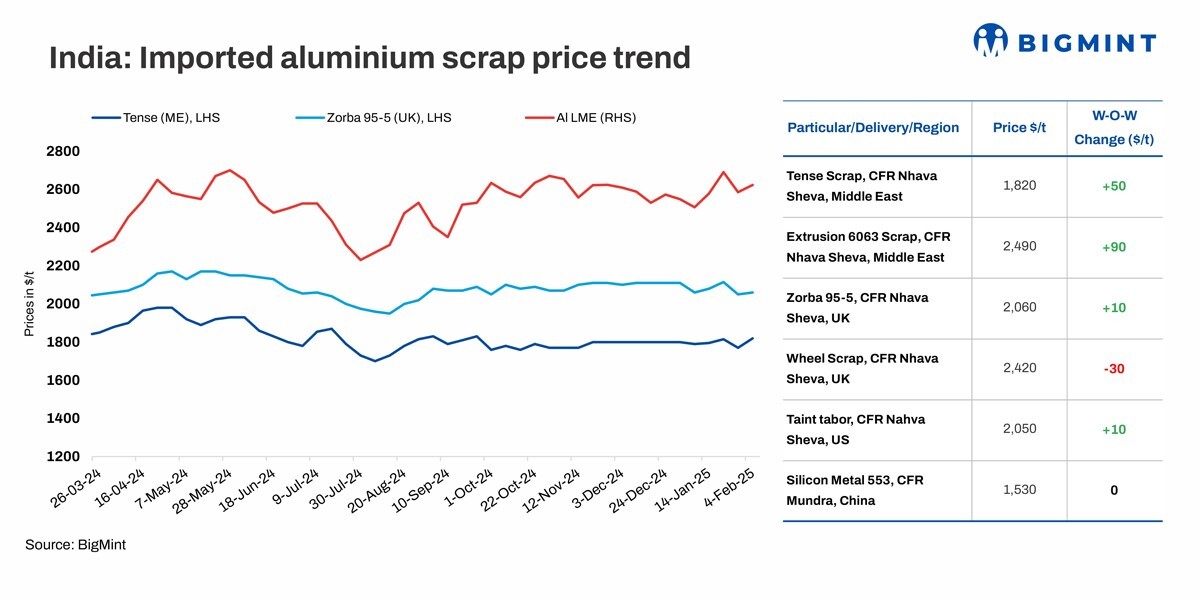

India: Imported aluminium scrap prices rise w-o-w following hike in LME tags

Imported aluminium scrap prices in India witnessed an upward trend week-on-week (w-o-w), driven by a rise in London Metal Exchange (LME) aluminium tags.

{alcircleadd}

BigMint's benchmark assessment for Tense scrap originating from the US was at $1,850/tonne (t), increasing by $35/t w-o-w, while Wheels from the UK stood at $2,420/t, down $30/t w-o-w, both CFR west coast, India.

This week, LME prices rose by 1.4 per cent to $2,624/t. Meanwhile, stocks at LME-registered warehouses stood at 587,200 t, falling by around 1 per cent w-o-w against 592,625 t last week.

Market scenario

A trader stated that the UAE's domestic market remains silent due to weak demand; however, trades in major grades like extrusion and taint tabor were heard concluded at higher levels for CIF Mundra. Some deals were heard for containers of Kuwait Extrusion at $2,470/t CIF Nhava Sheva and a few containers of UAE extrusion at $2,490/t- $2,500/t CIF Mundra.

Prices from the US and UK remained almost stable w-o-w with trades heard for UK Wheels LME less $150/t and UK tense 6 per cent at $1,860/t CIF West coast. A deal for talk scrap was heard at 54% LME from the US to the west coast of India on CIF basis.

A source commented, "We currently have a significant amount of material in transit. Due to currency fluctuations, we had temporarily halted fresh purchases. However, with the current pricing levels, we are now comfortable and may resume purchases this week based on available offers."

Domestic scrap prices stable w-o-w

In the domestic market, Tense scrap prices in both Delhi and Chennai remained stable w-o-w. According to BigMint's assessment, domestic Tense scrap stood at INR 174,000/t ex-Delhi-NCR and INR 175,000/t ex-Chennai.

China's silicon prices steady

According to BigMint's assessment, prices of China's 553-grade silicon declined w-o-w to $1,530/t CFR Mundra.

Global updates

US slaps tariffs on Canada, Mexico, and China: The US has imposed a 25% tariff on imports from Canada and Mexico and a 10 per cent levy on Chinese goods. Industry leaders are already debating the impact on global trade and market dynamics. With Canada exporting 3.3 mnt of aluminium annually to the US, alternative markets are now in focus.

Aluminium prices drop in Europe amid trade tensions: Aluminium prices for European consumers have dropped by over 10 per cent due to expectations of diverted Canadian shipments following US tariff impositions. As Canada accounts for 56 per cent of US aluminium imports, these market shifts are reshaping global supply chains. The price reduction is likely to impact production costs across various industries, including transportation, packaging, and construction.

Outlook

Aluminium prices are expected to remain rangebound in the near term, influenced by fluctuating LME trends. Sellers are holding firm, closely monitoring geopolitical developments, such as US tariffs, and their potential impact on market stability. Additionally, domestic demand concerns persist, particularly due to sluggish activity in the automotive sector.

Top image credit: Just Dial

Note: This article is received under the content exchange agreement with BIGMINT and published as received without edits from AL Circle.

This news is also available on our App 'AlCircle News' Android | iOS

.png/0/0)

.png/0/0)