Futures market: In the night session, the most-traded alumina 2505 contract opened at RMB 3,035 per tonne, with a high of RMB 3,037 per tonne, a low of RMB 2,992 per tonne, and closed at RMB 2,997 per tonne, down RMB 38 per tonne, a decrease of 1.25 per cent, with an open interest of 205,000 lots.

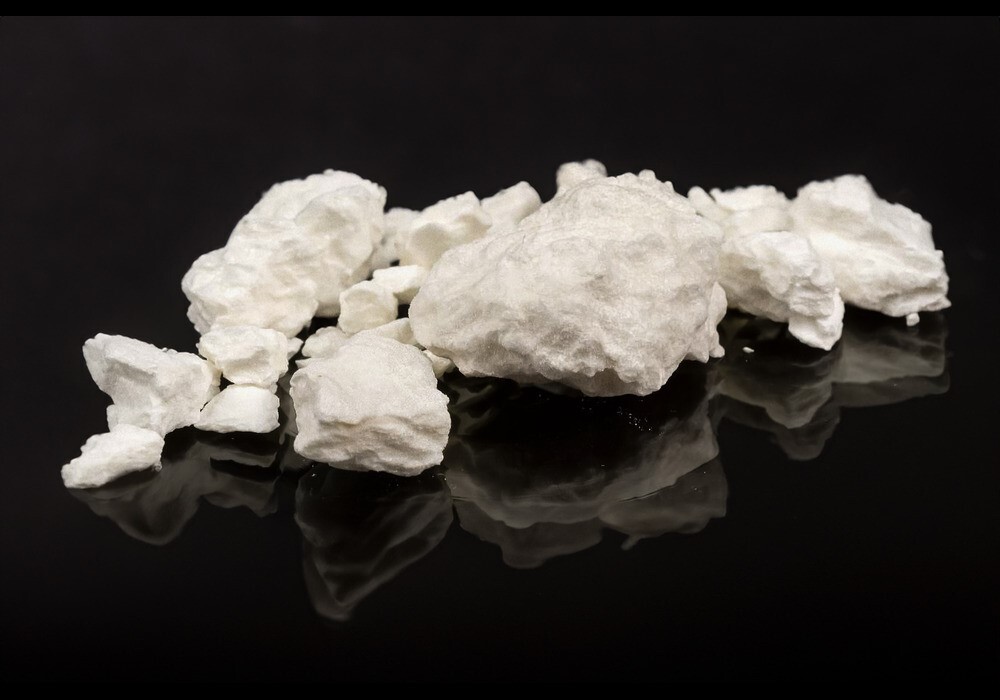

Image for referential purposes only

Ore side: As of March 28, the SMM imported bauxite index stood at USD 93.1 per tonne, down USD 0.06 per tonne from the previous trading day, mainly due to the decline in caustic soda prices in Shandong. The SMM Guinea bauxite CIF average price was USD 91 per tonne, flat from the previous trading day. The SMM Australia low-temperature bauxite CIF average price was USD 87 per tonne, flat from the previous trading day. The SMM Australia high-temperature bauxite CIF average price was USD 81 per tonne, flat from the previous trading day.

Industry news:

Basis daily report: According to SMM data, on March 28, the SMM alumina index was at a premium of RMB 75 per tonne against the most-traded contract's latest transaction price at 11:30.

Warrant daily report: On March 28, the total registered alumina warrants increased by 15,626 tonnes from the previous trading day to 298,500 tonnes. The total registered alumina warrants in Shandong remained flat at 4,513 tonnes from the previous trading day. The total registered alumina warrants in Henan remained flat at 25,800 tonnes from the previous trading day. The total registered alumina warrants in Guangxi remained flat at 49,800 tonnes from the previous trading day. The total registered alumina warrants in Gansu remained flat at 22,500 tonnes from the previous trading day. The total registered alumina warrants in Xinjiang increased by 15,626 tonnes from the previous trading day to 195,800 tonnes.

Overseas market: As of March 28, 2025, the FOB alumina price in Western Australia was USD 377 per tonne, with an ocean freight rate of USD 21.40 per tonne, and the USD/CNY exchange rate selling price was around 7.28. This price translates to a selling price of around RMB 3,358 per tonne at domestic mainstream ports, which is RMB 247 per tonne higher than domestic alumina prices, keeping the alumina import window closed.

Based on the latest FOB transaction price of USD 368 per tonne in Eastern Australia, the estimated selling price at domestic mainstream ports is around RMB 3,300 per tonne, less than RMB 200 per tonne higher than the SMM alumina price index. If overseas alumina prices further decrease and the rate of decrease exceeds that of domestic prices, the alumina import window may gradually open. On the export side, based on the latest spot transaction prices of alumina in Shandong, the domestic alumina export cost is around USD 450 per tonne, higher than overseas spot alumina prices, keeping the export window closed.

Summary: Last week, the weekly operating rate of alumina was lowered again, with the national total operating capacity of metallurgical alumina decreasing to 87.3 million tonnes per year, down 700,000 tonnes per year W-o-W, but the overall supply surplus in the alumina market has not yet reversed. According to SMM data, as of last Thursday, the total operating capacity of domestic aluminium was 43.88 million tonnes per year, translating to an alumina demand operating capacity of around 84.47 million tonnes per year, with theoretical demand increasing slightly but still below actual operating levels.

On the supply side, domestic bauxite supply remains low, with limited increments; increased imported bauxite supply has driven the total domestic bauxite supply, potentially making the bauxite supply and demand fundamentals more relaxed than before, with bauxite prices likely to remain under pressure in the short term.

Meanwhile, downstream aluminium plants reported that alumina procurement is mainly based on long-term contracts, and some plants that have stockpiled for winter are planning to actively reduce inventory. Last week, according to SMM statistics, alumina raw material inventory at aluminium plants decreased by 44,000 tonnes W-o-W. In the short term, alumina circulating supply is expected to remain relatively loose, and alumina prices may continue to operate under pressure. Subsequent attention should be paid to changes in alumina operating capacity.

Note: This article has been issued by SMM and has been published by AL Circle with its original information without any modifications or edits to the core subject/data.

Responses