India: Imported aluminium scrap prices remain range-bound w-o-w amid year-end uncertainty

Imported aluminium scrap prices in India remained range-bound w-o-w, with variations by up to 2 per cent, amid slow trading activity, which has caused market uncertainty towards the year-end.

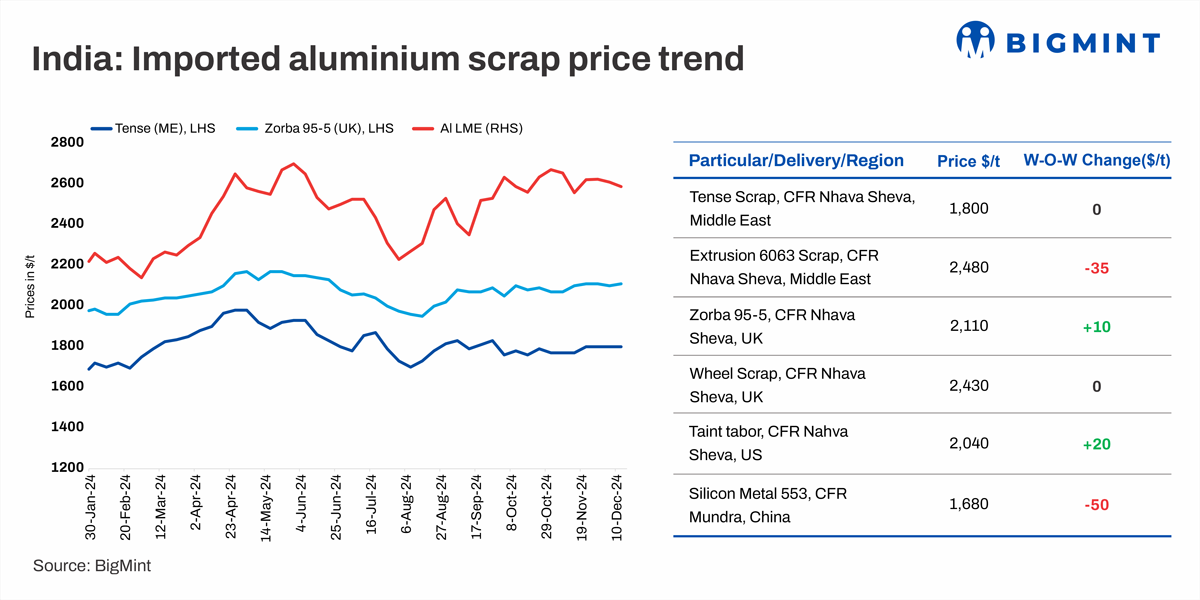

BigMint's benchmark assessment for Tense scrap originating from the UAE stood at $1,800/tonne (t), firm w-o-w, while Zorba 95/5 from the UK was at $2,110/t, largely stable w-o-w, both CFR west coast, India.

This week, London Metal Exchange (LME) prices dropped marginally by around 0.9 per cent to $2,587/tonne. Meanwhile, stocks at LME-registered warehouses stood at 681,600 tonnes, falling by around 9,000 tonnes w-o-w from 690,700 tonnes.

Market scenario

Demand for aluminium scrap picked up slightly this week, with some buyers securing material for shipments scheduled for January-February. Indian demand for UAE-origin Taint Tabor also increased, with recent transactions recorded at $2,160-2,180/tonne.

Meanwhile, China's silicon demand softened due to surplus inventories held by alloy manufacturers, which continued to weigh on prices. Additionally, Zorba imports into India were limited, as sellers prioritised Southeast Asian markets, where better price realisations are being achieved.

A market insider highlighted that Thailand and Malaysia are emerging as lucrative destinations for Zorba, offering a premium of $60-70/tonne over Indian prices. With higher returns and reduced shipping costs, global sellers are increasingly shifting their focus to these markets and other Far East regions to maximise profits. Meanwhile, Indian buyers are purchasing Zorba at lower levels of around $2,100/tonne, though they recently increased their bids by $10-20/tonne, according to sources.

Domestic scrap tags inch up

In the domestic market, Tense scrap prices were up slightly by INR 1,000/tonne in both Delhi and Chennai, while other grades also witnessed an uptrend. According to BigMint's assessment, domestic Tense scrap stood at INR 174,000/tonne ex-Delhi-NCR and INR 175,000/tonne ex-Chennai.

Automotive companies are gearing up for maintenance shutdowns, which is further dampening demand. However, year-end restocking led to a slight uptick in prices, though they are expected to remain range-bound.

China's silicon prices edge down

According to BigMint's assessment, prices of China's 553-grade silicon dropped by $50/tonne w-o-w to $1,680/tonne CFR Mundra. Freights were around $2,000-2,300 for a single container from China to Mundra.

Outlook

The aluminium market faces significant uncertainty. A bauxite shortage is driving up alumina prices, while supply concerns persist due to China's 13 per cent export tax rebate removal, which could impact Asian buyers. Additionally, Western suppliers are preparing for extended winter holidays starting, say, December 15, which could potentially cause a slight supply crunch and lead to higher aluminium prices in the coming weeks.

Note: This article is received under the content exchange agreement with BIGMINT and published as received without edits from AL Circle.

Top image credit: Tradeindia

This news is also available on our App 'AlCircle News' Android | iOS