Iran’s aluminium output reflects dip in latest report

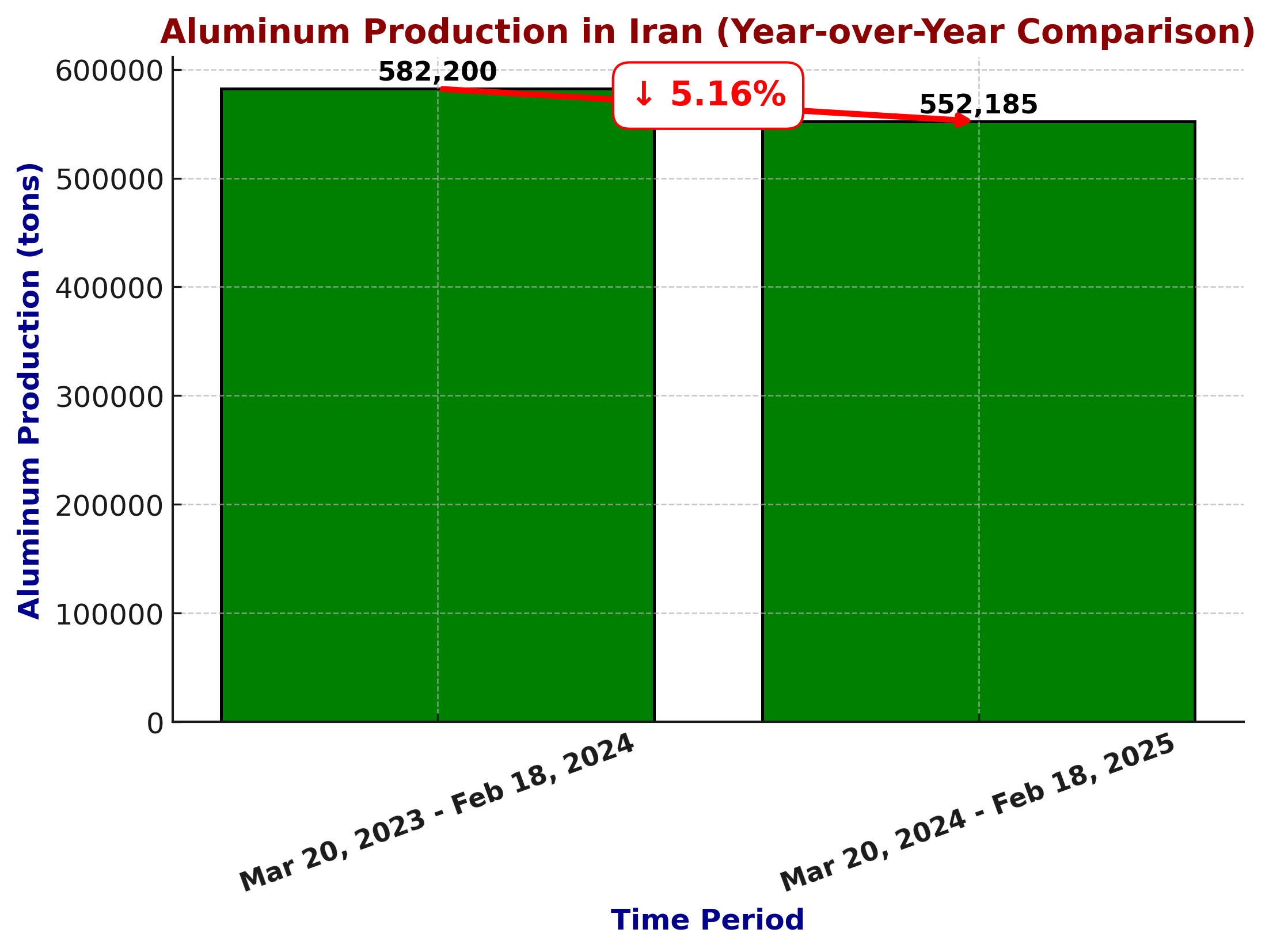

Iran's primary aluminium production has surpassed 552,000 tonnes in the first 11 months of the current Iranian year (March 20, 2024 – February 18, 2025), driven by substantial increases in bauxite and alumina output growth.

Image credit: Tehran Times

The country's four major primary aluminium producers—South Aluminum (SALCO), Iranian Aluminium Company (Iralco), Almahdi, and Iran Alumina—collectively produced 552,185 tonnes of aluminium ingots during the mentioned period, as reported by the Iranian Mines and Mining Industries Development and Renovation Organization (IMIDRO).

In spite of this significant output, this reflects a slight decline of 5.16 per cent compared with the 582,200 tonnes produced in the same period in the previous fiscal year.

IMIDRO is a major state-owned holding company active in the mining sector in Iran. IMIDRO has eight major companies and 55 operational subsidiaries active in the sectors of steel, aluminium, copper, cement, and mineral exploitation.

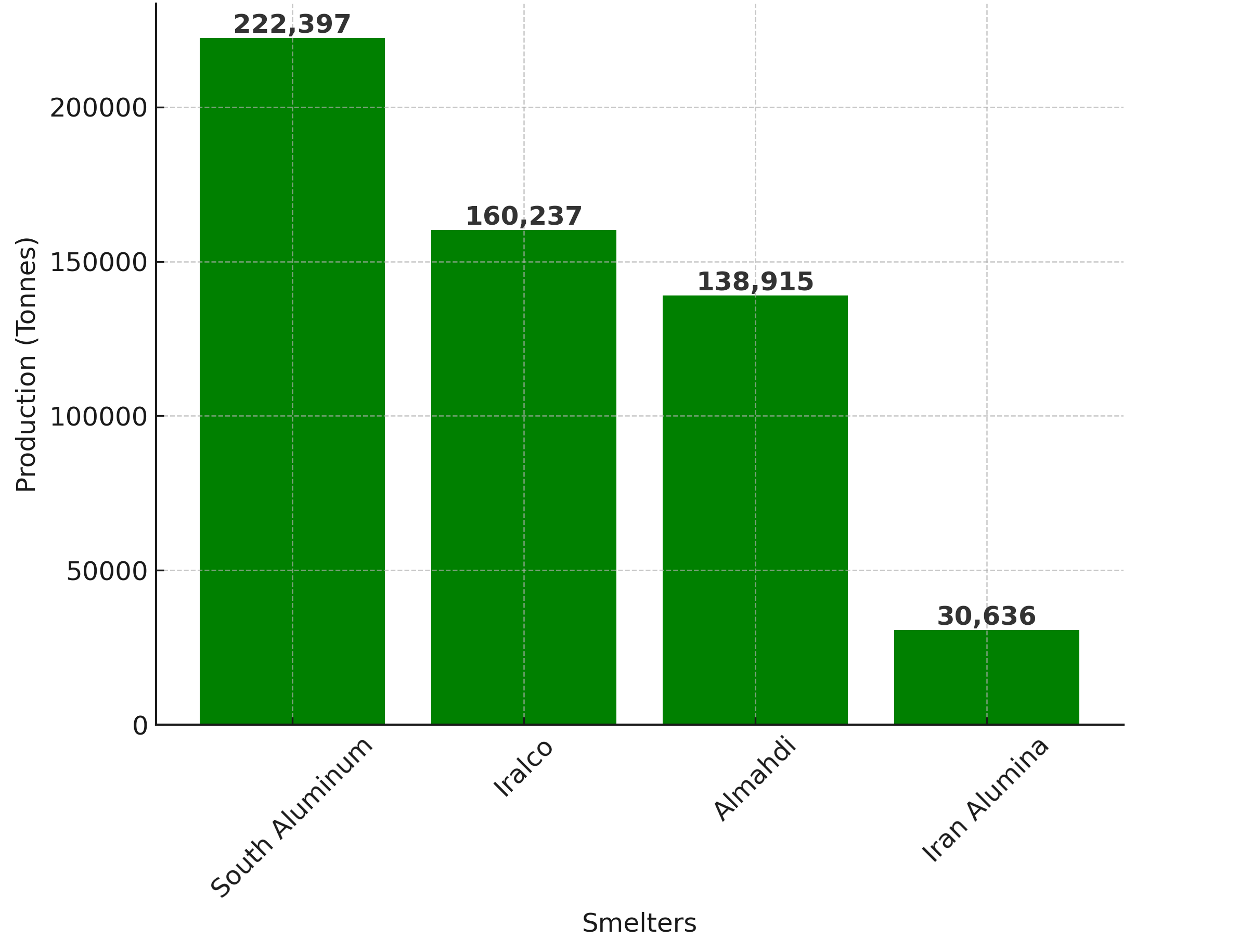

Iran: Aluminium smelter-wise production, March' 24 – February' 25 (in tonnes)

During the 11-month period, South Aluminum produced 222,397 tonnes of aluminium, followed by Iralco with 160,237 tonnes, Almahdi with 138,915 tonnes, and Iran Alumina with 30,636 tonnes of aluminium ingots.

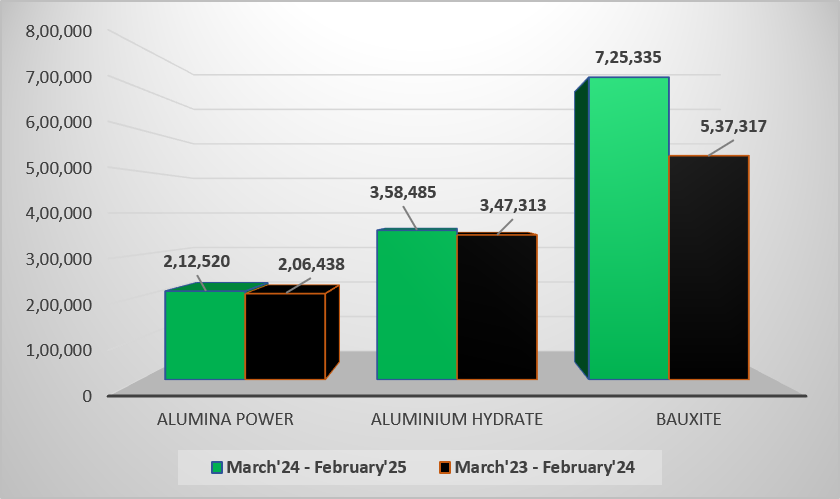

Iran Alumina Company production, March' 24-Feb '25 Vs March '23-Feb '24 (in tonnes)

Additionally, from March 2024 to February 2025, Iran Alumina Company recorded production of 212,520 tonnes of alumina powder, 358,485 tonnes of aluminium hydrate, and 725,335 tonnes of bauxite. Compared to the previous year's figures—206,438 tonnes of alumina powder, 347,313 tonnes of aluminium hydrate, and 537,317 tonnes of bauxite—this represents a growth of approximately 3 per cent in alumina powder and aluminium hydrate production, while bauxite output surged by 35 per cent.

Predictive analysis of aluminium production decline in Iran

The slight decrease in aluminium ingot production among Iran's major producers—from 582,200 tonnes to 552,185 tonnes—can be primarily attributed to the country's ongoing energy crisis. Iran has been facing significant electricity shortages. These shortages may have led to frequent power outages, compelling industries, including aluminium smelters, to reduce or halt operations to conserve energy.

In September 2024, an Iranian media outlet reported a worsening trend in the country's power and gas shortages. According to the same report published on September 27, 2024, Iran's electricity shortfall surged from 11,000 megawatts last summer to 20,000 megawatts this year. Additionally, the nation experienced a gas deficit of 250 million cubic meters per day during the previous winter, accounting for 25 per cent of its total winter demand. This broader industrial downturn underscores the widespread effect of energy shortages on Iran's heavy industries.

In January, Iran experienced the sharpest decline in steel production among major producers, dropping 24.1 per cent year-on-year to 2.2 million tonnes.

This news is also available on our App 'AlCircle News' Android | iOS

.jpg/0/0)

.gif/0/0)