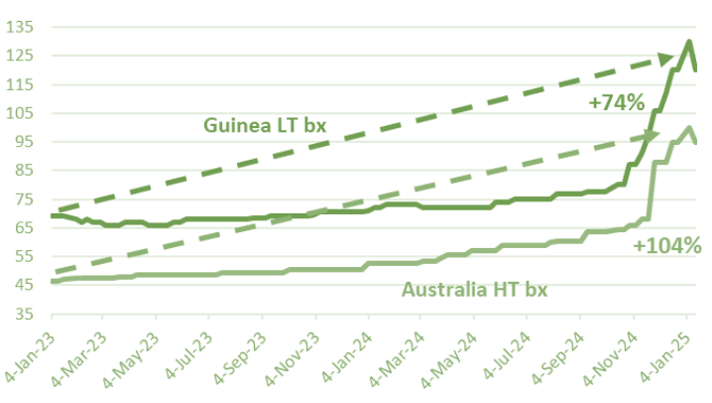

The bauxite market is experiencing a positive pricing trend. According to the latest spot market data, Guinea bauxite prices have risen to *US$120 per DMT, marking a 74 per cent increase since January 2023, while Australian high-temperature (HT) bauxite prices have climbed to *US$95 per DMT, reflecting a 104 per cent surge over the same period. Notably, the most significant price growth has occurred in the past six months.

Traded Bauxite Prices from Jan 2023 to Jan 2025 (US$/DMT CIF China: CM Group)

Source: Metro Mining

Metro's average FOB equivalent prices have increased significantly, rising approximately 32 per cent compared to Q3 2023 and 16 per cent compared to Q3 2024. These price adjustments broadly reflect prevailing market conditions at the time of negotiation for open volumes, with considerations for moisture and quality.

As illustrated in the accompanying graph, spot prices experienced a strong upward trend towards the end of Q4. Due to the wet season pause in shipments, MMI will not negotiate prices for Q1 2025 but plans to re-enter the market in February to negotiate Q2 2025 open volume contracts.

Metro has bolstered its customer portfolio for 2025 with multi-cargo contracts secured with Aluminium Corporation of China (Chalco), the world's largest aluminium producer, and Shandong Lubei Chemical (Lubei). These new agreements complement existing contracts with Xinfa Aluminium Group. Additionally, following a successful trial shipment to Emirates Global Aluminium's (EGA) Al Taweelah refinery in Abu Dhabi in 2024, a multi-cargo contract has been finalised with EGA for 2025. This brings Metro's total contracted offtake for 2025 to 6.9 million wet metric tonnes (WMT).

Operational Performance Production, Costs and Margins

Source: Metro Mining

Source: Metro Mining

Note 1 – Realised pricing for CIF-based sales only.

Note 2 – Total realised pricing for FOB and CIF basis sales (total revenue from customers less ocean freight costs, if applicable)

Key takeaways

- Record Q4 shipments totalling 2.1 million wet metric tonnes (WMT)- up 22 per cent y-o-y.

- Expansion delivers record CY 2024 shipments of 5.7 million WMT- up 24 per cent y-o-y.

- Q4 FOB pricing is up 16 per cent from Q3 2024, reflecting strong market conditions.

- Site EBITDA margins $17.4 /WMT.

- Metro has 6.9 million WMT contracted for 2025 through multi-cargo offtake contracts with Chalco, EGA (UAE), and Lubei, enhancing and diversifying its customer base.

- The senior debt and royalty restructuring with Nebari Partners LLC has been completed.

- Junior debt of A$11.7M repaid to lenders.

- $42M in cash and trade receivables at the end of the quarter.

Gain valuable insights into the global bauxite and alumina sector with AL Circle's comprehensive "Global Aluminium Industry Outlook 2025." To make informed decisions, stay ahead of industry trends, production forecasts, and shipment data. Secure your copy today to access critical market intelligence and strategic foresight.

Source: CM Group

This news is also available on our App 'AlCircle News' Android | iOS

.png/0/0)

.png/0/0)