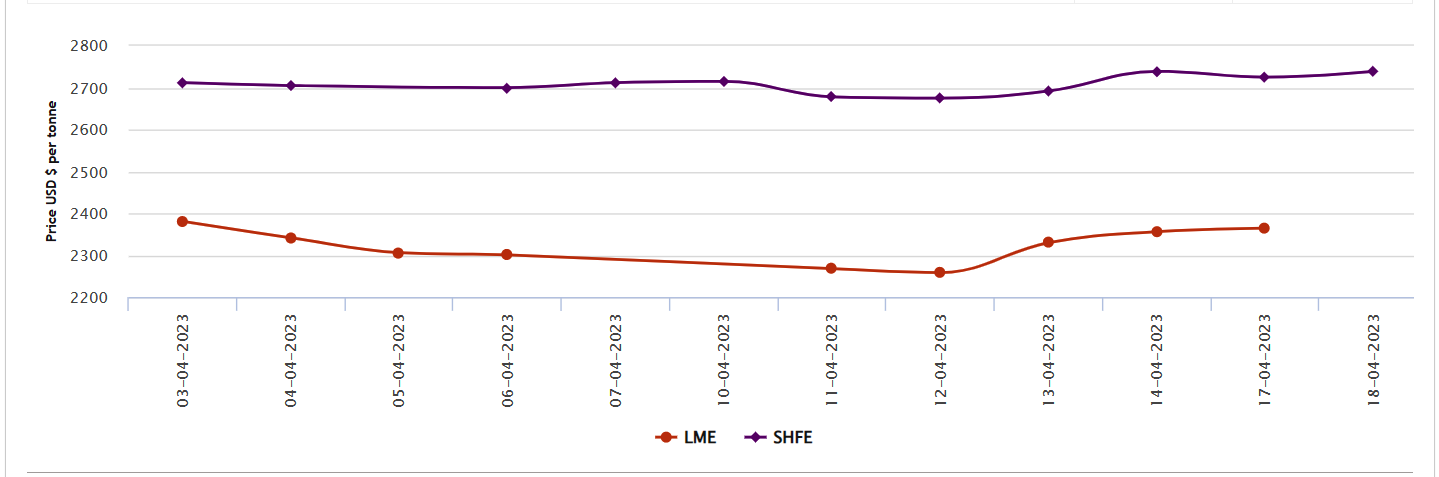

LME aluminium benchmark price edges US$8.5/t higher at US$2,364.5/t; SHFE gains US$14/t

Three-month LME aluminium opened at US$2,386 per tonne on Monday and closed at US$2,372.50 per tonne, down US$17.5 per tonne or 0.73 per cent.

On Monday, April 17, both LME aluminium cash bid price and LME aluminium official settlement price expanded at the same rate to reach US$2,363.50 per tonne and US$2,364.50 per tonne, respectively. Data shows the prices gained US$8.50 per tonne or 0.36 per cent, marking the fourth consecutive rise.

But 3-month bid price and 3-month offer price slipped by US$17 per tonne on the same day to stand at US$2,370 per tonne and US$2,371 per tonne. December 24 bid price and December 24 offer price shrank by US$18 per tonne, settling at US$2,545 per tonne and US$2,550 per tonne.

LME aluminium opening stock dropped 2,300 tonnes to peg at 528350 tonnes. Live warrants remained restrained at 452950 tonnes, while cancelled warrants plunged by 2,300 tonnes to 75400 tonnes.

LME aluminium 3-month Asian Reference Price inched down by US$0.50 per tonne to initiate the week at US$2,381.65 per tonne.

SHFE aluminium price

On Tuesday, April 18, the SHFE aluminium benchmark price grew by US$14 per tonne after a fall over the weekend to stand at US$2,739 per tonne.

SHFE 2305 aluminium added RMB 75 per tonne or 0.40 per cent to RMB 18,770 per tonne. The open interest dipped 2,028 lots to 172,676 lots.

Overnight, the most-traded SHFE 2305 aluminium contract opened at RMB 18,780 per tonne, and rose to RMB 18,840 per tonne, but then pulled back before closing at RMB 18,765 per tonne, up RMB 10 per tonne or 0.05 per cent.

This news is also available on our App 'AlCircle News' Android | iOS

.gif/0/0)