Alcoa Corporation reports Q4 and full year 2023 results; primary aluminium output rises 5%

On January 17, 2023, Alcoa Corporation reported fourth quarter and full year 2023 results demonstrating progress on key priorities.

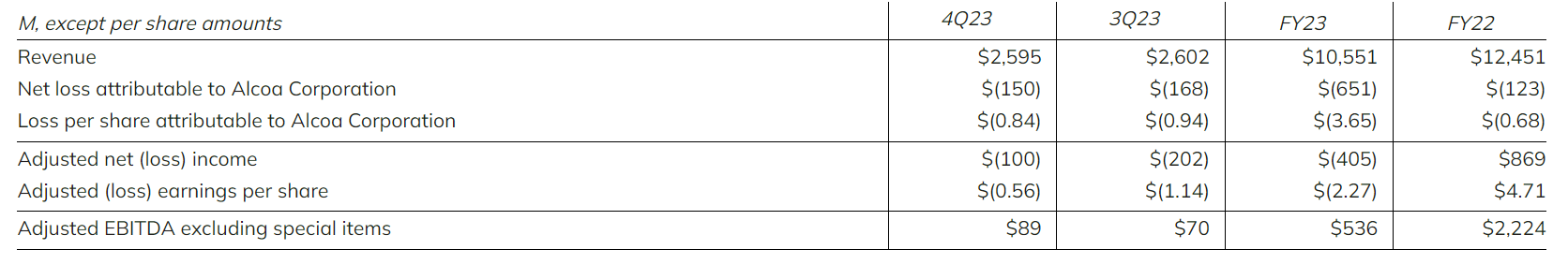

Financial results and highlights

Fourth quarter 2023

Fourth quarter 2023

- Received approval to continue bauxite mining in Western Australia

- Received clarification on qualification for Section 45X of the Inflation Reduction Act (IRA)

- Began restart of additional smelting capacity at Warrick Operations in Indiana

- Initiated engagement with Spanish stakeholders regarding the path forward for the San Ciprián complex

Full-year 2023

- Increased aluminium production by 5 per cent sequentially; set annual production records across the Canadian smelter system and at the Mosjøen smelter in Norway

- Returned cash to stockholders through $72 million in quarterly dividend payments

“In the fourth quarter of 2023, we made progress on key challenges, including gaining approval on our Western Australia bauxite mine plans, and we’re continuing to advance operational stability while we work to improve our global asset portfolio,” said Alcoa President and CEO William F. Oplinger. “We are building on our positive momentum and implementing actions to drive improved profitability.”

Fourth quarter 2023 results

- Production: Alumina production decreased 1 per cent sequentially to 2.79 million metric tons on lower production from the Australian refineries. In Aluminium, Alcoa produced 541,000 metric tons, a 2 per cent increase from the third quarter’s strong output.

- Shipments: Third-party alumina shipments decreased 5 per cent sequentially in the Alumina segment primarily due to decreased trading. In Aluminium, total shipments increased by 1 per cent sequentially.

- Revenue: The Company’s total third-party revenue was flat sequentially at $2.60 billion. In the Alumina segment, revenue decreased 5 percent on an average realized third-party price decrease of 3 percent and lower shipments. In the Aluminium segment, revenue increased 2 percent on an average realized third-party price increase of 1 percent and higher shipments.

- Net loss attributable to Alcoa Corporation was $150 million, or $0.84 per share. Sequentially, the results include lower raw material and production costs and favourable currency impacts, partially offset by higher energy costs mainly due to carbon dioxide compensation changes in Norway. Additionally, the results include a $152 million charge to tax expense to record a valuation allowance on Alcoa World Alumina Brasil Ltda. (AWAB) deferred tax assets, and reflect the non-recurrence of a tax benefit of $58 million recognized for the full reversal of the valuation allowance recorded against the deferred tax assets of the Company’s subsidiaries in Iceland in the third quarter of 2023.

The Norwegian government recently approved an updated budget proposal that limits carbon dioxide compensation to be paid in 2024 based on 2023 power purchased and used in production. The unfavourable sequential impact is $24 million, which includes amounts previously accrued through September 30, 2023, and the absence of related accruals for the fourth quarter of 2023.

- Adjusted net loss was $100 million, or $0.56 per share, excluding the impact from net special items of $50 million. Notable special items include $102 million in discrete and other tax items primarily related to the recognition of the AWAB tax valuation allowance discussed above, a gain on the sale of carbon credits related to a closed site of $19 million, mark-to-market gains on energy contracts of $7 million, and noncontrolling interest impacts on above items of $40 million.

- Adjusted EBITDA excluding special items was $89 million, a sequential increase of $19 million primarily due to lower raw material and production costs, partially offset by higher energy costs primarily in Europe.

- In December 2023, the U.S. Treasury Department clarified that commercial-grade aluminium can qualify for the Advanced Manufacturing Tax Credit on Section 45X (IRA 45X credit), enacted as part of the IRA. In the fourth quarter of 2023, the Company recorded the full-year benefit totalling $36 million in Cost of goods sold at the Massena smelter in New York and the Warrick smelter in Indiana.

- Cash: Alcoa ended the quarter with a cash balance of $944 million. Cash provided from operations was $198 million. Cash provided from financing activities was $6 million, primarily related to $18 million of net contributions from noncontrolling interest and $14 million of net short-term borrowings, partially offset by $18 million of cash dividends on common stock. Cash used for investing activities was $197 million, primarily related to capital expenditures of $188 million and $19 million in contributions to the ELYSISTM partnership. Free cash flow was $10 million.

- Working capital: For the fourth quarter, receivables from customers of $0.7 billion, inventories of $2.2 billion and accounts payable, and trade of $1.7 billion comprised DWC working capital. The Company reported 39 working capital days, a sequential improvement of 11 days. Accounts payable days increased by nine days primarily due to the timing of energy and raw materials payables and increased capital expenditures.

Full-year 2023 results

- Production: Alumina production decreased by 13 per cent annually, primarily due to lower-grade bauxite at the Australian refineries and partial curtailments at the San Ciprián refinery in Spain and the Kwinana refinery in Australia. Aluminium production increased 5 per cent annually, primarily due to the restart of the Alumar smelter in Brazil.

- Shipments: In the Alumina segment, third-party alumina shipments decreased by 5 per cent, primarily due to reduced production at the Australian refineries and the San Ciprián refinery, partially offset by increased trading opportunities.

- In Aluminium, total shipments decreased 3 percent annually primarily due to reduced production at the San Ciprián and Lista smelters and decreased trading opportunities, partially offset by higher shipments due to the Alumar smelter restart.

- Revenue: The Company’s total third-party revenue decreased 15 per cent to $10.6 billion, driven primarily by lower average realized third-party prices for aluminium and alumina. Annually, the average realized third-party price of alumina decreased 7 percent to $358 per tonne and the average realized third-party price of aluminium decreased 18 percent to $2,828 per tonne.

- Net loss attributable to Alcoa Corporation was $651 million, or $3.65 per share, compared with the prior year’s net loss of $123 million, or $0.68 per share. The results reflect lower aluminium and alumina prices and higher production costs. In addition to the restructuring charges noted below, the 2023 results include a net charge to tax expense of $94 million discussed above.

- Adjusted net loss was $405 million, or $2.27 per share, excluding the impact from net special items of $246 million. Notable special items include charges of $117 million related to the permanent closure of the Intalco smelter, $53 million for certain employee obligations related to the February 2023 viability agreement for the San Ciprián smelter, $33 million related to the restart costs at the Alumar smelter, $45 million in discrete and other tax items primarily related to tax valuation allowance adjustments discussed above, partially offset by the noncontrolling interest impacts on above items of $42 million.

- Adjusted EBITDA excluding special items decreased 76 per cent sequentially to $536 million, mainly attributable to year-over-year lower average realized prices for aluminium and alumina, as well as higher production costs primarily in the Alumina segment.

- Cash: Alcoa ended 2023 with a cash balance of $944 million. Cash provided from operations was $91 million. Cash provided from financing activities was $57 million, primarily related to $158 million of net contributions from noncontrolling interest and $55 million of net short-term borrowings, partially offset by $72 million in cash dividends on common stock, $52 million for site separation expenditures related to the 2021 sale of the Warrick Rolling Mill in Indiana and $34 million for payments related to tax withholding on stock-based compensation awards. Cash used for investing activities was $585 million, primarily due to $531 million in capital expenditures and $70 million in contributions to the ELYSISTM partnership. Free cash flow was negative $440 million.

- Working capital: The Company reported 39 days of working capital, a year-over-year improvement of eleven days. The change primarily relates to a decrease of seven days in inventory primarily due to lower volumes and prices for raw materials and a decrease of four days in accounts receivable primarily due to lower pricing for aluminium and favourable receivables collection terms.

Key strategic actions

Operational

- WA mine approvals: In December 2023, the Western Australian (WA) Government approved Alcoa’s latest five-year mine plan – known as the 2023-2027 Mining and Management Program (MMP) – for its Huntly and Willowdale bauxite mines. The approvals include operating enhancements to meet evolving requirements and expectations. In addition, the WA Government granted an exemption that allows Alcoa to continue its mining operations while the WA Environmental Protection Authority (EPA) assesses the environmental impact on parts of the MMP.

- Kwinana refinery: On January 8, 2024, the Company announced the decision to curtail the Kwinana refinery in Australia beginning in the second quarter of 2024.

- San Ciprián complex: In December 2023, the Company initiated engagement with Spanish stakeholders at the San Ciprián complex regarding financial losses and to find a long-term solution for the combined complex.

- Since the smelter was curtailed in January 2022, the Company has honoured its commitments under the viability agreements signed in December 2021 and February 2023, including paying all employees, making capital investments, and preparing for restart. However, current market conditions, including the cost of energy, do not support an economically viable restart. Further, permitting and development of renewable energy projects, which were a critical component of the restart, have been delayed. The refinery and smelter incurred significant losses in 2023 and prior years, which have been funded with internal credit lines that are now nearing their limits and which the operations have no ability to repay.

- Warrick Operations: During the fourth quarter of 2023, the Company took actions to improve the competitiveness of its Warrick Operations site in Indiana. Alcoa began the restart of one line (54,000 mtpy) that was curtailed in July 2022 and also began the closure of a line (54,000 mtpy) that had not operated since 2016 to allow for future capital investments to improve casting capabilities. Restructuring charges related to the closure totalled $1 million in the fourth quarter of 2023 to establish reserves related to demolition obligations. Additionally, Alcoa recorded $1 million in Cost of goods sold to write off the remaining net book value of related inventory.

Financial

- Productivity and competitiveness programs: In January 2024, the Company initiated a productivity and competitiveness program across its global operations and functions. The program is the first step in the Company’s objective to improve competitiveness and includes a target to save approximately 5 per cent of operating costs, exclusive of raw materials, energy and transportation costs, which are already under active management and cost control programs. Total savings are expected to approximate $100 million on a run rate basis and to be achieved by the first quarter of 2025.

- Revolving Credit Facility: On January 17, 2024, Alcoa amended its Revolving Credit Facility to provide the Company flexibility to implement its portfolio actions during 2024; terms include a temporary reduction of the minimum interest coverage ratio required thereunder from 4.00 to 1.00 to 3.00 to 1.00, and an increase to the maximum addback for cash restructuring charges to Consolidated EBITDA (as defined in the Revolving Credit Facility), in each case for the 2024 fiscal year. In connection with the amendment, Alcoa also agreed to provide collateral for its obligations under the Revolving Credit Facility, with a ratings-based release mechanism that would apply starting in 2025.

2024 Outlook

The following outlook does not include reconciliations of the forward-looking non-GAAP financial measures Adjusted EBITDA and Adjusted Net Income, including transformation, intersegment eliminations and other corporate Adjusted EBITDA; operational tax expense; and other expense; each excluding special items, to the most directly comparable forward-looking GAAP financial measures because it is impractical to forecast certain special items, such as restructuring charges and mark-to-market contracts without unreasonable efforts due to the variability and complexity associated with predicting the occurrence and financial impact of such special items. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to future results.

For 2024, the Company provides an outlook for both production and shipments for both segments. Alcoa expects alumina production to range between 9.8 and 10.0 million tonnes and alumina shipments to range between 12.7 and 12.9 million tonnes in 2024. The difference between production and shipments reflects trading volumes and externally sourced alumina to fulfil customer contracts due to the curtailment of the Kwinana refinery. The Aluminium segment is expected to produce 2.2 to 2.3 million tonnes, an increase from 2023 due to smelter restarts. Aluminium shipments are expected to be between 2.5 million and 2.6 million metric tons, consistent with 2023, as increased shipments from smelter restarts are offset by lower trading volumes.

Within the first quarter of 2024 alumina segment adjusted EBITDA, the Company expects approximately $15 million of unfavourable impacts related to higher maintenance costs and lower shipments in Australia. In addition, the Company expects sequential benefits from lower raw material and energy costs to be fully offset by other factors.

Within the first quarter of 2024 Aluminium Segment Adjusted EBITDA, the Company expects sequential favourable energy costs, primarily due to lower prices in Brazil and Norway, to be fully offset by lower product premiums and an unfavourable net impact due to the non-recurrence of fourth quarter 2023 items related to the IRA 45X credit and carbon dioxide compensation changes in Norway. Alumina costs in the Aluminium segment are expected to be unfavourable by $5 million sequentially. Additionally, the Company expects an unfavourable sequential impact of approximately $20 million from hedge programs for the Alumar smelter restart, which ended in December 2023.

Other income for the fourth quarter of 2023 included favourable impacts of $51 million related to foreign currency gains that may not recur.

Based on current alumina and aluminium market conditions, Alcoa expects negligible first-quarter operational tax expense, which may vary with market conditions and jurisdictional profitability.

This news is also available on our App 'AlCircle News' Android | iOS

.gif/0/0)