India: Imported aluminium scrap prices remain range-bound w-o-w amid slow trading

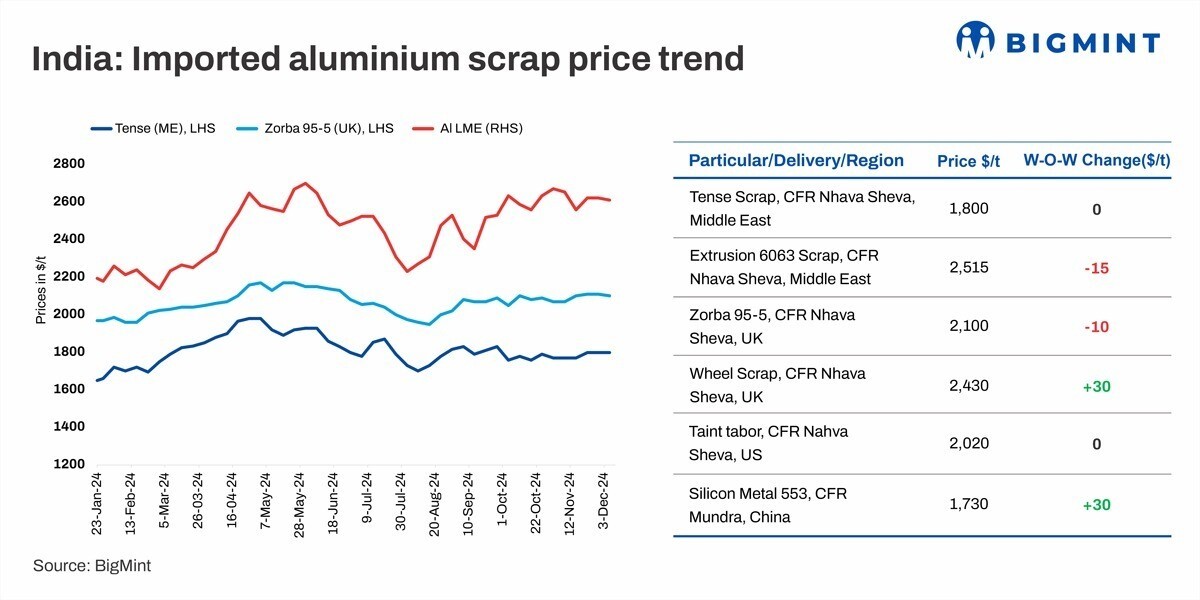

Imported aluminium scrap prices in India remained range-bound w-o-w, with variations by up to 1.3 per cent, amid slow trading activity. BigMint's benchmark assessment for Tense scrap originating from the UAE stood at $1,800/tonne (t), firm w-o-w, while Zorba 95/5 from the UK stood at $2,100/t, largely stable w-o-w, both prices CFR west coast, India.

{alcircleadd}

This week, London Metal Exchange (LME) prices dropped to around $2,600/t after a brief rise following China's proposed removal of the export tax rebate on aluminium semi-finished products. The price surge moderated as the market adjusted to the policy changes and shifted its focus to current demand trends.

At the time of reporting, three-month aluminium futures on the LME stood at $2,620/tonne, range-bound compared to the previous week's levels of around $2,620-2,630/tonne. Meanwhile, stocks at LME-registered warehouses stood at 706,000 tonnes, falling by 1.4 per cent w-o-w from 693,500 tonnes.

Sources informed, "Aluminium prices remain steady, with only a slight dip in LME levels. However, imported scrap offers are still relatively high. Despite this, demand for scrap has improved since mid-November, with buyers actively booking shipments for January and February."

A key market player noted, "Thailand and Malaysia are becoming attractive markets for aluminium Zorba, offering $60-70/t more compared to India. With better prices and lower shipping costs, global sellers are now focusing on trading Zorba with Thailand to boost their profits, while Indian players are buying at lower levels of around $2,100/t."

Domestic scrap stable

In the domestic market, Tense scrap prices remained steady w-o-w in both Delhi and Chennai, while other grades witnessed a downtrend. According to BigMint's assessment, domestic tense scrap stood at INR 173,000/t ex-Delhi NCR and INR 174,000/t ex-Chennai.

A manufacturer stated, "Local demand in Delhi remains subdued, driven by limited industrial activity. High air pollution levels have forced many factories to cut production significantly, with furnaces operating at just 40-50 per cent of their capacity due to operational constraints and a labour shortage. Adding to the slowdown, automotive companies are preparing for maintenance shutdowns, further weakening market demand."

China's silicon prices edge up

According to BigMint's assessment, prices of China's 553-grade silicon went up by $30/t w-o-w to $1,730/t CFR Mundra. Freights were at around $2,300 for a single container from China to Mundra.

Outlook

Aluminium prices are likely to stay stable for now. As winter sets in and the holiday season begins, say from December 15 onwards, supply from Western countries may decrease, causing potential shortages. This could slow down trading activity and add pressure to the market till year-end.

Received under the content exchange agreement with BIGMINT

Top image credit: LinkedIn

This news is also available on our App 'AlCircle News' Android | iOS