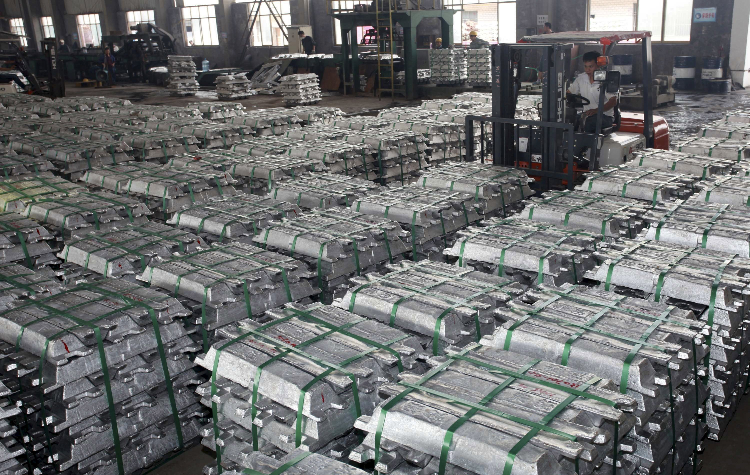

On-warrant LME aluminium inventories drop 9.7% to a two-decade low; but price retreats from its gains on a weak demand outlook

Aluminium stocks in the London Metal Exchange have decreased to a record low but the sign of supply shortages has yet not wobbled the bearish sentiment of the global metal price anticipating weaker demand in the near future.

According to the data shown by London Metal Exchange, on-warrant aluminium inventories have dropped 9.7 per cent to total 260,275 tonnes, surpassing the previous low in the year 2000. Stockpiles have plummeted by 63 per cent this year, approaching towards a record annual decline and deepened deficit, due to robust demand amid production curtailments.

But despite the incessant fall in stocks, the LME aluminium price has retreated from the earlier gains, which indicates the fact that the industry focus is now on the risks of low demand.

The mood in metals markets has shifted dramatically in the past few weeks, as the persisting tight supply is giving way to concerns about the state of the global economy. Aluminium demand has plunged 33 per cent from a record high in March, resulting in the price falling from 13-year high.

“The rally in aluminum was relentless, and now we’re seeing a pretty strong correction,” Geordie Wilkes, head of research at Sucden Financial Ltd., said by phone from London. “The demand outlook is pretty weak across the globe, but the supply risk is still very evident.”

This news is also available on our App 'AlCircle News' Android | iOS