India's imported aluminium scrap prices continue to rise

The imported aluminium scrap prices in the Indian market are experiencing an upward trend, which is attributed to several factors. These include the notable increase in aluminium LME (London Metal Exchange) levels, a scarcity of material both domestically and globally, and rising freight rates.

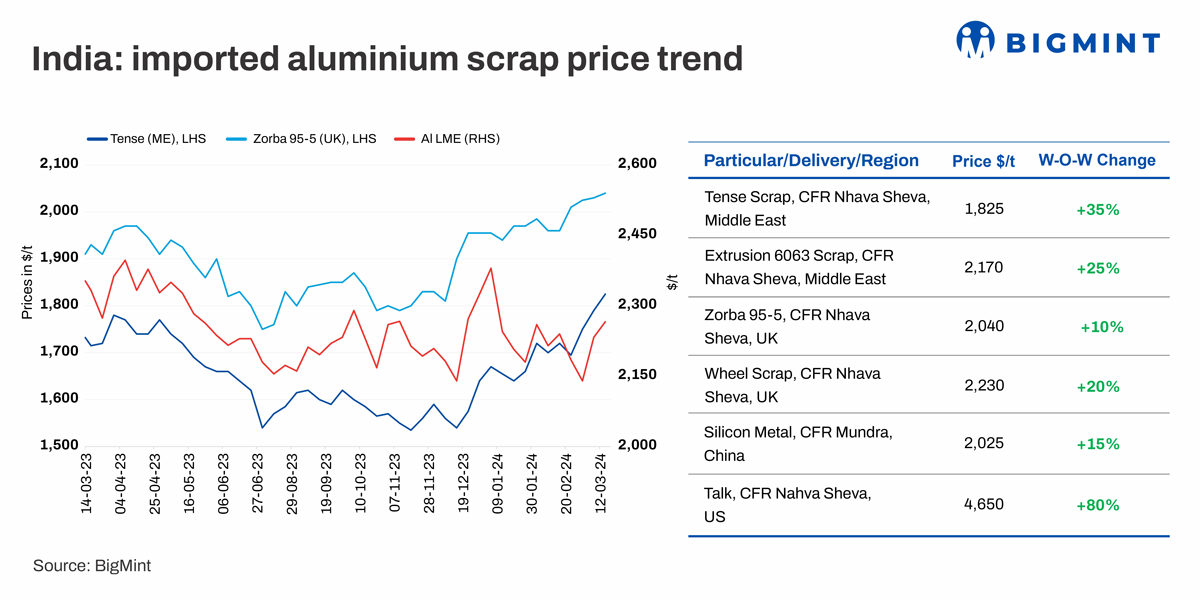

The three-month LME price stood at approximately $2,260 per metric ton, marking a $40 per tonne increase week-over-week. Concurrently, stocks were reported at 577,675 metric tons, representing a 1 per cent decline week-over-week, further contributing to the rise in LME prices.

As per assessments conducted by BigMint, imported aluminium scrap prices have surged by up to 2.6 per cent. Tense scrap originating from the UAE witnessed a $35 per metric ton increase, reaching $1,825 per metric ton, while zorba 95/5 of UK origin rose by $10 per tonne to $2,040 per tonne CFR (Cost and Freight) Mundra.

Additionally, UAE extrusion 6063 scrap observed a $25 per metric ton rise to $2,170 per tonne CFR Western Coast India, whereas talk scrap from the UAE surged by $80 per tonne to $4,490 per tonne.

The persistent shortage of tense scrap in both local and global markets has fuelled price hikes, particularly in the northern region.

Meanwhile, China's silicon 553 prices also increased by $15 per tonne and reached $2,025 per tonne CFR Mundra.

A recycler based in the Middle East region stated, "Most of the bids have evolved as per the metal futures trend, and moderate trade activities have been recorded in line with limited scrap material inflow in the domestic Indian market."

A second trade participant based in the northern Indian market shared that "The market has positive sentiments for raw materials as semi-finished products, specifically alloy grades, are dominating the overall trades, and most of the established buyers are willing to keep the premiums high as per the market dynamics".

Further, a few opinions by small and medium alloy manufacturers highlighted that "Due to tight procurement in the domestic market, we are unable to speed up the full operational cycle, and somewhere it affects the monthly conversion spread".

Domestic market

In the domestic aluminium market, tense scrap prices are currently trading at premiums of up to INR 178,000/t. However, BigMint's assessment price stands at INR 175,000/t, ex-Delhi. Gujarat reported tense scrap prices at INR 175,000/t on a credit basis and INR 173,500/t for immediate payment.

Recent deals for CIF WC India

- USA-origin Zorba 95/5 was traded at $2,050/t ~ 45 t.

- UAE-origin extrusion was traded at $2,160/t - 50 t.

- UAE-origin taint tabor was traded at $1,980/t - 25 t.

- UAE origin talk (fe) was traded at 51 per cent LME prices - 20 t.

- USA origin taint tabor HRB was traded at $1,820/t ~ 45 t.

- USA origin extrusion 95/5 was traded at $1,950/t - 50 t.

- USA wheels were traded at $2,200/t ~ 38 t.

- USA tense (5-7 per cent) was traded at $1,870/t ~ 50 t.

- Europe origin tense (2 per cent) was traded at $1,980/t, CIF WC Damaiyu ~ 70 t.

- USA-origin Taint Tabor (2-3 per cent) was traded at $1,820/t ~ 45 t.

- USA-origin Telic clean traded at $1,650/t recently ~50 t.

Outlook

Moderate trade activities and a constrained supply chain for specific grades, coupled with the potential price increase of semi-finished materials by major automobile companies, could contribute to sustained prices in the short term.

Received under the content exchange agreement with SteelMint

This news is also available on our App 'AlCircle News' Android | iOS

.png/0/0)