India: Imported aluminium scrap prices rise w-o-w even as some grades witness tight supply

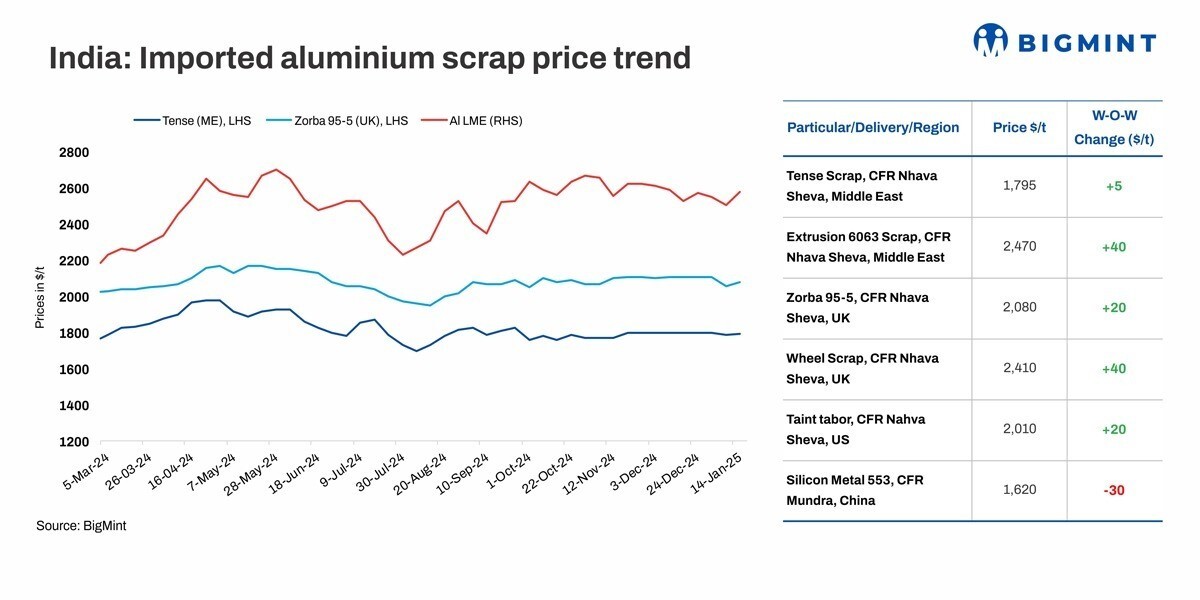

Imported aluminium scrap prices in India witnessed an uptrend w-o-w, with fluctuations of up to 1.7 per cent, amid recovery demand post-New Year holidays. Amid a rise in London Metal Exchange (LME) aluminium prices, certain scrap grades reported supply shortages.

{alcircleadd}

BigMint's benchmark assessment for Tense scrap originating from the US stood at $1,830/tonne (t), rising by $10/t w-o-w, while wheels from the UK were priced at $2,410/t, up $40/t w-o-w, both CFR west coast, India.

This week, LME prices rose by around 2.62 per cent to $2,580/t.Meanwhile, stocks at LME-registered warehouses stood at 619,400 t, falling by around 7,000 t w-o-w.In the first 11 months of 2024, China's total aluminium production increased by 4.6 per cent y-o-y, reaching 40.22 mnt. Meanwhile, the global refined aluminium market faced a supply deficit of 40,300 tonnes in October, with production at 6.09 mnt and consumption at 6.13 mnt.

Market scenario

Market scenario

This week, the Indian imported aluminium scrap market showed signs of recovery as activity resumed following the holiday season. New trade engagements were observed, with transactions reported from both the US and the EU. However, bid-offer disparities were seen for certain grades, such as US Taint Tabor and Extrusion.

In contrast, UAE-sourced materials were preferred due to a significantly shorter transit time of 7-10 days. This made UAE-origin scrap a more efficient and timely choice for importers compared to the 30-45 days required for shipments from the US.

A buyer source said, "Materials like Wheels and Tense are being prioritised for UK buyers by European suppliers over Indian buyers, as UK demand has surged post-holidays, with buyers offering flat LME pricing for Wheels".

A trader source stated: "India's consumption of Tense scrap from South Africa has increased, as the material now comes cleaner compared to earlier shipments, which often included high attachments. South African Tense is currently offered at $1,700-$1,750/t, up from pre-holiday levels of $1,600-$1,650/t".

Domestic scrap remains rangebound

In the domestic market, Tense scrap prices in both Delhi and Chennai remained stable w-o-w, while other grades showed recovery by INR 1,000/t. According to BigMint's assessment, domestic Tense scrap stood at INR 174,000/t ex-Delhi-NCR and INR 175,000/t ex-Chennai.

China's silicon prices fall

According to BigMint's assessment, China's 553-grade silicon prices declined w-o-w to $1,620/t CFR Mundra. Freights were around $1,900 for a single 20ft container from China to Mundra.

Silicon prices remained stable w-o-w despite weak demand in the domestic alloyed ingot market. Manufacturers reported adequate silicon inventories, contributing to the stagnant pricing.

Outlook

India's imported aluminium scrap prices are expected to remain positive in the near term as LME prices rebound. However, the price announcement for aluminium alloy ingots by a major automaker for February 2025 settlements will play a key role in determining scrap demand and influencing import pricing decisions.

Note: This article is received under the content exchange agreement with BIGMINT and published as received without edits from AL Circle.

Top image credit: AL Circle Biz

This news is also available on our App 'AlCircle News' Android | iOS